Swing trading is a popular trading style that focuses on capturing short- to medium-term gains from stock price movements.

Unlike day trading, which involves buying and selling within the same day, swing trading allows traders to hold positions for several days or weeks, making it a flexible option for those looking to capitalize on short-term market trends.

One of the most effective strategies for swing trading is the CANSLIM strategy, developed by renowned investor William J. O’Neil.

Originally designed to identify high-growth stocks, CANSLIM combines both fundamental and technical analysis to help traders select stocks with the potential for significant price appreciation.

This blog will explore how the CANSLIM strategy can be applied to swing trading to maximize profits and manage risk.

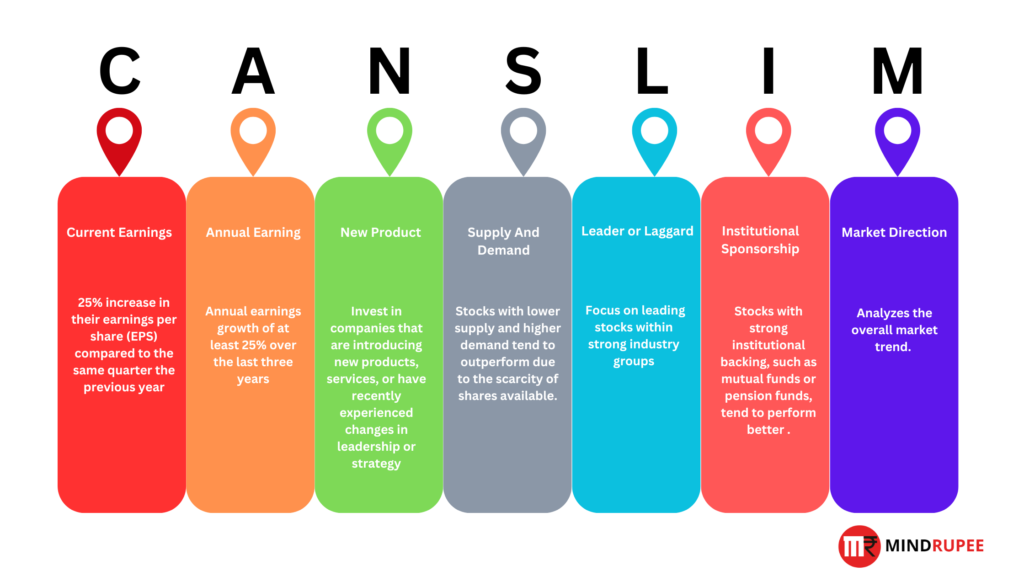

What is the CANSLIM Strategy?

The CANSLIM strategy is a stock selection method that blends fundamental analysis with market trends. Developed by William J. O’Neil, this strategy identifies stocks with strong growth potential by focusing on specific criteria.

For India Markets William J. O’Neil product name is Marketsmith India.

Here’s a breakdown of each component:

- C = Current Earnings: Focuses on stocks with strong quarterly earnings growth. Look for companies with at least a 25% increase in their earnings per share (EPS) compared to the same quarter the previous year.

- A = Annual Earnings: Targets stocks with consistent annual earnings growth. Companies should show annual earnings growth of at least 25% over the last three years.

- N = New Product or Management: Invest in companies that are introducing new products, services, or have recently experienced changes in leadership or strategy. These innovations often lead to increased revenue and stock growth.

- S = Supply and Demand: This factor considers the stock’s float (number of shares available) and the level of demand. Stocks with lower supply and higher demand tend to outperform due to the scarcity of shares available.

- L = Leader or Laggard: Focus on leading stocks within strong industry groups. Leading stocks have relative strength and outperform their peers, while laggards underperform the market.

- I = Institutional Sponsorship: Stocks with strong institutional backing, such as mutual funds or pension funds, tend to perform better due to the significant capital these institutions bring.

- M = Market Direction: Analyzes the overall market trend. Even strong stocks tend to perform poorly in a bear market, so it’s crucial to align trades with the broader market direction.

The CANSLIM strategy combines these fundamental factors with the current market trends to help swing traders select stocks that have the potential for explosive price movements, making it a comprehensive method for stock selection.

Why CANSLIM Works for Swing Trading?

The CANSLIM strategy is particularly effective for swing trading because it targets high-growth stocks, which are ideal for traders looking to capitalize on short- to medium-term price movements. Here’s why it works:

- Focus on High-Growth Stocks: CANSLIM selects stocks that are showing strong earnings growth, both quarterly and annually, making them prime candidates for upward momentum. Swing traders thrive on such movements, seeking to capture gains as the stock’s price accelerates.

- Momentum-Driven Selection: The “New Product or Management” and “Leader or Laggard” components identify companies that are either innovating or leading their industry. These factors often create momentum, providing swing traders with opportunities to enter and exit trades quickly and profitably.

- Balance Between Fundamentals and Technicals: CANSLIM combines both fundamental analysis and market trends, offering a holistic view of a stock’s potential. While short-term technical indicators guide entry and exit points, the underlying fundamentals ensure that the stocks chosen have strong growth prospects.

By blending solid financial data with current market performance, CANSLIM aligns well with the swing trader’s goal of profiting from price swings within a relatively short timeframe.

Breaking Down the CANSLIM Components for Swing Trading

C = Current Earnings and A = Annual Earnings

- How Earnings Drive Momentum: Strong earnings growth, both quarterly and annually, is a key driver of stock price momentum. Swing traders benefit from stocks with impressive earnings, as they tend to attract attention from other traders, creating short-term price movements that can be capitalized on.

- Focus on Growth: Stocks with at least 25% or higher earnings growth quarter-over-quarter or year-over-year are prime candidates for swing traders looking for upward price momentum.

N = New Product, Service, or Management

- Capitalizing on Market Excitement: Stocks that introduce new products, services, or are under new management often experience increased interest and excitement in the market, leading to sudden price movements. Swing traders can ride these waves of optimism for quick gains.

- Opportunity for Breakouts: New developments often lead to stock breakouts, where prices surge past resistance levels, offering ideal entry points for swing traders.

S = Supply and Demand

- Importance of Limited Supply: Stocks with fewer shares available for trading and higher demand tend to see sharper price increases, creating profitable opportunities for swing traders. Low float stocks with high volume often experience rapid price changes that can be exploited.

- Volume as a Confirmation Tool: Swing traders monitor trading volume to confirm upward price movements. Higher volume means higher demand, making it easier to predict and act on momentum.

L = Leader or Laggard

- Focus on Market Leaders: Swing traders focus on stocks that are outperforming their peers, also known as market leaders. These stocks tend to be the first to rise when the market moves up, offering early entry points for swing trades.

- Capturing Trends: By targeting leading stocks in hot sectors, swing traders can ride the prevailing trend, maximizing short-term gains.

I = Institutional Sponsorship

- Institutional Backing as a Sign of Strength: When institutional investors, like mutual funds or hedge funds, invest in a stock, it often signals confidence in the company’s growth prospects. This institutional support can lead to increased buying pressure, pushing stock prices higher, which swing traders can take advantage of.

- Following Smart Money: Swing traders often track institutional buying and selling trends to align their trades with large market movements.

M = Market Direction

- Trading in Sync with Market Direction: The CANSLIM strategy emphasizes the importance of trading in alignment with the overall market. Swing traders avoid going against the market’s momentum and instead follow trends that align with broader market direction, whether bullish or bearish.

- Using Technical Indicators: Swing traders often use technical indicators like moving averages or market breadth indicators to determine whether the market is in an uptrend, downtrend, or sideways movement, timing their trades accordingly.

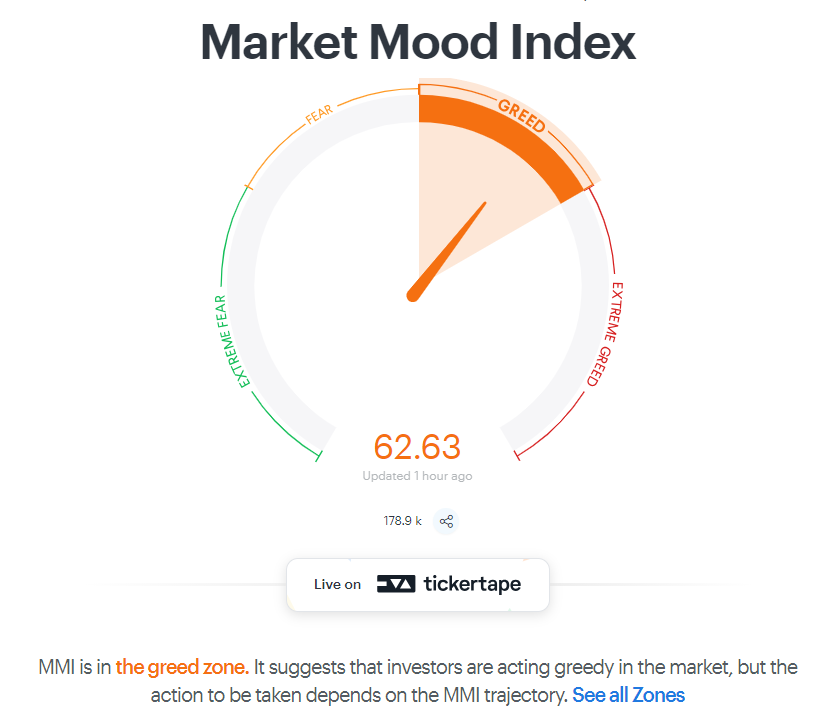

For Indian Markets one of the methods to find direction of trend is using Ticker Tape’s Market Mood Indicator.

7% Stoploss Rule

One of the USP of Canslim Strategy is it exit criteria. William’O’Neil professed 7% Hard Stop Rule.

The 7% stop-loss rule is a straightforward risk management strategy used by traders to limit potential losses.

It dictates that when a stock’s price falls by 7% from the purchase price, the trader should exit the position, regardless of market conditions or emotions. This automatic sell trigger helps traders avoid the emotional pitfalls of holding onto a losing position in the hope of a recovery.

The primary goal of the 7% stop-loss rule is to protect traders from significant losses while still allowing room for potential gains.

By capping the downside risk to just 7%, traders can stay in control of their investments without risking large portions of their portfolio on a single trade. This makes it particularly useful in volatile markets, where sudden price movements can quickly erode capital.

The rule was popularized by William J. O’Neil, a renowned stock market analyst and founder of Investor’s Business Daily.

It is an integral part of O’Neil’s CAN SLIM strategy, which combines both technical and fundamental analysis.

The 7% stop-loss rule fits into this strategy by ensuring that traders cut their losses early while still holding onto winning trades long enough to capture meaningful gains.

It serves as a safeguard against the inherent unpredictability of the markets, offering traders peace of mind and long-term portfolio protection.

How to Apply CANSLIM in Swing Trading?

Screening Stocks Using CANSLIM Criteria

- Using Stock Screeners: Start by filtering stocks using the CANSLIM criteria, focusing on companies with strong earnings growth (C & A), new innovations (N), and institutional backing (I).

- Finding Market Leaders: Use tools like stock screeners or financial platforms to identify market leaders (L) in trending sectors. Filter for high-performing stocks with increased demand (S) and those in sync with the market direction (M).

For Screening Stocks you can use Marketsmith India’s Paid subscription or yu can use free screener by Screener.in

Combining CANSLIM with Technical Analysis for Timing Trades

- Moving Averages: Use short-term moving averages (e.g., 50-day or 20-day) to spot entry points when the stock price crosses above these levels, confirming upward momentum.

- Volume Indicators: Monitor trading volume to confirm price movements. Higher-than-average volume during price surges indicates strong buying pressure and aligns with the “S” (Supply and Demand) component of CANSLIM.

- Chart Patterns: Look for chart patterns like breakouts, flags, or triangles to identify potential trade setups. Use these patterns alongside CANSLIM to time entries and exits efficiently.

To know about Candlestick patterns,you can read my blog on “Introduction to CandleSticks”

Benefits of Using CANSLIM for Swing Trading

- Higher Probability of Selecting Winning Stocks:

CANSLIM helps traders identify fundamentally strong companies with growing earnings and favorable market conditions. By focusing on high-growth stocks, swing traders are more likely to catch stocks poised for short-term price momentum, increasing their chances of profitable trades. - Balanced Approach:

CANSLIM combines both fundamental analysis (earnings growth, new products, institutional backing) with technical analysis (price action, volume, moving averages). This dual approach helps traders make well-informed decisions, improving the accuracy of trade entries and exits. - Capitalizing on Market Trends:

By focusing on stocks that are leading in their respective industries and that are backed by institutional investors, CANSLIM enables traders to ride strong market trends. This allows them to take advantage of bullish market phases and identify stocks that are outperforming the market. - Flexibility Across Market Conditions:

The CANSLIM strategy can be applied in different market environments. Whether in a bull market or a sideways-moving market, the focus on strong earnings and growth allows swing traders to identify potential winners regardless of broader conditions. - Incorporates Market Sentiment:

By tracking institutional sponsorship and market direction, CANSLIM integrates market sentiment into stock selection. This helps swing traders align with large market players and profit from positive sentiment when stocks are trending upwards. - Encourages Disciplined Trading:

CANSLIM’s structured approach to stock selection, based on earnings and market leadership, promotes disciplined trading. Swing traders who follow CANSLIM are more likely to stick to predefined criteria rather than making emotional or impulsive trading decisions. - Helps Identify Stocks Early in Their Growth Cycle:

CANSLIM focuses on companies with new products, management, or other developments, allowing traders to get in early during growth phases. This early entry helps maximize profits during rapid stock price increases.

Challenges in Using CANSLIM for Swing Trading

- Requires In-Depth Research:

CANSLIM involves detailed analysis of earnings reports, market trends, product developments, and institutional activity. Swing traders must dedicate time to regularly monitoring news, earnings data, and industry trends, which can be time-consuming and complex. - Reliance on Market Timing:

CANSLIM emphasizes the importance of trading in sync with market direction, which requires precise market timing. Mistiming market trends can lead to premature entries or exits, potentially resulting in losses if the market turns unexpectedly. - Difficulty in Identifying New Developments:

One of the key factors of CANSLIM is capitalizing on stocks with new products or management changes. However, identifying these catalysts in real-time can be difficult, especially in fast-moving markets. - Dependence on Institutional Buying:

CANSLIM puts a lot of weight on institutional sponsorship. While institutional buying is generally a sign of strength, heavy reliance on this can lead to risks if institutions begin selling or reallocating their positions, causing stock prices to drop quickly. - Challenges in Fast-Moving Markets:

In volatile markets, stocks that meet CANSLIM criteria may exhibit rapid price swings, leading to potential losses for swing traders. This volatility can make it difficult to set appropriate stop losses or manage risk effectively. - Not Ideal for All Types of Stocks:

CANSLIM tends to favor high-growth, leading stocks, which may not apply well to value stocks, dividend-paying companies, or sectors that are less growth-oriented. Swing traders focusing on sectors like utilities or real estate may find CANSLIM less applicable. - Risk of Over-Reliance on Earnings Reports:

Earnings can be volatile, and an over-reliance on positive earnings reports may result in trades being made just before disappointing results are released, leading to significant losses.

Tips for Maximizing Success with CANSLIM in Swing Trading

- Set Stop-Loss Limits for Risk Management:

Always define your risk before entering a trade by setting stop-loss orders. For CANSLIM swing trading, this helps protect your capital in case the stock price moves against your position. Consider setting your stop-loss at a level where the stock shows a clear sign of trend reversal or violation of key support levels. - Use a Trailing Stop to Protect Profits:

As the stock price moves in your favor, consider using a trailing stop to lock in profits while still allowing room for the stock to rise. A trailing stop adjusts automatically with price movement, enabling you to ride the momentum while ensuring you exit before significant pullbacks. - Monitor Volume and Momentum:

Volume spikes and momentum indicators are key to confirming the strength of a stock’s price movement. Always check if the stock is experiencing higher-than-average volume or if momentum is building before making a move. This can help you validate the potential of the stock based on CANSLIM criteria. - Stay Updated on Earnings Reports and News:

Since CANSLIM heavily relies on strong earnings and new developments, keeping track of quarterly earnings reports and relevant company news is essential. This will help you stay informed and anticipate stock movements driven by earnings surprises or product announcements. - Always Consider Market Direction Before Entering Trades:

CANSLIM stresses the importance of trading in sync with the broader market trend. Before entering any swing trade, assess the overall market sentiment. If the market is trending upwards, your trades are more likely to succeed. If the market is in a downturn, even fundamentally strong stocks may struggle to perform well. - Use a Stock Screener for Efficient Selection:

Utilizing stock screeners based on CANSLIM criteria can save time and ensure that you’re consistently finding stocks that meet the strategy’s requirements. Screen for earnings growth, leadership, and institutional sponsorship to streamline your stock-picking process. - Avoid Overtrading:

While CANSLIM can help you identify opportunities, don’t feel compelled to take every trade that meets the criteria. Quality over quantity is key in swing trading. Be patient and wait for the best setups with the strongest fundamentals and technical confirmation. - Backtest and Paper Trade:

Before committing real capital to the CANSLIM strategy, consider back-testing the approach on historical data or using paper trading to gain confidence in your ability to select and execute trades successfully. This helps refine your understanding of the strategy and improves your decision-making skills.

Conclusion

CANSLIM combines the best of both fundamental and technical analysis, giving traders a systematic way to identify high-growth stocks with strong earnings and institutional backing. Its focus on stocks with momentum makes it particularly suitable for swing trading, where timing and short-term price movement are critical.

CANSLIM provides a structured framework for swing trading, but it’s important to remember that success requires discipline, consistent research, and solid risk management. By combining CANSLIM with technical analysis, proper stop-loss settings, and an awareness of market conditions, traders can maximize their chances of success in swing trading.