Swing trading is a popular strategy among traders who seek to profit from short to medium-term price movements in the financial markets.

Unlike day trading, which involves buying and selling within the same day, swing trading aims to capture larger price movements over a period of days, weeks, or even months.

This blog will guide you through the basics of swing trading, its mechanics, and the strategies that can help you succeed.

What is Swing Trading?

Swing trading is a trading strategy where traders look to capitalize on price swings in the market. These swings can last from a few days to several weeks.

The idea is to buy an asset when it’s expected to rise in price and sell it when it reaches its peak, or vice versa, sell an asset when it’s expected to fall and buy it back when it hits a low.

The goal of swing trading is to capture a portion of the potential price movement. Swing traders typically rely on technical analysis, studying price charts, patterns, and indicators to make informed decisions.

For those looking to explore a more automated approach, Understanding Algorithmic Trading: Definition, Benefits, and How It Works provides a detailed look at how algorithms can manage trades over various time frames, including day and swing trading.

Why Do We Call It Swing Trading?

The term “swing” in swing trading refers to the up-and-down movements, or “swings,” in the market. Just like a pendulum swings back and forth, prices in the financial markets tend to fluctuate over time.

Swing traders aim to catch these swings, entering trades when they believe the market is about to move in their favor.

This strategy works on the assumption that markets never move in a straight line; instead, they zigzag, creating opportunities for traders to profit from both upward and downward movements.

How Does Swing Trading Work?

Swing trading involves a series of steps:

- Market Analysis: Traders analyze the market to identify potential trading opportunities. This involves studying price charts, looking for trends, patterns, and key support and resistance levels. Identifying the trend is key in swing trading.

- Entry Point: Once an opportunity is identified, the trader decides on the best time to enter the trade. This is usually when the price is near a support level (for buying) or a resistance level (for selling).

- Holding Period: After entering the trade, the trader holds the position for a period ranging from a few days to several weeks, waiting for the price to move in the desired direction.

- Exit Strategy: The trader exits the trade when the price reaches a predetermined target or if market conditions change, triggering a stop-loss.

Risk Management: Throughout the process, traders use risk management techniques, such as setting stop-loss orders, to protect against significant losses.

What are Some Real-World Examples?

Swing Trading vs. Day Trading

Swing trading and day trading are both popular strategies, but they differ in several key ways:

| Feature | Swing Trading | Day Trading |

| Time Frame | Days to weeks, sometimes months | Minutes to hours, all trades completed within a day |

| Trading Frequency | Fewer trades, focusing on larger price movements | High frequency, multiple trades within a single day |

| Risk Level | Moderate risk, less stress due to longer holding periods | High risk, requires constant monitoring and quick decisions |

| Market Analysis | Relies on daily and weekly charts, broader analysis | Focuses on intraday charts, short-term technical indicators |

What is the Time Frame Used for Swing Trading?

The time frame for swing trading varies depending on the asset and market conditions. Generally, swing traders focus on a period ranging from a few days to several weeks. The most common time frames used in swing trading include:

- Daily Charts: Show price movements within a single day, providing an overview of the market’s short-term behavior.

- Weekly Charts: Provide a broader view of market trends, helping traders identify longer-term patterns.

- 4-Hour Charts: Some swing traders use shorter time frames, like the 4-hour chart, to fine-tune their entries and exits.

The choice of time frame depends on the trader’s strategy and the specific asset being traded.

Strategies for Swing Trading

Swing traders use a variety of strategies to identify and profit from market swings. Some of the most common strategies include:

- Trend Trading: This involves trading in the direction of the market’s overall trend. Traders buy during an uptrend and sell during a downtrend.

- Counter-Trend Trading: In this strategy, traders look to capitalize on short-term corrections within a larger trend. For example, buying during a temporary dip in an uptrend.

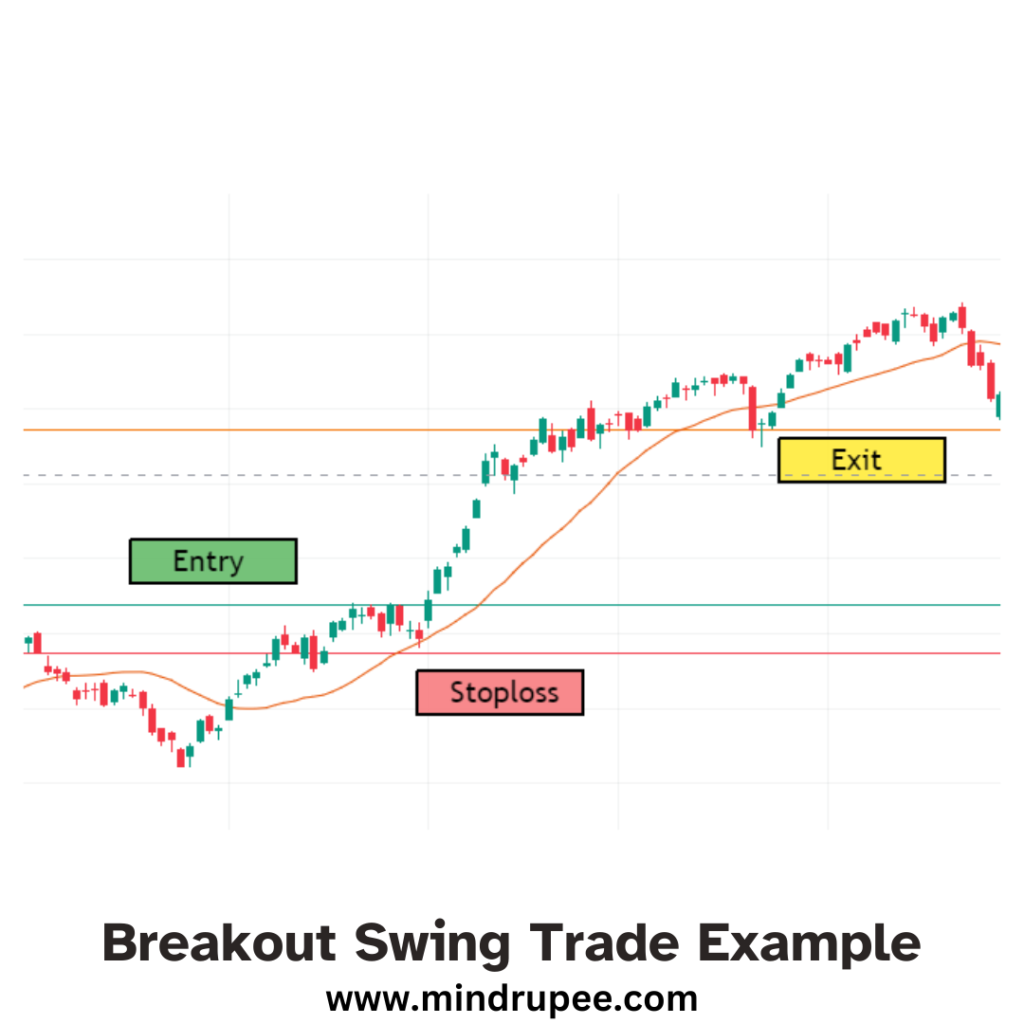

- Breakout Trading: This strategy involves entering a trade when the price breaks out of a consolidation pattern, such as a range or triangle. Breakouts often signal the start of a new trend.

- Reversal Trading: Traders using this strategy look for signs that the market is about to reverse direction, buying at the bottom of a downtrend or selling at the top of an uptrend.

Types of Instruments Best Suited for Swing Trading

Swing trading can be applied to a wide range of financial instruments, including:

- Stocks: Equities are the most common instruments for swing trading, as they offer plenty of volatility and liquidity.

- Forex: The foreign exchange market is ideal for swing traders due to its 24/7 availability and frequent price swings.Moreover high amount of leverage is another advantage.

- Commodities: Assets like gold, oil, and silver are popular among swing traders, especially during periods of economic uncertainty.

- Cryptocurrencies: The high volatility in cryptocurrencies like Bitcoin and Ethereum provides ample opportunities for swing trading.

- Indices: Swing traders often trade indices like the S&P 500 or NASDAQ to gain exposure to broader market movements.

Each instrument has its own characteristics, and traders should choose the one that best suits their strategy and risk tolerance.

Swing Trading Tools and Indicators

Swing trading relies heavily on technical analysis, which involves using various tools and indicators to make informed trading decisions. These indicators help traders identify trends, measure momentum, and determine potential entry and exit points. Here are some of the most commonly used tools and indicators in swing trading:

1. Moving Averages:

- What It Is: Moving averages are one of the simplest and most effective indicators used in swing trading. They smooth out price data to create a single flowing line that shows the average price over a specific period.

- How It’s Used: Traders often use two types of moving averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA). A common strategy involves the crossover of a short-term moving average (like the 50-day EMA) with a long-term moving average (like the 200-day EMA). When the short-term average crosses above the long-term average, it’s a buy signal, and when it crosses below, it’s a sell signal.

2. Relative Strength Index (RSI):

- What It Is: RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and helps identify overbought or oversold conditions in the market.

- How It’s Used: A reading above 70 typically indicates that a stock is overbought and might be due for a pullback, while a reading below 30 suggests that it’s oversold and could be due for a bounce. Swing traders use RSI to time their entries and exits, often buying when the RSI is low (but rising) and selling when it’s high (but starting to fall).

3. Moving Average Convergence Divergence (MACD):

- What It Is: MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of the MACD line, the signal line, and a histogram.

- How It’s Used: Swing traders look for crossovers between the MACD line and the signal line. When the MACD line crosses above the signal line, it’s a bullish signal; when it crosses below, it’s a bearish signal. The histogram also helps in gauging the strength of the signal, with larger bars indicating stronger momentum.

4. Fibonacci Retracements:

- What It Is: Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. These levels are derived from the Fibonacci sequence, a mathematical pattern found in nature.

- How It’s Used: Traders use Fibonacci retracements to identify potential reversal levels. Common retracement levels include 38.2%, 50%, and 61.8%. Swing traders look for price reversals or bounces at these levels, entering trades when the price retraces to one of these key levels before continuing in the direction of the trend.

How These Indicators Work Together?

- Combining Indicators: No single indicator should be used in isolation. Swing traders often combine these indicators to confirm signals and increase the likelihood of successful trades. For example, a trader might use moving averages to identify the trend, RSI to spot overbought or oversold conditions, MACD for momentum, and Fibonacci retracements to pinpoint entry and exit levels.

- Customizing for Your Strategy: Each trader may customize the use of these indicators based on their trading style and the specific asset they are trading. It’s essential to backtest your strategy with these indicators to see how well they perform in different market conditions.

Note : These are some of the indicators and this list is not exhaustive.

Checklist for Entering a Swing Trade

Before entering a swing trade, it’s important to follow a checklist to ensure you’re making a well-informed decision:

- Identify the Trend: Determine whether the market is in an uptrend, downtrend, or consolidation.

- Set Entry and Exit Points: Establish clear entry and exit points based on technical analysis.

- Risk Management: Define your risk tolerance and set stop-loss orders to protect against large losses.

- Market Conditions: Check the overall market conditions and news that could impact your trade.

- Position Size: Calculate the appropriate position size based on your risk management plan.

- Review the Trade Setup: Double-check the setup to ensure it aligns with your strategy.

Following this checklist can help you make more disciplined and profitable trades.

Understanding Market Cycles in Swing Trading

Market cycles play a crucial role in swing trading. Recognizing whether the market is in a bullish, bearish, or consolidation phase can significantly impact your trading decisions and strategy.

1. Bullish Market:

- In a bullish market, prices are generally rising, and there is widespread optimism among investors. Swing traders in a bullish cycle often look for opportunities to buy during pullbacks or corrections, anticipating that prices will continue to rise.

- Strategy: During a bullish phase, the strategy might involve buying near support levels and riding the upward momentum until the price approaches resistance or shows signs of reversal.

2. Bearish Market:

- A bearish market is characterized by falling prices and pessimism among investors. Swing traders in a bearish market look for opportunities to short-sell, expecting prices to continue declining.

- Strategy: In a bearish phase, swing traders might focus on short-selling at resistance levels or after a brief rally, aiming to profit from the subsequent downward movement.

3. Consolidation Market:

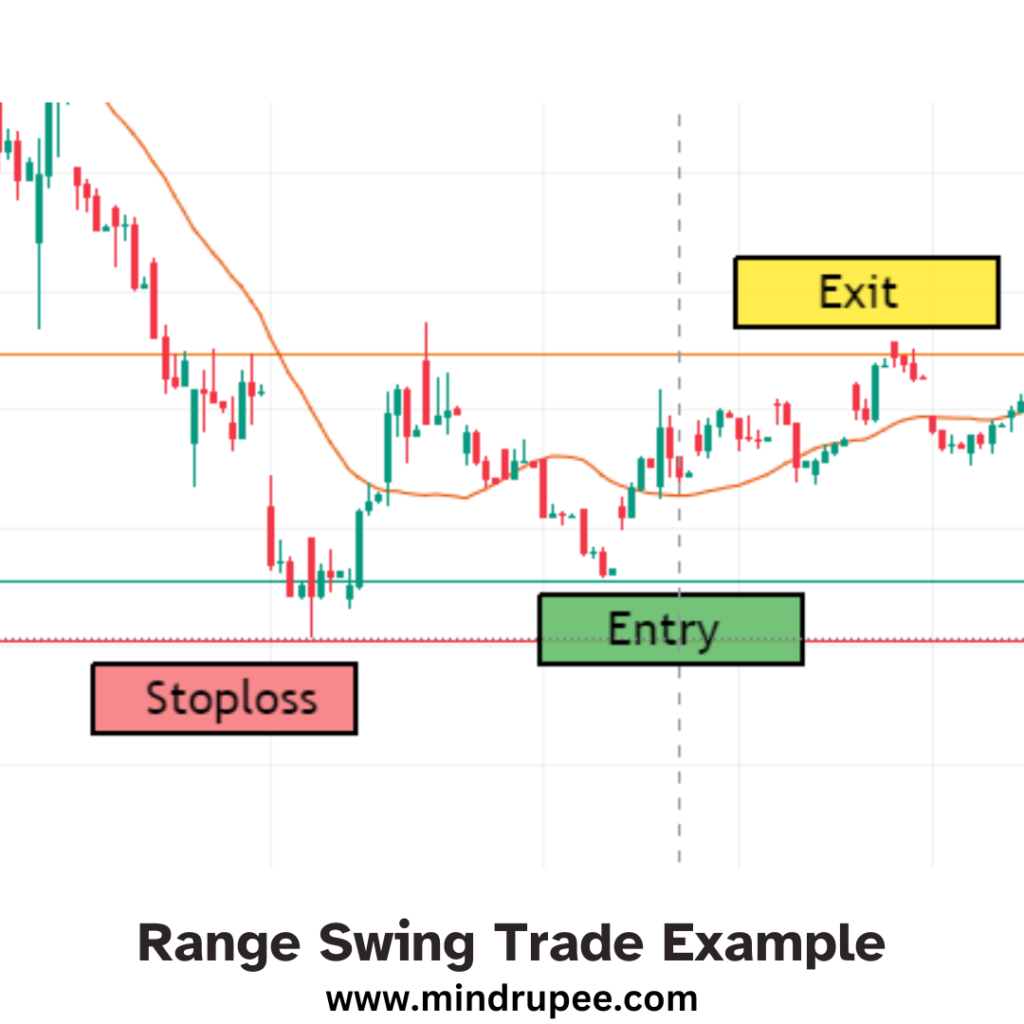

- In a consolidation phase, the market is neither clearly bullish nor bearish; instead, prices move within a narrow range, with no significant upward or downward trends. This can be a challenging environment for swing traders, as there are fewer clear opportunities.

- Strategy: During consolidation, traders often wait for a breakout or breakdown from the range. Alternatively, they might trade within the range by buying at the lower boundary (support) and selling at the upper boundary (resistance), but with caution, as breakouts can happen suddenly.

Why Understanding Market Cycles is Important?

- Timing Your Trades: Knowing the current market cycle helps you time your trades better. For instance, in a bullish market, you’d aim to enter trades at the beginning of an upward swing, while in a bearish market, you’d look for opportunities to short-sell.

- Adapting Your Strategy: Each market cycle requires a different approach. What works in a bullish market might not work in a bearish one. By understanding the cycle, you can adjust your strategies accordingly to maximize your chances of success.

- Managing Risk: Market cycles also influence the level of risk in your trades. In a volatile bearish market, for example, you might tighten your stop-loss levels or reduce your position size to manage risk more effectively.

The Psychology of Swing Trading

Swing trading isn’t just about analyzing charts and using technical indicators—it’s also about managing your emotions and staying mentally strong. The psychological aspects of trading can significantly influence your success, so it’s essential to develop the right mindset. Here are some key psychological factors that play a crucial role in swing trading:

1. Patience:

- Why It’s Important: Unlike day trading, where you’re constantly in and out of trades, swing trading requires you to hold positions for several days or even weeks. This means you need to be patient and allow your trades to play out according to your strategy.

- Challenge: It can be tempting to exit a trade early when you see a small profit or cut losses too soon when the market moves against you temporarily. However, successful swing traders understand that patience is key to capturing the full potential of a swing.

2. Discipline:

- Why It’s Important: Discipline is critical in swing trading because it ensures that you stick to your trading plan and avoid impulsive decisions. A well-defined strategy is only effective if you have the discipline to follow it.

- Challenge: Emotional trading, such as chasing after a losing trade to recover losses (revenge trading) or deviating from your plan due to fear or greed, can lead to poor outcomes. Discipline helps you stay focused and consistent, even when emotions run high.

3. Handling Wins and Losses:

- Why It’s Important: Both wins and losses are part of the trading journey. How you handle them can make a big difference in your long-term success. It’s easy to get overconfident after a winning streak or discouraged after a series of losses, but it’s important to stay balanced.

- Challenge: Overconfidence after wins can lead to reckless trading, while a series of losses can make you doubt your strategy or lead to fear-based decisions. The key is to treat each trade as a separate event and not let past outcomes influence your future decisions. Accepting that losses are part of the process and focusing on the overall strategy rather than individual trades is crucial.

4. Managing Expectations:

- Why It’s Important: It’s easy to enter swing trading with the expectation of making quick profits. However, the reality is that swing trading involves ups and downs, and not every trade will be a winner.

- Challenge: Unrealistic expectations can lead to frustration and rash decisions. It’s important to have realistic goals and understand that consistent, steady gains over time are more sustainable than trying to hit a home run with every trade.

5. Staying Calm Under Pressure:

- Why It’s Important: The market can be unpredictable, and prices can move against you unexpectedly. Staying calm and composed allows you to make rational decisions based on your trading plan rather than reacting emotionally to market movements.

- Challenge: When a trade doesn’t go as planned, it’s natural to feel stressed or anxious. However, it’s crucial to avoid making impulsive decisions out of fear or panic. Developing a calm, measured approach to trading helps you stay focused on the bigger picture.

Tips for Developing the Right Trading Mindset:

- Practice Mindfulness: Techniques like meditation or deep breathing can help you stay calm and focused, especially during volatile market conditions.

- Keep a Trading Journal: Documenting your trades, including your emotions and thought processes, can help you identify patterns and improve your psychological approach to trading.

- Set Clear Rules: Having clear entry and exit rules, along with a well-defined trading plan, can reduce emotional decision-making and help you stay disciplined.

Good Read if you want to understand and develop Trading mindset : Trading in the Zone by Mark Douglus

Or Watch his Youtube video Series :

What Software Can Be Used for Swing Trading?

Several trading platforms offer tools and features tailored for swing traders. Here are some of the best options available in India:

- Zerodha Kite: Zerodha Kite is one of the largest retail stockbrokers in India. Its trading platform is known for its user-friendly interface and comprehensive charting tools. Kite provides real-time data, advanced technical indicators, and easy-to-use order placement features, making it ideal for swing traders.

- Upstox: Upstox offers a powerful trading platform with advanced charting tools, technical analysis, and a range of order types. It’s popular among traders for its low-cost structure and intuitive design, helping swing traders make quick and informed decisions.

- Angel Broking: Angel Broking provides a trading platform with features like advanced charts, technical analysis tools, and personalized advisory services. It’s suitable for both beginners and experienced swing traders looking for a reliable platform.

- Sharekhan: One of the oldest stockbrokers in India, Sharekhan’s trading platform offers a variety of features, including research reports, analysis tools, and educational resources. It’s a great choice for traders who value comprehensive market research.

- ICICI Direct: The brokerage arm of ICICI Bank, ICICI Direct offers a robust trading platform with a range of features for stock trading, including research reports, market analysis, and portfolio management tools. It’s well-suited for traders who want a full-service experience.

- Kotak Securities: Kotak Securities offers a trading platform with advanced charting, live market updates, and research reports. It’s ideal for swing traders who require up-to-date market information and analysis.

- Trade Smart Online: This discount brokerage provides a simple and cost-effective trading platform. It’s a good option for swing traders looking for a no-frills experience with competitive pricing.

- 5paisa: Known for its low-cost trading services, 5paisa offers a platform with various features like real-time market data, analysis tools, and an easy-to-use interface. It’s perfect for budget-conscious traders who don’t want to compromise on quality.

Advantages and Disadvantages of Swing Trading

Like any trading strategy, swing trading comes with its own set of pros and cons. Understanding these can help you decide if swing trading is the right approach for you.

Advantages

- Flexibility: Swing trading offers more flexibility compared to day trading. You don’t need to be glued to your screen all day. You can analyze the market at your own pace and make decisions without the rush.

- Potential for Larger Gains: Since swing traders hold positions for several days or weeks, they can capture larger price movements. This can lead to higher profits compared to the quick, small gains often seen in day trading.

- Less Stressful: With swing trading, you don’t have to make decisions in split seconds. You have time to analyze the market and your positions, which can lead to a less stressful trading experience.

- Works in Different Market Conditions: Swing trading can be effective in both trending and range-bound markets, giving you opportunities in various market environments.

- Lower Transaction Costs: Since you’re trading less frequently than a day trader, you’ll typically incur fewer transaction fees, which can help increase your overall profit.

Disadvantages

- Overnight Risks: Since swing traders hold positions overnight, they are exposed to risks from after-hours news or events that can cause significant price gaps, potentially leading to unexpected losses.

- Requires Patience: Swing trading isn’t about instant gratification. It requires patience to wait for the market to move in your favor, which might not suit those looking for quick wins.

- Need for Market Knowledge: To be successful in swing trading, you need a good understanding of technical analysis and market trends. This can be challenging for beginners who are still learning the ropes.

- Potential for Missed Opportunities: Since swing traders are not constantly in the market, they might miss short-term opportunities that day traders could capitalize on.

- Emotional Challenges: Holding onto trades for several days or weeks can be emotionally challenging, especially if the market moves against you temporarily. It’s important to stick to your strategy and not let emotions dictate your decisions.

Common Mistakes to Avoid in Swing Trading

Swing trading can be a rewarding strategy, but it’s also easy to fall into some common traps, especially if you’re new to the game. Being aware of these pitfalls can help you avoid costly mistakes and improve your chances of success. Here are some of the most common mistakes that swing traders should watch out for:

1. Overtrading:

- What It Is: Overtrading occurs when a trader enters too many trades, often without sufficient analysis or strategy behind them. This can happen due to impatience, the desire to make quick profits, or simply the fear of missing out (FOMO).

- Why It’s a Problem: Overtrading increases transaction costs and can lead to poor decision-making. It also dilutes focus, making it harder to manage existing trades effectively. Quality over quantity should be the mantra for swing traders.

- How to Avoid It: Stick to a well-defined trading plan and only enter trades that meet your criteria. Avoid the urge to trade just for the sake of being active in the market.

2. Ignoring Risk Management:

- What It Is: Risk management involves setting stop-loss orders, determining position sizes, and knowing how much of your capital is at risk on any given trade. Ignoring this crucial aspect can lead to significant losses.

- Why It’s a Problem: Without proper risk management, a single bad trade can wipe out a large portion of your trading account. Swing trading involves holding positions overnight or longer, which means there’s always a risk of unexpected market moves.

- How to Avoid It: Always use stop-loss orders to protect your capital. Determine your risk tolerance before entering a trade and never risk more than you can afford to lose.

3. Letting Emotions Drive Decisions:

- What It Is: Trading based on emotions like fear, greed, or hope rather than on analysis and strategy. This can lead to impulsive decisions, such as holding onto a losing trade for too long or exiting a winning trade too early.

- Why It’s a Problem: Emotional trading often leads to inconsistent results and can cause traders to deviate from their plan, leading to unnecessary losses.

- How to Avoid It: Develop and stick to a trading plan that includes specific entry and exit criteria. Practice emotional discipline by reminding yourself that trading is a long-term game, and not every trade will be a winner.

4. Failing to Adapt to Market Conditions:

- What It Is: Markets go through different cycles—bullish, bearish, and consolidation phases. Sticking to the same strategy in all market conditions without adapting can lead to losses.

- Why It’s a Problem: A strategy that works well in a bullish market might fail in a bearish one. Failing to recognize changing market conditions can result in poor trade performance.

- How to Avoid It: Regularly assess the market’s current phase and adjust your strategy accordingly. For example, in a bearish market, you might focus more on shorting opportunities rather than going long.

5. Chasing the Market:

- What It Is: Chasing the market occurs when traders enter a trade after the price has already moved significantly in one direction, often out of fear of missing out.

- Why It’s a Problem: Entering a trade late can increase the risk of a reversal, leading to losses. Chasing the market usually results in buying high and selling low.

- How to Avoid It: Be patient and wait for the right setup that fits your trading strategy. It’s better to miss an opportunity than to enter a trade with poor risk-reward potential.

6. Neglecting to Review and Learn from Trades:

- What It Is: Failing to review past trades, both wins and losses, and not learning from them. This can lead to repeating the same mistakes over time.

- Why It’s a Problem: Without reviewing your trades, it’s difficult to identify what’s working and what’s not. Continuous improvement is essential for long-term success in swing trading.

- How to Avoid It: Keep a trading journal where you document each trade, including your thought process, emotions, and the outcome. Regularly review your journal to identify patterns and areas for improvement.

Last Section but certainly not the least important Section.

Tracking and Reviewing Your Trades

One of the most effective ways to improve as a swing trader is to keep track of your trades and regularly review them. By doing so, you can identify patterns in your trading behavior, learn from your mistakes, and refine your strategies over time. Here’s how you can do this effectively:

1. The Importance of a Trading Journal:

- Why You Need One: A trading journal is a detailed record of every trade you make. It’s not just about recording the numbers; it’s about documenting your thought process, the reasons behind each trade, and how you felt during the trade. This helps you understand what’s working and what isn’t.

- What to Record: In your trading journal, you should note down:

- Date and time of the trade

- Asset traded (e.g., stock, currency pair)

- Entry and exit prices

- Trade size (number of shares, lots, etc.)

- The strategy used

- The reason for entering the trade

- The outcome of the trade (profit or loss)

- Emotions and thoughts during the trade

- Any lessons learned

2. Using Software to Track Trades:

- Digital Tools: While a physical journal works well, there are also software tools and apps designed specifically for tracking trades. These tools can automatically pull in data from your trading account, making it easier to keep detailed records.

- Popular Tools:

- Excel/Google Sheets: Simple spreadsheets are a popular choice for many traders. You can customize them to suit your needs and track metrics that matter to you.

- TradingView: Known for its charting capabilities, TradingView also allows traders to annotate charts and keep notes on specific trades.

- Edgewonk: A dedicated trading journal that offers detailed analytics and performance tracking, helping you to identify strengths and weaknesses in your trading strategy.

- Tradervue: Another powerful journaling tool that allows for trade import, tagging, and detailed performance analysis.

3. Regularly Reviewing Your Trades:

- Why Review Matters: Regularly reviewing your trades helps you spot patterns in your trading behavior, such as consistently profitable strategies or recurring mistakes. It’s a critical step in continuous improvement.

- What to Look For: When reviewing your trades, consider:

- Win/Loss Ratio: Are you winning more trades than you’re losing? If not, what’s going wrong?

- Average Gain vs. Average Loss: Are your winning trades making more money than your losing trades are costing you?

- Common Mistakes: Are there specific mistakes that you keep repeating? Understanding these can help you avoid them in the future.

- Emotional Patterns: Do you make different decisions when you’re stressed, excited, or tired? Understanding your emotional triggers can help you manage them better.

- Setting Goals: Based on your reviews, set specific, measurable goals for improving your trading. For example, you might aim to reduce the number of impulsive trades or improve your risk management practices.

4. Continuous Learning and Adaptation:

- Adapting Your Strategy: As you gather more data and insights from your trading journal, you can start adapting your strategy to improve performance. This might mean adjusting your entry and exit criteria, refining your risk management rules, or focusing on different types of trades.

- Learning from Mistakes: Every trader makes mistakes, but successful traders learn from them. Use your journal as a tool for growth, allowing you to turn each mistake into a valuable learning experience.

For traders using algorithmic strategies, mastering back-testing is crucial, as explained in Mastering Algorithmic Back-testing: A Comprehensive Guide.

Swing trading offers a balanced approach to trading, combining the potential for significant profits with a more relaxed pace than day trading.

By understanding market swings, applying the right strategies, and using the right tools, you can successfully navigate the markets and take advantage of short to medium-term price movements.

Remember, like any trading strategy, swing trading requires discipline, patience, and continuous learning. Happy trading!

FAQs

Is Swing Trading Profitable?

Yes, swing trading can be profitable, but it requires skill, patience, and a solid understanding of market dynamics. Profits are generated by correctly predicting short to medium-term price movements. However, like all trading strategies, it comes with risks, and not all trades will be successful.

What is the Amount of Money Required to Start Swing Trading?

The amount of money required to start swing trading varies depending on the market and the instrument you choose. In general, it’s recommended to start with a minimum of ₹10,000 to ₹50,000 for stocks. However, the more capital you have, the more flexibility you’ll have in managing risks and diversifying your trades.

Should a Beginner Do Swing Trading?

Swing trading can be suitable for beginners, but it’s important to start with a solid understanding of technical analysis and risk management. Beginners should practice with a demo account or start with small positions to gain experience before committing significant capital.

What Should Be the Volume Criteria for Swing Trade?

Volume is an important factor in swing trading. Higher volume indicates strong market interest and can confirm the strength of a price movement. As a rule of thumb, swing traders should look for stocks with average daily trading volumes of at least 500,000 shares to ensure liquidity and minimize the impact of slippage.

More Reads

High-Frequency Trading V/S Algorithmic Strategies

Decoding the Timeline: A Comprehensive History of Algorithmic Trading