Introduction to Algorithmic Back-testing

Traders can now make deals more accurately and quickly thanks to algorithmic trading, which has changed the way investment markets work.

Back-testing is an important step in creating and improving trade strategies.

By using past market data to test a trading strategy, an algorithmic trading system back-testing can help you figure out how well it works and whether it will make you money.

Definition and Significance

You can use past market data to simulate trades based on a set of rules and parameters that have already been set. This is called algorithmic back-testing.

Before using their trading strategies in real markets, traders can test how well their strategies work in this risk-free training system.

Another important thing that back-testing does is show how a plan might have worked in the past. This information helps traders decide if they think it will work in the future.

Role in Evaluating Trading Algorithms

It’s impossible to say enough about how important automated back-testing is. Traders and buyers who want to build and improve their trading algorithms need this tool more than anything else.

Back-testing lets traders see how well trading methods work and how profitable they are over time by putting them through historical market conditions.

Back-testing also helps traders find and fix any risks or biases that might be in their methods, which makes trading systems stronger and more reliable.

In this introduction, we’ll learn more about algorithmic back-testing, including how it works, what problems it can cause, and the best ways to do it.

Because the financial markets change so quickly these days, traders can get an edge by fully understanding automated back-testing.

Come with us as we find out the secrets to good algorithmic trading back-testing strategies and increase your chances of becoming a great trader.

Before we move any further we need to understand various biases that could plague your back testing results.

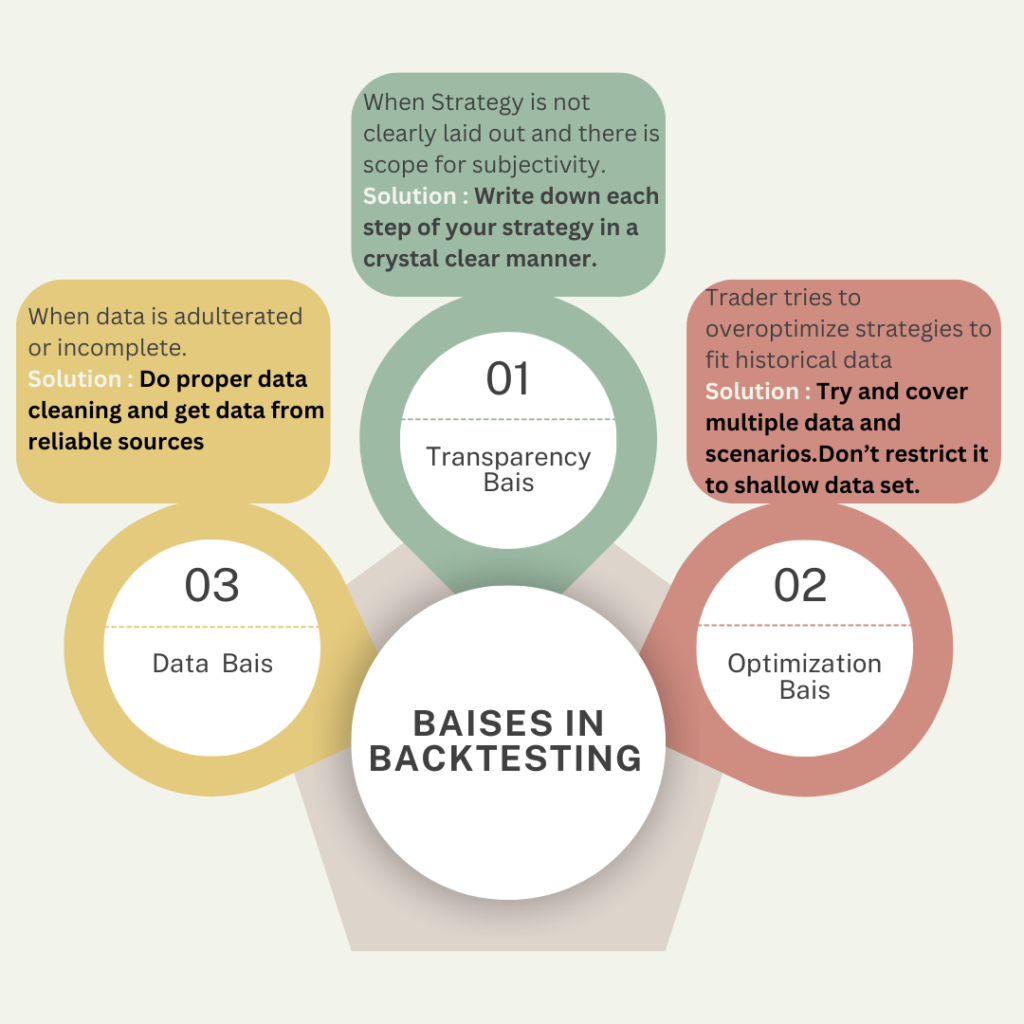

Biases Affecting Strategy Back tests

Different types of bias can change the results of back testing. Human judgment, data selection, statistical tools, and methodological choices are some of the things that cause these biases.

Back test results must be accurate and reliable, so it is important to understand and deal with these flaws/Biases.

Lack of Transparency

In order to make sure that the results are honest and reliable, back-testing strategy must be clearly laid out. There are times when it’s hard to figure out how results were obtained when methods are not clear or are not well documented.

Clear and repeatable methods are needed to fix transparency problems. This makes back-testing processes and results more reliable.

Selection Bias in Optimization

As traders try to make their strategies fit historical data more and more exactly, they can experience optimization bias.

Because of this, strategies may do very well in back-tests , but they might not work well in real trading because they are too specific.

Achieving a balance between past success and the ability to adapt to changing market conditions is necessary to reduce optimization bias. This makes sure that strategies stay strong and useful over time.

Quality of the data and its accessibility

There is a big difference in how reliable back-test results are depending on the quality and availability of previous data.

When you back-test, mistakes and biases can be introduced by bad or incomplete data, which makes the results less reliable.

Carefully choosing the right data, cleaning it up, and coming up with new ways to get it are all part of solving data problems and making sure that past datasets are correct and complete.

Tools and Techniques for Backtesting

Algorithmic trading relies heavily on backtesting to validate strategies before deploying them in live trading environments.

In this section, we’ll explore the various tools and techniques used for backtesting, focusing particularly on software packages available in India and the acquisition of historical market data.

Software Packages for Backtesting in India

It is very important to have the right tools when you want to backtest algorithmic trading strategies. Traders and investors in India can use a number of software packages to test their plans against past data. These are some common choices:

#1 Zerodha Streak: Zerodha Streak has a user-friendly design and a number of backtesting tools that are specifically made for the Indian market. Traders can use historical data to make and test their strategies. They can use either technical or fundamental research.

#2 Upstox Pro: Upstox Pro lets users test strategies across a wide range of time periods and asset types by performing extensive backtesting. The site gives users access to historical data and advanced charting tools that can help them come up with strategies.

#3 Amibroker: Many traders and analysts use Amibroker, which is a powerful platform that lets you test complicated trading strategies in the past. It has indicators that can be changed, strong scripting features, and a lot of past data for in-depth analysis.

#4 Tradetron : Tradetron helps you backtest strategies and deploy them in live market.

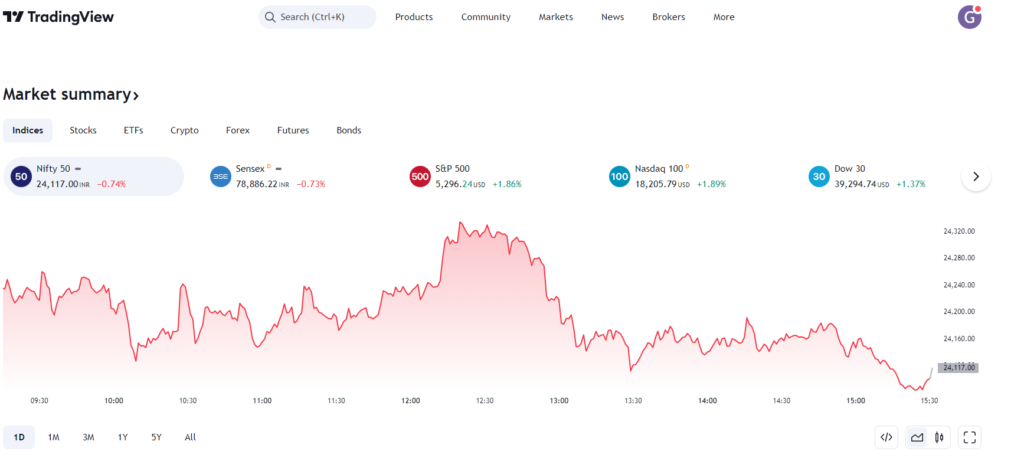

#5 Tradingview : Tradingview is a charting software that helps you backtest your strategies. You can use Pinescript to backtest your strategies.

Historical Data Acquisition

For correct backtesting, you need to get high-quality historical market data. In India, you can get historical statistics for stocks, futures, options, and other asset classes from a number of different places. Some popular ways to get historical information are:

- Data Vendors: Indian market historical data is available from data suppliers that charge a fee, like NSE, BSE, and MCX. Traders can buy data sets that are tailored to their needs. This gives them access to correct and trustworthy data for backtesting..

- API Services: Some brokerage firms and data providers offer API services that let traders use programs to get to past market data. This choice is great for algorithmic traders who like having data gathering and analysis done automatically.

- Data Scraping: Traders may use web scraping methods to get old market information from online sources. This method may take longer and be less reliable, but it may be a cheap way to get information from places other than the usual ones.

Algo-Trading Time Scales

This type of trading can be done over a wide range of time frames, from high-frequency trading (HFT) to long-term investment. You need to understand the different time scales in order to make good trade plans. These time frames are often used in automated trade:

- Intraday Trading: During an intraday trade, tick or minute-level data is used to profit from short-term price changes that happen during a single trade day.

- Swing Trading: This is a short-term approach that looks for price changes that happen every few days to a few weeks. You can use daily or hourly data for this.

- Position Trading: When you use position trading, one long-term strategy is to look at data every day or every week to catch big market trends that last for weeks or months.

It is important to make sure that the time frame of a trading plan fits with your trade goals and the way the market is right now for the best results and lowest risk. When traders pick the right time frame for their automated trading systems, they should give things like volatility, liquidity, and transaction costs a lot of thought.

Challenges and Considerations

Current Challenges in Back-testing

As useful as algorithmic back-testing is, it has a lot of problems that need to be fixed right away. Some of these problems are as follows :

- The quality of the data, which means that wrong or incomplete past data can distort the results.

- Also, optimization biases happen a lot when traders make their strategies to fit only past or future data. This makes strategies that work well in back-tests but not in real markets.

- Another concern is transparency, since methods that aren’t clear can make it hard to believe back-test results.

To deal with these problems, you need a multifaceted approach that focuses on data security, flexible strategies, and open methods.

Potential Solutions

Practitioners are looking into a number of different methods to help deal with these problems. Some of the solutions are as follow:

- Data quality can be raised by using strong data cleaning methods and picking the right data sources.

- Cross-validation and other techniques can help lower optimization errors.

- The use of open-source back-testing tools and clear documentation of methods can help make things more clear.

- Using adaptive strategies that put adaptability ahead of past success can also help make trading algorithms more future-proof.

What is expected to happen in the future ?

In the near future, computer back-testing is likely to change even more.

New technologies like AI and machine learning are likely to play a bigger role, making it possible for strategies and prediction models to be more complex.

Changes to regulations may also affect how back-testing is done, forcing traders to figure out how to meet the new rules.

In addition, the growing complexity of financial markets and the popularity of new data sources create both problems and chances for automated traders. This makes it even more important for back-testing methods to be flexible and new.

Algorithmic Trading Strategies

Overview of Strategies

There are many different types of quantitative trading techniques that are included in algorithmic trading. Each has its own goals and characteristics.

Some of these are mathematical model-based approaches, which use statistical and quantitative models to find trading chances. Trend-following or mean-reversion techniques, on the other hand, use market trends or price changes to make money.

High-frequency trading (HFT) techniques, on the other hand, focus on making a lot of trades very quickly to take advantage of short-term problems in the market.

Case Studies and Examples

Looking at real-life case studies and examples can help you understand how algorithmic trading methods can be used in the real world.

For example, momentum strategies can be used to find current price trends, and arbitrage strategies can be used to take advantage of price differences between markets.

By looking at these case studies, traders can learn more about the pros and cons of different methods and change how they do things to fit those needs.

Performance Evaluation

Evaluation Methods and Metrics

Using certain review methods and metrics is needed to figure out how well algorithmic trading strategies are doing.

Standard metrics include risk-adjusted returns, which show how much risk was needed to get a certain level of return, and drawdowns, which show how much equity dropped from its highest point to its lowest point during a certain time.

As another popular metric in quantitative finance, the Sharpe ratio measures how well an investment plan works by looking at its risk-adjusted return.

Importance of Continuous Evaluation

Refining and improving trading algorithms requires constant review of how well strategies are doing on the stock market.

When markets are dynamic and always changing, traders have to change their tactics to keep up.

Tracking success metrics and looking at trading results on a regular basis helps traders find ways to improve and change their strategy to fit the current market conditions.

Maintaining a competitive edge in algorithmic trade requires this iterative process of testing and improving.

Keeping a trading Journal is an amazing habit every trader must adopt.

Advanced Concepts and Considerations

Integration of Backtesting with Real-time Trading

A very important part of algorithmic trading is combining the results of back-testing with present day trading.

This means moving from looking at past data to trading and executing trades in real time while keeping things consistent and effective.

Creating strong risk management rules, setting clear criteria for making decisions, and putting in place automated trading systems are all ways to achieve seamless integration.

Real-time trading has clear benefits, like being more efficient and quick to react to changes in the market. However, problems like latency and slippage must be carefully handled to get the best results.

Beyond the Usual Trading Algorithms

Algorithmic trading is changing because of new ideas and more powerful trading algorithms. Traders are looking into new strategies that use machine learning, artificial intelligence, and quantitative analysis in addition to standard ones like trend-following and mean-reversion.

These advanced algorithms can find complicated trends in market data, make more accurate predictions about how prices will move in the future, and change automatically when market conditions change.

Traders can get ahead of the competition and take advantage of new chances in the financial markets by using cutting-edge tools and technologies.

How Algorithmic Trading Works

What makes algorithmic trading work is a complex set of rules and processes that make it work.

The idea of automation is at the heart of this. With automation, trading choices are made automatically based on rules or algorithms that have already been set up.

Some important parts of algorithmic trading are the percentage of volume (POV), which tells you how much of the total market volume a trade makes up, and the volume-weighted average price (VWAP), which figures out the average price of a security by taking into account how much it trades over a certain amount of time.

It is important to understand these basic ideas in order to make good algorithmic trading plans and get around in the complicated financial markets.

Ethical Considerations and Regulation

Ethical Considerations in Back-testing

When it comes to algorithmic back-testing and other automated trading tools, ethics are very important.

As algorithmic strategies get smarter, moral problems like fairness, transparency, and bias need to be carefully thought through. Traders and developers need to make sure that back-testing methods are clear, can be used again, and properly reflect how trading works in the real world.

Also, moral standards should be set up to stop people from doing unethical things like changing facts or manipulating the market. Traders can keep their integrity and trust in algorithmic trading methods by following ethical rules.

Regulation and Compliance

Important parts of automatic trading are oversight and following the rules.

A lot of rules have been put in place to protect investors and keep markets honest because algorithmic trade could change the way they work.

Most of the time, these rules cover things like risk management, market monitoring, algorithmic trade strategies, and what information can and can’t be shared.

It is the law to follow the rules set by officials. Doing so also helps keep the market stable and builds trust among investors.

Regulators may create new rules and guidelines to deal with new issues and lower possible risks in algorithmic trade since it is always changing.

It’s important to follow these rules so that markets stay fair and organized and so that algorithmic trade can keep going in the future.

FAQs on Algorithmic Backtesting

- How do you do algorithmic back-testing?

- Back-testing trade algorithms means using old market data to simulate how well a trading strategy would have done in the past. Traders use special software to run the plan on historical data and measure how well it worked.

- Is algorithmic trading really profitable?

- Traders who come up with good methods and know how to handle risk can make money with algorithmic trading. However, profitability relies on many things, including the state of the market, the strategy itself, how quickly it is put into action, and how well it handles risks.

- Is algorithmic trading illegal?

- While algorithmic trade isn’t necessarily illegal, some of the things that are done may be closely watched by regulators or limited. Traders must follow the rules and laws that apply to financial markets and dealing in securities.

- Is 100 trades enough for backtesting?

- The right sample size for a backtest relies on the trading strategy, the market conditions, and the level of statistical significance needed. While 100 trades might give you some useful information, for a more solid analysis, you should usually do a lot more tests.

- Can you trade without back-testing?

- You can trade without back-testing, but there is more danger and uncertainty when you do. Back-testing is a way for traders to see how well a strategy works, find possible flaws, and improve trading rules before putting real money into live markets.

- Which is the fastest back-testing framework?

- QuantConnect, Quantopian, and MetaTrader are some of the backtesting platforms that offer fast and effective simulation features. The choice relies on things like which trading platforms work with it, which programming language you prefer, and the features you want.

- Which back-testing software is best?

- Which back-testing software is best relies on personal tastes, trading goals, and technical needs. Amibroker, NinjaTrader, TradeStation, and MultiCharts are all popular choices, and each has its own set of features and functions.

- What is the difference between back-testing and validation?

- Back-testing means simulating trading methods using data from the past to see how well they worked. Validation, on the other hand, uses out-of-sample data or forward-testing methods to check how strong and reliable a plan is.

- What is the difference between manual and automated back-testing?

- In manual back-testing, you look at past data and make trades by hand following rules that have already been set up. In automated back-testing, software does the work of evaluating strategies and analyzing performance automatically.

- What is the difference between clean back-testing and dirty back-testing?

- Clean back-testing means running tests without any data mining or data snooping bias. This makes sure that the results truly show how the trading strategy worked. When dirty back-testing is done, on the other hand, biases are added during the testing process, either on purpose or by accident. This can lead to results that are too good to be true.

Conclusion: Looking Ahead

In conclusion, algorithmic back-testing serves as a critical tool for traders and investors seeking to develop and evaluate trading strategies. Throughout this exploration, we’ve delved into various aspects of algorithmic backtesting, from its quantitative research and defining its core concepts to identifying biases, addressing challenges, and exploring advanced strategies.

As we look ahead, it’s evident that algorithmic trading will continue to evolve, driven by advancements in technology, data analysis, and market dynamics. However, amidst the rapid pace of innovation, it’s essential for market participants to remain mindful of ethical considerations and regulatory requirements. Transparency, accountability, and adherence to ethical guidelines are fundamental to maintaining trust and integrity in algorithmic trading practices.

In summary, algorithmic backtesting offers valuable insights and opportunities for traders to enhance their decision-making processes and improve trading performance. By embracing best practices, staying abreast of emerging trends, and prioritizing ethical conduct, traders can navigate the complexities of algorithmic trading with confidence and resilience.

As we embark on the journey of algorithmic trading, let us remain committed to fostering a culture of innovation, integrity, and responsible trading practices, shaping a future of financial industry where algorithmic strategies empower traders to achieve their financial goals while upholding the highest standards of ethics and professionalism.