Trading is like a big playground where people try to make money by buying and selling things, like stocks. But not everyone plays the same way. Some people like to take their time and watch things change slowly, while others prefer quick action.

In the world of trading, these two styles are called Swing Trading and Day Trading. So Swing Trading Vs. Day Trading , which one is better?

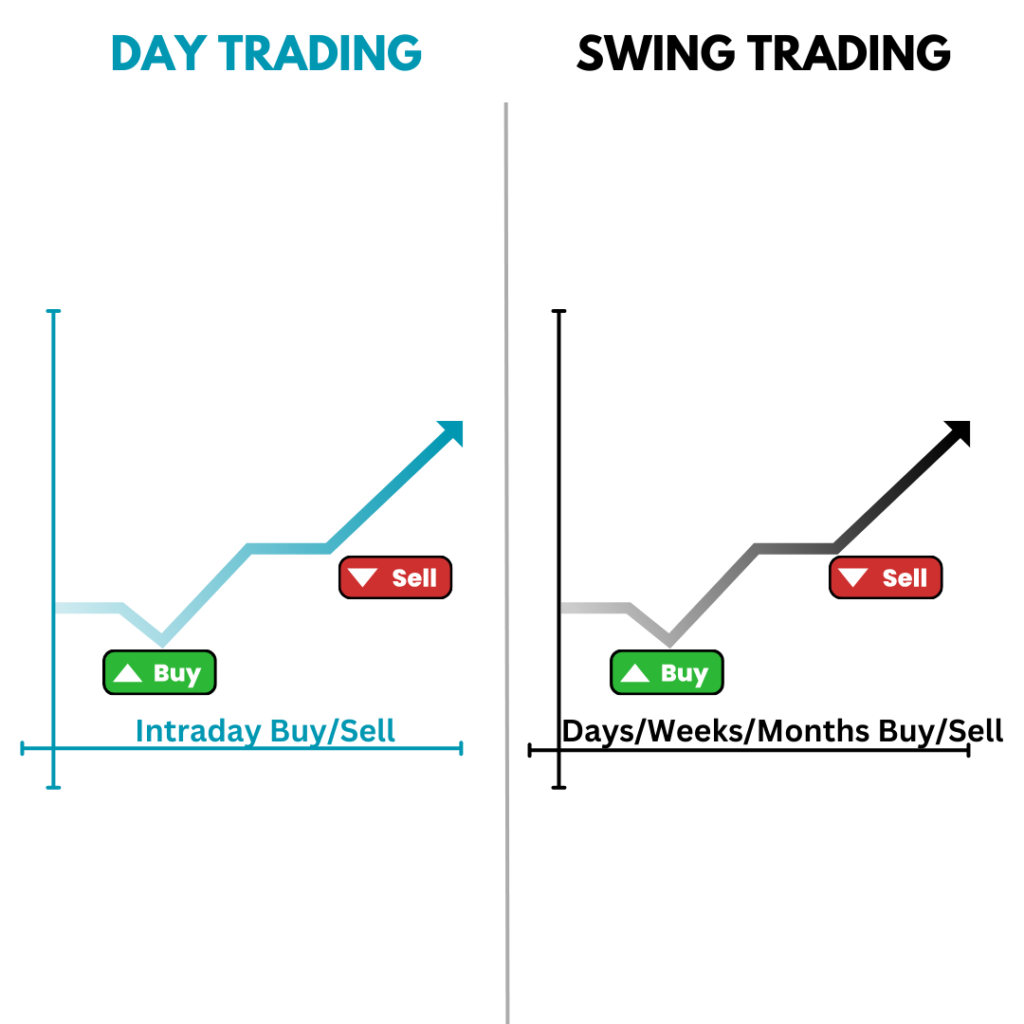

Swing Trading is like a long game where you might hold onto what you buy for days or even weeks, waiting for the right moment to sell. Day Trading, on the other hand, is fast-paced—you buy and sell within the same day, trying to catch quick opportunities.

In this blog, we’re going to compare these two trading styles. By the end, you’ll know which one might be the best fit for you.

What is Swing Trading ?

Swing Trading is a game of patience. Imagine you buy something today, but instead of selling it right away, you wait for a few days, maybe even weeks, to sell it at a higher price. That’s what swing traders do.

- Time Frames: In swing trading, the time frame is longer—days, weeks, or sometimes even months.

- Main Objective: The goal is to catch bigger price changes. Swing traders aren’t in a hurry; they wait for the market to move in their favor.

- Types of Analysis: Swing traders often use technical analysis (studying charts and patterns) and sometimes fundamental analysis (looking at a company’s health) to decide when to buy or sell.

Advantages of Swing Trading

- Flexibility: You don’t need to be at your computer all day. This makes swing trading great for people who have jobs or other commitments.

- Potential for Larger Gains: Since you hold onto trades longer, you can capture bigger price movements.

- Lower Transaction Costs: Fewer trades mean you spend less on fees.

- Work-Life Balance: You can trade without it taking over your life.

Disadvantages of Swing Trading

- Overnight Risk: Holding trades overnight means you’re exposed to news and events that could affect the market while you’re not watching.

- Patience Required: You need to be patient and disciplined, which can be challenging.

- Missed Short-Term Opportunities: While waiting for a trade to mature, you might miss out on quick profits.

What is Day Trading?

Day Trading is like a race. You buy something in the morning and sell it by the end of the day, trying to make quick profits from small price changes.

- Time Frames: Day trading happens fast—within minutes or hours, but always within the same day.

- Main Objective: The goal is to make money from quick price movements. Day traders don’t hold anything overnight.

- Types of Analysis: Day traders focus heavily on technical analysis and market indicators to make quick decisions.

Advantages of Day Trading

- No Overnight Risk: You don’t have to worry about what happens to the market after hours.

- Quick Profits: You can make money quickly if you’re good at it.

- High-Frequency Trading Opportunities: The more trades you make, the more chances you have to profit.

- Focus: It’s ideal if you can commit your full time to trading.

Disadvantages of Day Trading

- High Stress: Day trading is intense and can be very stressful.

- Time-Consuming: It requires you to be fully engaged during market hours.

- Higher Transaction Costs: More trades mean more fees, which can add up quickly.

Swing Trading Vs. Day Trading : Key Differences

| Criteria | Swing Trading | Day Trading |

|---|---|---|

| Time Commitment | Requires monitoring but not constant attention. | Requires full-time commitment during trading hours. |

| Risk Level | Moderate risk, with the potential for overnight exposure. | High risk, with no overnight positions but higher intraday volatility. |

| Potential Profitability | Profits from larger, longer-term price swings. | Profits from small, rapid price movements. |

| Stress and Lifestyle | Less stressful, suitable for those with other commitments. | High stress, often considered a full-time job. |

| Tools and Techniques | Use of daily/weekly charts, trend analysis. | Use of intraday charts, quick decision-making, and technical indicators. |

| Flexibility | Allows for a more balanced lifestyle with fewer trades. | Requires constant focus and attention, with more frequent trades. |

| Transaction Costs | Lower transaction costs due to fewer trades. | Higher transaction costs due to frequent trading. |

| Overnight Risk | Exposed to overnight market risks, as positions are held for several days or weeks. | No overnight risk, as all positions are closed before the end of the day. |

| Capital Requirements | May require more capital to manage overnight risks and larger positions. | Requires less capital to start but involves frequent trades, which can add up in costs. |

| Execution of Trades | Trades take longer to mature, allowing time to track market movements and reduce risks. | Trades are executed quickly; speed and accuracy are critical to capitalize on short-term market movements. |

Who Should Choose Swing Trading?

Swing trading is a good choice if you:

- Prefer a balanced lifestyle.

- Want to trade but also have time for other activities.

- Are comfortable with holding positions overnight and managing the associated risks.

Infographic Idea: A person balancing trading on one side and personal activities on the other, symbolizing a balanced lifestyle.

Who Should Choose Day Trading?

Day trading might be for you if you:

- Can commit to trading full-time.

- Are comfortable with high-risk, high-reward scenarios.

- Prefer to close all your positions by the end of the day, avoiding overnight risks.

Infographic Idea: A person focused intently on multiple screens, symbolizing the intensity and commitment required for day trading.

Conclusion

Both swing trading and day trading can be profitable, but they suit different types of people. Swing trading is great if you want to take a more relaxed approach and balance trading with other parts of your life. Day trading is for those who love fast-paced action and can dedicate themselves fully to the market.

Choosing the right strategy depends on your lifestyle, risk tolerance, and trading goals. Remember, both strategies require discipline, patience, and continuous learning.

FAQs

- Can you switch between swing trading and day trading?

- Yes, many traders switch between the two depending on market conditions and personal schedules.

- Is one strategy more profitable than the other?

- It depends on your skills, risk tolerance, and market conditions. Both can be profitable if done correctly.

- What tools are essential for each strategy?

- Swing Trading: Daily/weekly charts, trend analysis tools.

- Day Trading: Intraday charts, fast execution platforms.

- How do I start with swing trading/day trading?

- Start by learning the basics, practicing with a demo account, and gradually building your skills and confidence.