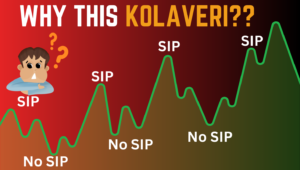

In today’s fast-paced trading world, staying on top of market movements can be overwhelming—especially for swing traders who aim to capitalize on short- to medium-term price fluctuations.

This is where automated swing trading steps in, offering a hands-off approach to navigating the markets.

Imagine a system that tracks, analyzes, and executes trades for you based on predefined criteria, all without the need for constant monitoring.

It sounds like a dream, right?

But like any tool, automated swing trading has its upsides and downsides.

In this blog, we’ll dive into the pros and cons of letting the machines do the work and whether this approach is right for your trading style.

What is Automated Swing Trading?

Automated swing trading involves the use of algorithms or trading bots to execute buy and sell orders based on predefined conditions, such as price movements, technical indicators, or market trends. It is also called as Algorithmic Trading.

Instead of manually monitoring the market and making decisions, the system does it all for the trader—triggering trades in response to market shifts, aiming to capture short- to medium-term price swings.

Why is Automation Popular in Swing Trading?

Automation has become increasingly popular in swing trading because it allows traders to capitalize on market fluctuations without the need for constant oversight.

Traders set their strategies, and the system follows the rules consistently.

This approach eliminates emotional decision-making, ensures trades are executed on time, and allows traders to take advantage of opportunities even when they’re not actively watching the markets.

As a result, automation can lead to more disciplined and efficient trading, especially in fast-moving or volatile markets.

How Automated Swing Trading Works?

The Role of Algorithms and Bots

Automated swing trading relies on sophisticated algorithms and bots to analyze market conditions, track price movements, and execute trades.

These systems are designed to follow specific patterns, monitor technical indicators, and respond to real-time price data, making decisions on behalf of traders based on pre-established rules.

It sounds Geeky but Algorithms can be as simple as Buying Nifty @ 10 AM every Morning and Selling @ 11 AM.

It is basically making objective rules and let the computers execute it.

Predefined Trading Strategies

For successful automation, traders need to set predefined rules, such as stop-losses, take-profit levels, and trade entry/exit criteria.

These strategies allow the automated system to follow a consistent trading plan without emotional bias, ensuring trades are executed precisely as planned, even when the market fluctuates unexpectedly.

Pros of Automated Swing Trading

#1 Emotion-Free Trading

One of the most significant advantages of automated swing trading is its ability to eliminate emotional biases like fear and greed.

Automated systems stick strictly to the predefined rules, removing emotional interference and helping traders avoid impulsive decisions.

#2 Consistency in Strategy Execution

Automation ensures that trading strategies are executed with unwavering consistency.

The system follows the rules without deviation, executing trades according to the plan without hesitation, even during volatile market conditions.

#3 Time-Saving

Automated swing trading saves traders from the need to monitor markets constantly.

Once a strategy is set, the system manages trades autonomously, freeing up time for traders to focus on other activities while their strategies run in the background.

#4 Back-testing Capabilities

Automated systems allow for extensive backtesting against historical data.

Traders can simulate strategies across different market environments to assess performance and optimize for potential future gains, increasing the chances of success.

#5 24/7 Market Monitoring

Unlike manual trading, automated systems monitor the market continuously.

Even if a trader is away, the system can execute trades, ensuring that no opportunity is missed due to the trader’s absence.

Cons of Automated Swing Trading

#1 Over-Reliance on Technology

With automation comes the risk of technological glitches, system failures, or connectivity issues. Such problems can result in missed trades, unexpected losses, or delayed execution, putting traders at risk.

#2 Lack of Human Judgment

While automated systems follow rules precisely, they lack the ability to interpret market sentiment or react to unexpected news events.

Human traders may pick up on these nuances and adjust their strategies accordingly, while automated systems cannot.

#3 Potential for Overfitting

Backtesting can sometimes lead to overfitting, where a strategy performs exceptionally well on historical data but fails to deliver in real-time market conditions.

Automated systems may struggle with this, causing inconsistent results.

#4 High Initial Setup Costs

Developing or acquiring a reliable automated trading system often involves significant upfront costs.

Traders may also face ongoing expenses such as subscription fees, maintenance, and occasional upgrades.

#5 Market Volatility and Black Swan Events

Automated systems can struggle during periods of extreme market volatility or in response to black swan events. Since these systems are rule-based, they may not adapt quickly enough to avoid losses during market crashes or unexpected events.

Best Tools for Automated Swing Trading

Popular Automated Trading Platforms

When it comes to automated swing trading, choosing the right platform or tool is crucial. Each platform offers unique features suited for different types of traders, from beginners to seasoned professionals. Here’s a detailed overview of some of the best tools for automated swing trading:

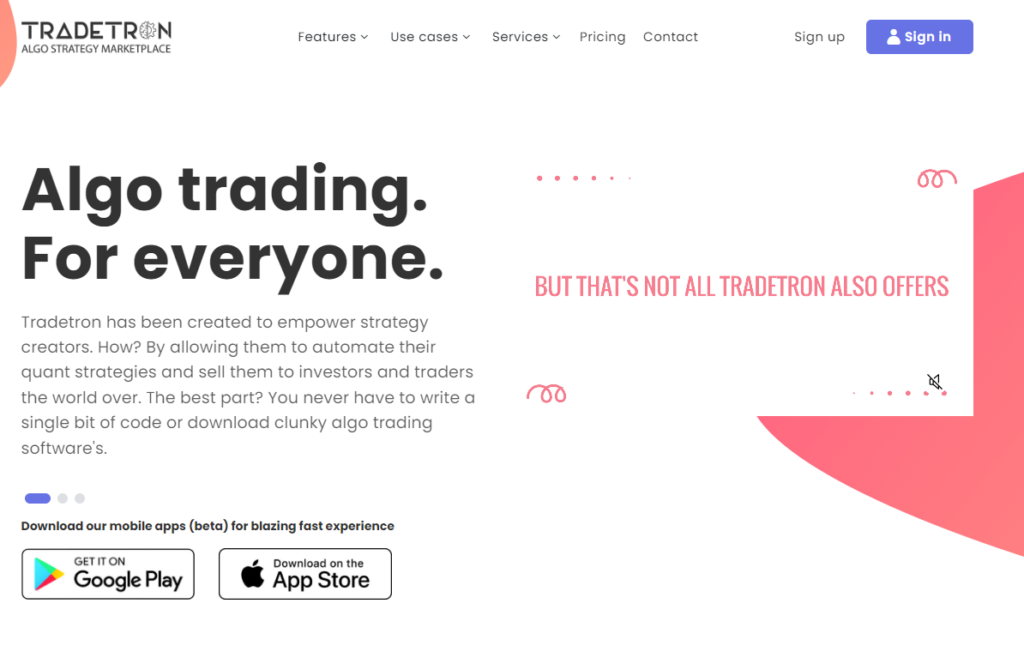

1. Tradetron

Tradetron is a cloud-based platform that allows traders to create, backtest, and deploy automated trading strategies without the need for coding. It offers flexibility with multiple brokers, and its strategy marketplace enables users to rent or subscribe to pre-built algorithms created by other traders.

- Best For: Non-coders and traders who prefer a cloud-based, multi-broker platform.

- Key Features: Strategy creation, backtesting, cloud deployment, and broker integration.

2. AlgoTrader AG

AlgoTrader is an institutional-grade automated trading platform, designed for hedge funds, banks, and professional traders. It supports multi-asset class trading, including stocks, forex, and cryptocurrency, with a focus on high-frequency trading.

- Best For: Advanced traders and institutions seeking a comprehensive algorithmic trading solution.

- Key Features: High-frequency trading, multi-asset support, institutional-grade performance, and scalability.

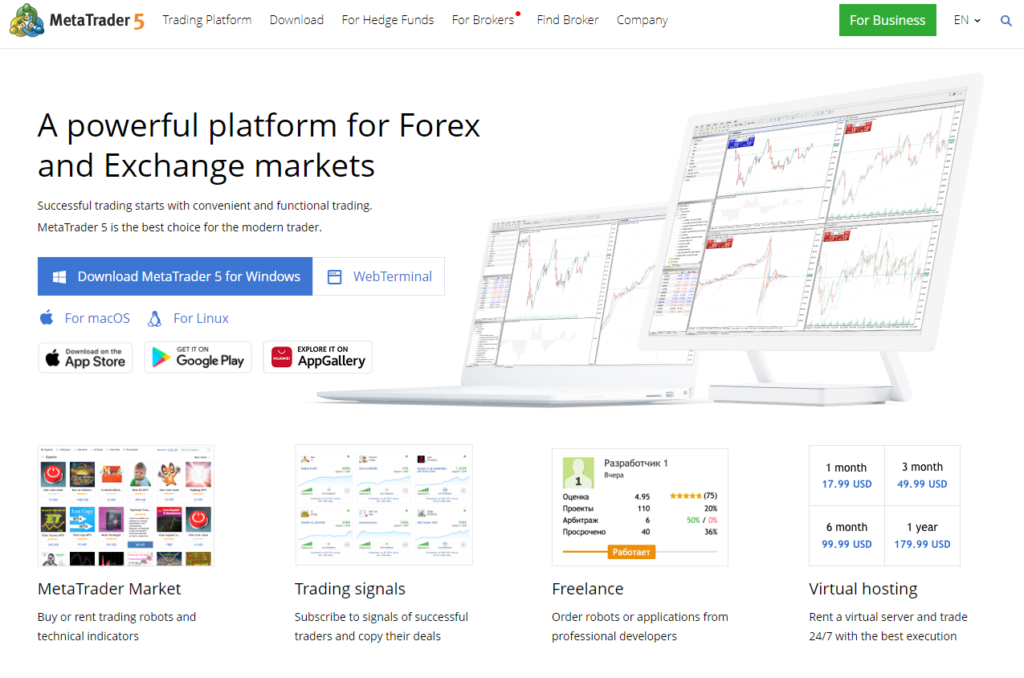

3. MetaTrader 5

MetaTrader 5 (MT5) is one of the most popular platforms for retail traders. It supports a wide range of financial instruments, including stocks, forex, and commodities. MT5 offers robust charting tools, technical indicators, and a marketplace for pre-built algorithms, allowing traders to automate their strategies efficiently.

- Best For: Traders who want an all-in-one solution for both manual and automated trading.

- Key Features: Advanced charting, backtesting, built-in market for trading bots (Expert Advisors), multi-asset support.

4. Upstox

Upstox is a popular Indian brokerage platform that integrates automated trading through its API, allowing traders to deploy algo strategies in the Indian stock market. The platform offers low brokerage fees and seamless access to various assets such as equities, commodities, and derivatives.

- Best For: Indian traders who want a low-cost platform with automation capabilities.

- Key Features: Low brokerage, API integration for algorithmic trading, wide market access.

5. AlgoBulls

AlgoBulls is a platform designed for retail traders and investors looking to automate their trading strategies without coding. It offers pre-built strategies, backtesting tools, and broker integration with major Indian brokers. AlgoBulls also supports equity, derivatives, and commodities markets.

- Best For: Non-technical traders in India looking for a ready-to-use algorithmic trading platform.

- Key Features: Pre-built strategies, backtesting, and integration with Indian brokers.

6. AlgoTest

AlgoTest is a cloud-based platform focused on backtesting and analyzing options trading strategies. While it’s more specialized for options traders, it offers robust tools for testing and analyzing strategies to ensure they are effective before deploying them live.

- Best For: Options traders who want to test and optimize strategies before automation.

- Key Features: Cloud-based backtesting, options strategy analysis, easy-to-use interface.

Custom vs. Pre-Built Algorithms

Pre-Built Algorithms

- Pros: Easy to set up, no coding required, often designed by experienced traders, and available on many platforms.

- Cons: Limited customization, may not fit specific trading goals, and could underperform in different market conditions.

Custom Algorithms

- Pros: Tailored to the trader’s strategy, fully customizable, and able to adapt to unique market conditions.

- Cons: Requires coding skills or hiring a developer, time-consuming to create and optimize, and higher setup costs.

How to Get Started with Automated Swing Trading

Step 1 : Define Your Trading Strategy

Before diving into automation, it’s crucial to develop a clear and well-defined trading strategy.

This includes setting entry and exit points, determining risk tolerance, and establishing rules for managing stop-losses and take-profits.

Automation can only be as effective as the strategy behind it, so ensuring that the strategy is robust and fits your trading goals is the first step.

Step 2 : Choose the Right Platform

Selecting the appropriate platform is essential for success in automated swing trading.

Consider factors like ease of use, available features, supported markets, and the platform’s ability to run your specific strategies.

Popular platforms like TradeTron or MetaTrader are great starting points, but customization needs and fees should also be taken into account.

Step 3 : Back-test Your Strategy

Backtesting your strategy using historical data is critical to assess its effectiveness. This step helps you identify potential flaws in the strategy and make necessary adjustments before deploying it live.

Most automated trading platforms provide backtesting tools, allowing traders to refine their strategies based on real-world market scenarios.

Step 4 : Set Realistic Expectations

While automation can enhance trading efficiency, it’s important to set realistic expectations.

Automated systems are not infallible and can still experience losses.

Traders should understand the limitations of algorithms and focus on steady, long-term gains instead of expecting instant profits or risk-free trading.

Conclusion

Automated swing trading offers traders a powerful way to eliminate emotional decision-making, enhance consistency, and save time.

With backtesting capabilities and the ability to trade 24/7, automation provides a significant edge.

However, it’s essential to recognize the risks—such as over-reliance on technology, potential system errors, and the inability to adapt to market volatility.

Is Automated Swing Trading Right for You?

Automated swing trading isn’t for everyone.

It requires upfront investment, diligent strategy development, and continuous monitoring.

Traders need to evaluate whether their trading style, risk tolerance, and market goals align with the benefits of automation.

For those looking for a hands-off approach while maintaining control over strategy, automated trading may offer a valuable solution.

Ready to take your swing trading to the next level?

Explore automated trading platforms, backtest your strategies, and consider incorporating automation into your trading plan.

With the right setup and a disciplined approach, automated swing trading can complement your efforts and potentially enhance your trading performance.