Let us start by Understanding briefly about Demat Account!!

A Demat account, short for Dematerialized account, is an electronic repository for financial securities such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

It enables digital possession of your investments, eliminating the need for physical certificates. This digitalization enhances security, reduces paperwork, and streamlines the process of buying, selling, and transferring securities.

In India, maintaining a Demat account is mandatory for trading in the stock market.

Now little about GROWW!

In 2016, four Flipkart employees – Lalit Keshre, Harsh Jain, Ishan Bansal and Neeraj Singh, quit their jobs to start a venture that could make investing easy. They called this venture Groww and started operations In 2017.

Based on their own experience and that of their friends and acquaintances, the founders felt that the process of investing in financial products in India is too complex and opaque. There are close to 200 million people with investable income in India, while only 20 million actively invest.

The only way to bring the next 180 million on board is by making investing simple. Groww aimed to provide the necessary information, resources and user experience for people to start investing in the simplest way possible.

Key Benefits For Opening the Account With Groww

1. Cost-Effective Trading

- Zero Brokerage on Equity Delivery and Mutual Funds: Groww offers zero brokerage on direct mutual fund investments and equity delivery trades, making it an attractive choice for long-term investors looking to save on trading costs.

- Flat ₹20 Fee on Intraday and F&O Trades: For intraday, futures, and options (F&O) trading, Groww charges a flat ₹20 per executed order or 0.05% (whichever is lower), ensuring cost-effective trading for active traders.

2. User-Friendly Platform

- Intuitive Trading App & Website: Groww’s simplistic and clutter-free platform makes investing accessible for both beginners and experienced traders. Its easy navigation, interactive charts, and smooth interface enhance the user experience.

- Advanced Charting & Research Tools: Equipped with real-time market data, technical indicators, and customizable charts, Groww provides traders with all necessary insights for informed decision-making.

- All-in-One Dashboard: Groww’s portfolio dashboard allows users to track investments, generate tax reports, and analyze past trades, ensuring complete control over their finances.

3. Wide Range of Investment Options

- Invest in Multiple Asset Classes: Groww offers a diverse range of investment options, including stocks, mutual funds, ETFs, F&O, government bonds, and digital gold, catering to both traders and investors.

- Commission-Free Direct Mutual Funds: With Groww Mutual Funds, investors can invest in direct plans without any commission, leading to higher returns compared to regular plans.

4. Secure & Reliable

- SEBI & BSE/NSE Registered: Groww is a SEBI-registered stockbroker and provides a secure trading environment with bank-grade security encryption.

- Two-Factor Authentication (2FA): Groww ensures safe and secure logins with multi-layer authentication and OTP verification.

Why Choose Groww?

With zero-commission mutual funds, low-cost stock trading, an intuitive interface, and multiple asset classes, Groww is a one-stop solution for both new investors and seasoned traders.

Prerequisite for Account Opening

To open a Demat account with Groww, it’s essential to have the following prerequisites in place:

1. Essential Documents

- PAN Card: A self-attested copy of your Permanent Account Number (PAN) card is mandatory for identity verification.

- Aadhaar Card: Ensure your Aadhaar is linked to your current mobile number to facilitate OTP-based verification during the account opening process.

- Bank Account Proof: Provide proof of your bank account to link it with your trading account. Acceptable documents include:

- A personalized cancelled cheque with your name printed on it.

- A bank statement or passbook copy displaying your account number, bank logo, MICR, and IFSC codes.

- Income Proof: Required if you intend to trade in Futures & Options (F&O) segments. Acceptable documents include:

- The latest six months’ bank statement or passbook.

- Latest salary slip.

- Income Tax Return (ITR) acknowledgment.

- Net worth certificate from a Chartered Accountant.

- Statement of demat holdings.

2. Digital Requirements

- Stable Internet Connection: A reliable internet connection is crucial to smoothly complete the online application and verification processes.

- Device with Camera: A smartphone, tablet, or computer equipped with a camera is necessary for In-Person Verification (IPV). During IPV, you’ll be required to display a one-time password (OTP) sent to your registered mobile number while being clearly visible on camera.

How to open an Account in Groww?

STEP #1

- Download Groww App from Playstore.

- Since Groww is a mobile first platform and opening account over web is not user friendly. It is suggested to Open your account using mobile phone only.

STEP #2

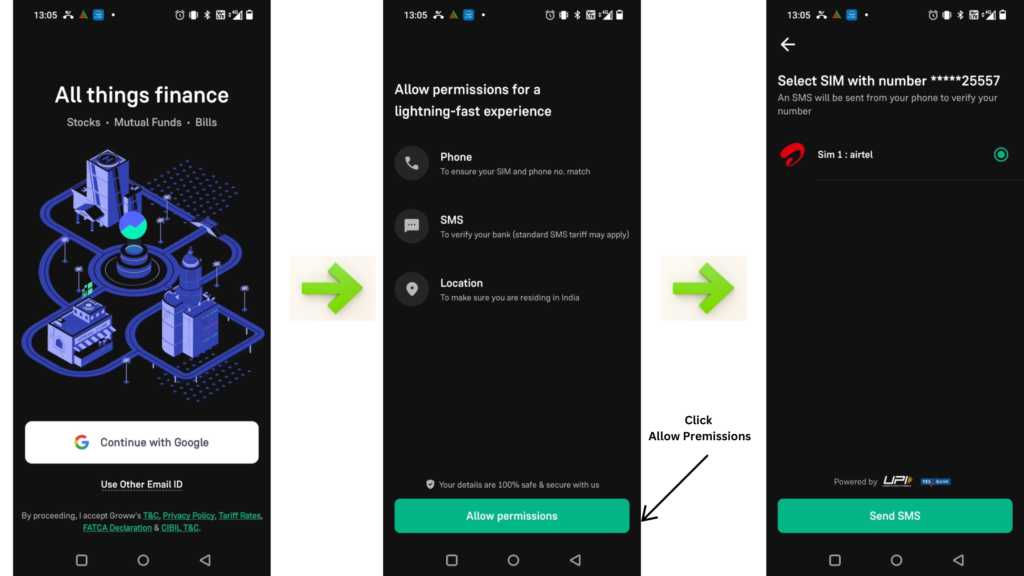

- Now you will be prompted to enter your Email ID.

- You can login by entering Email ID or you can login directly by Gmail.

- Allow phone , sms and Location Permissions.

- Allow Sim-card.

STEP #3

- Now Select the Account linked to your Mobile Number.

- Now enter PANCARD Number and your Date of Birth.

- Date of Birth has to be entered in YYYY-MM-DD Format.

- Click Continue.

STEP #4

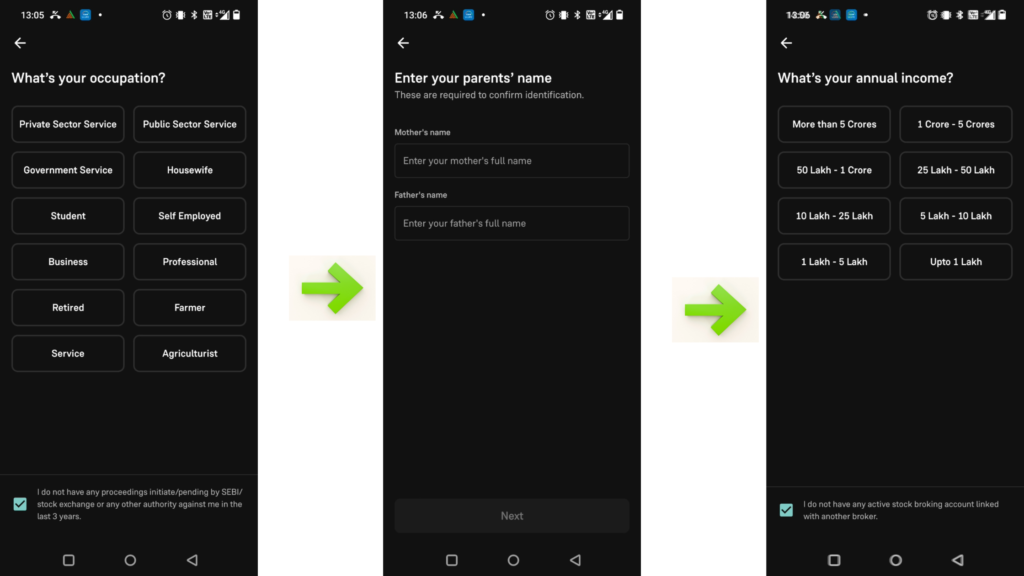

- Next Step is to answer Few Questions.

- A. Father’s Name : Fill the Name as on your Aadhar Card.

- B. Mother’s Name

- C. Marital Status : If you are not married fill single, else fill Married.

- D. Annual Income Bracket : Choose as per your Annual Income. For Example if your Annual Income is Rs. 7 Lacs. Choose 5-10 Lacs Option

- E. Trading Experience : If you are newbie select New else choose as per your total trading experience.

- F. Occupation : If any of the options provided does not fit. Choose others.

STEP #5

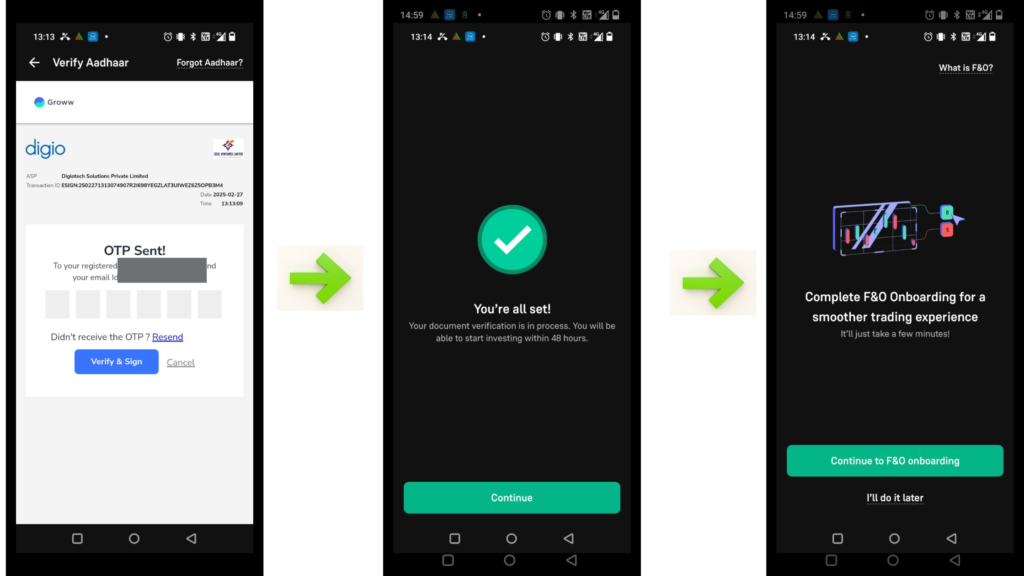

Next step is aadhaar verification.

STEP #6

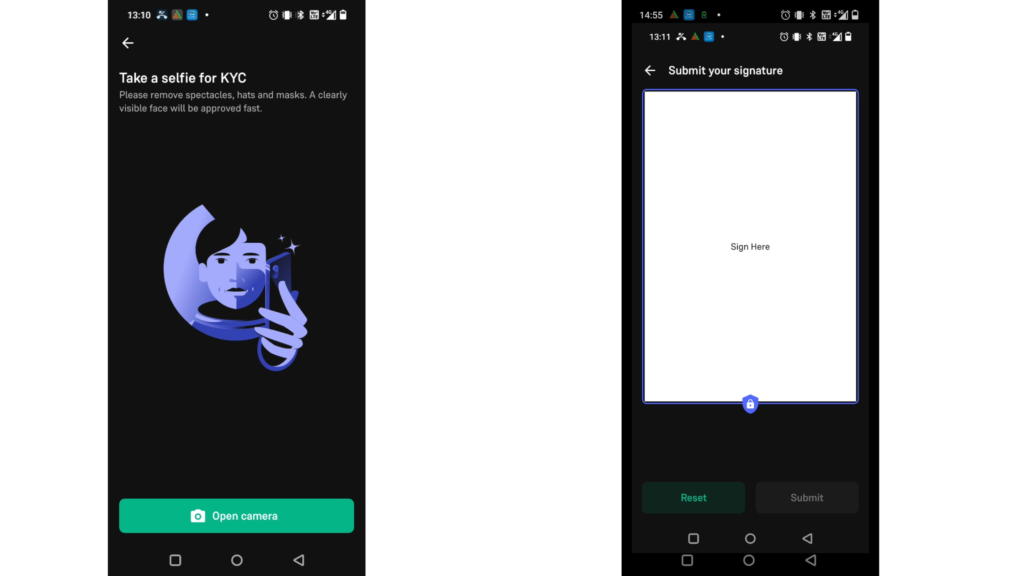

- Next, you’ll proceed with video verification.

- Next Step is to do digital Signature.

STEP #7

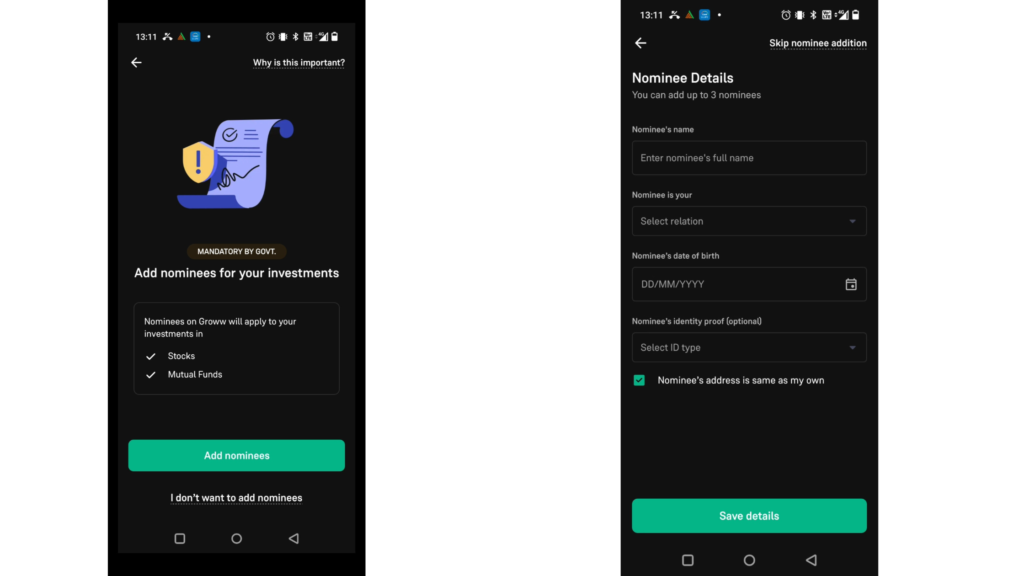

- Next, the step is to add a nominee.

- A nominee is a person you designate to inherit your investments in case of any unforeseen circumstances. This ensures a smooth transfer of assets without legal complications. You can nominate a family member, spouse, or any trusted individual.

- You can also add multiple nominees. If you choose to have more than one nominee, you must specify the percentage allocation for each. For a single nominee, the percentage must be set to 100%.

STEP #8

- The final step is completing the Digital Signature process.

- To verify your identity, you will need to authenticate using your Aadhaar number. This is done through e-sign, a secure and legally valid method that links your Aadhaar to your digital signature. Once you enter your Aadhaar number, you will receive an OTP (One-Time Password) on your registered mobile number. Enter this OTP to complete the verification process.

- This step ensures that your account is securely authenticated and legally approved for activation.

FAQs on Demat Account Opening with Groww

1. What is a Demat Account?

A Demat (Dematerialized) account is an electronic account that holds your financial securities like stocks, bonds, mutual funds, and ETFs in digital form. It eliminates the need for physical share certificates and ensures secure, hassle-free transactions in the stock market.

2. Why is a Demat Account Necessary?

In India, a Demat account is mandatory for trading in shares and other securities. It simplifies investment management, enhances security, and eliminates the risk of loss or damage to physical share certificates.

4. What Are the Documents Required to Open a Groww Demat Account?

To open an account, you need:

- PAN Card (Mandatory for identity verification)

- Aadhaar Card (Linked to a mobile number for OTP verification)

- Income Proof (Required for trading in Futures & Options, such as a bank statement, salary slip, or ITR)

5. How Long Does It Take to Open a Groww Demat Account?

If all documents are correctly submitted, the account is usually activated within 24-48 hours. Any discrepancies in documents may delay the process.

6. Is There Any Charge for Opening a Groww Account?

No.

7. Can I Add Multiple Nominees?

Yes, you can add multiple nominees, but you must allocate percentage shares to each. If you have a single nominee, the allocation must be 100%.

8. What Is Video Verification, and Why Is It Required?

Video verification is a compliance step where you verify your identity using a webcam.

10. What Is Digital Signature (e-Sign) and How Does It Work?

The digital signature (e-Sign) process is the final step of account opening. You will authenticate your identity using your Aadhaar number and OTP verification, making the process legally valid and secure.