1. What is Momentum Trading?

Definition

Momentum trading is an investment strategy where traders buy assets that are rising in price and sell them when that momentum slows down.

This approach focuses on the continuation of price trends, capitalizing on the idea that assets with strong momentum are likely to continue moving in the same direction.

Unlike value investing, which targets undervalued assets, momentum trading focuses purely on the asset’s price action.

Its basically strategy capitalizing on Newton’s First law :p

Newton’s first law of motion, also known as the law of inertia, states that an object will remain at rest or in motion unless acted upon by an external force

The core principle behind momentum trading is that “the trend is your friend.”

Traders aim to catch stocks, commodities, or other financial instruments as they are gaining momentum.

As the asset increases in value, traders ride the wave of momentum, selling off the asset before it reverses direction.

Unlike long-term value investing, momentum traders capitalize on short-term trends.

While value investors seek to buy low and hold long-term, momentum traders are more reactive, focusing on current price trends rather than the underlying value of the asset.

This strategy often involves faster decision-making and more frequent trading, taking advantage of market volatility.

2. Why is Momentum Trading Popular?

Volatility is a Friend

Momentum trading thrives on market volatility. For traders, the more volatile the market, the greater the potential for rapid gains.

In volatile markets, prices move more quickly, offering momentum traders opportunities to profit from sudden price surges.

Volatility creates price trends, and momentum traders benefit from these moves, whether the market is going up or down.

Potential for Quick Profits

One of the key attractions of momentum trading is the potential for fast profits.

By entering trades at the right moment, traders can earn substantial returns within a short time frame.

In contrast to other strategies that may require months or years to realize profits, momentum traders can see results within days, hours, or even minutes. This immediacy appeals to traders seeking quick, high returns.

Market Psychology

Momentum trading capitalizes on the herd mentality of the market. As more investors jump on a trending asset, the price rises, and momentum builds.

This creates a snowball effect where more buyers push the price higher. Momentum traders aim to stay ahead of the crowd, buying early and selling just before the price begins to drop.

3. Who Uses Momentum Trading?

Individual Traders vs. Institutional Investors

Both individual traders and institutional investors use momentum trading strategies. Individual traders, often with smaller portfolios, are drawn to the high potential for quick profits.

On the other hand, institutional investors use momentum strategies in conjunction with algorithmic trading to capitalize on large price movements.

Experienced Traders

Momentum trading requires skill, experience, and a deep understanding of market conditions.

Experienced traders are better equipped to manage the risks associated with the strategy, such as rapid price reversals. They can make quick decisions based on Price Action, technical indicators and market trends, which is crucial for momentum trading’s success.

Day Traders and Swing Traders

Momentum trading is particularly popular among day traders and swing traders.

Day traders benefit from intra-day price movements, entering and exiting trades multiple times within a single trading session.

Swing traders, on the other hand, aim to capture price movements over a few days to weeks, making momentum trading an ideal strategy for them as well.

4. When is Momentum Trading Most Effective?

Bull Markets

Momentum trading tends to work best in bull markets, where prices are generally trending upward. During these periods, there are frequent opportunities for traders to capitalize on rising stock prices. Bull markets provide the ideal environment for momentum traders, as asset prices move quickly and steadily.

Volatile Periods

Momentum trading is most effective during periods of high volatility. In a volatile market, price swings are more frequent and substantial, providing traders with multiple opportunities to enter and exit positions. These price fluctuations create the necessary momentum for traders to exploit.

Earnings Season/News Events

News events, such as earnings reports or economic announcements, can create significant price momentum. Companies that exceed earnings expectations often experience sharp price increases, making these moments ripe for momentum traders. Similarly, poor earnings can trigger downward momentum, creating short-selling opportunities.

5. Where is Momentum Trading Used?

Markets

Momentum trading is widely used in various financial markets, including stocks, commodities, forex, and cryptocurrency. Each of these markets offers liquidity and price movement, which are essential for momentum trading. Stocks, in particular, are popular due to their frequent price fluctuations and the availability of technical analysis tools.

Time-frames

Momentum trading can be applied across multiple timeframes. Some traders use daily charts to identify longer-term trends, while others use minute-by-minute charts to make quick trades. The versatility of momentum trading allows traders to tailor the strategy to their specific needs.

To Know which time-Frame is best for Swing Trading : Read This

High-Liquidity Markets

Liquidity is crucial for momentum trading. High-liquidity assets, such as large-cap stocks or major currency pairs, provide the volume needed for traders to enter and exit positions quickly. Momentum traders often focus on high-volume stocks or other liquid assets to ensure they can make trades without causing significant price shifts.

6. How Does Momentum Trading Work?

Process Overview

Momentum trading follows a simple process:

#Step 1 : Identify a trending asset,

#Step 2 : Enter the trade as momentum builds, and

#Step 3 : Exit before the momentum fades.

Traders use technical analysis tools to spot these trends and assess the strength of momentum. The key is to enter the trade early enough to ride the wave and exit before the trend reverses.

Technical Indicators

Momentum traders generally rely on technical indicators to measure the strength of price movements.

Popular indicators include the Relative Strength Index (RSI), which helps identify overbought or oversold conditions, and the Moving Average Convergence Divergence (MACD), which signals trend reversals. Moving averages are also commonly used to smooth out price data and highlight trends.

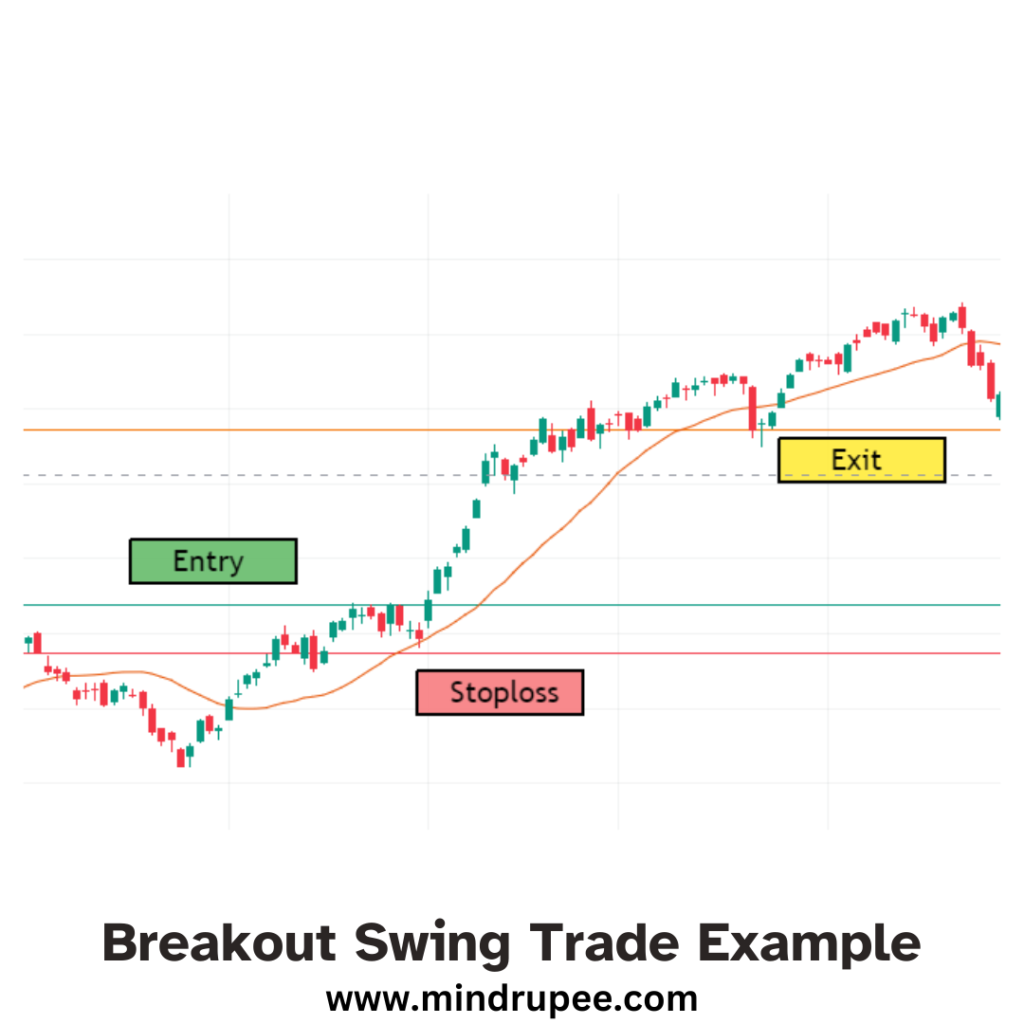

Entry and Exit Strategy

Entry and exit points are critical in momentum trading. Traders look for signals that indicate the start of momentum, such as a breakout above a resistance level or a significant increase in volume.

Once in the trade, they monitor the momentum, setting stop-loss orders to protect their positions. As the momentum shows signs of slowing, such as a weakening RSI, traders exit the trade to lock in profits.

Example

For instance, a trader identifies a stock that has been steadily increasing in price. Using the RSI, they see that the stock is not yet overbought, indicating that the momentum could continue.

They enter the trade and set a stop-loss order. As the price rises, the MACD shows a crossover, confirming the bullish momentum. After a few days, the RSI shows that the stock is now overbought, and the price begins to stall.

The trader exits the position, securing their profits.

Good Watch !

7. History of Momentum Trading

Early Beginnings

Momentum trading has roots in classical finance theory, dating back to the 19th century. The concept was first introduced by economists who observed that assets that performed well in one period tended to continue performing well in subsequent periods.

The Father of Momentum Investing

Richard Driehaus is often credited as the father of modern momentum investing.

His philosophy of “buying high and selling higher” was groundbreaking at a time when the prevailing wisdom was to “buy low, sell high.”

Driehaus believed that stocks with strong price momentum would continue to rise, making them profitable investments. He popularized this strategy through his successful hedge fund, Driehaus Capital Management.

Evolution of the Strategy

Momentum trading has evolved over the years from a simple focus on price action to a more sophisticated approach using technical indicators.

Today, traders use a variety of tools, such as moving averages and oscillators, to measure momentum and make informed trading decisions.

The advent of algorithmic trading has also automated momentum strategies, allowing institutional investors to capitalize on market movements at scale.

Academic Support

Academic research has validated momentum trading as a viable strategy.

In the 1990s, economists Narasimhan Jegadeesh and Sheridan Titman conducted studies that demonstrated how momentum investing could outperform the market.

Their research showed that stocks that performed well in the past three to twelve months continued to do well in the future, supporting the momentum hypothesis.

8. Elements of Momentum Trading

#1 Choosing Liquid Securities

Liquidity is essential for momentum trading because it ensures that traders can enter and exit positions quickly.

High liquidity allows for smoother price movements and less slippage, which is crucial for executing momentum trades.

Stocks with a high average daily trading volume are often the best candidates for momentum strategies.

#2 Risk Management

Momentum trading can be risky, so effective risk management is crucial.

Traders use stop-loss orders to limit potential losses if the trade moves against them. Tight risk control, such as limiting the size of trades, helps prevent significant losses in volatile markets.

#3 Timing Entry and Exit

Entering a trade early in the momentum phase is key to maximizing profits. Traders often use breakout strategies, where they enter a trade when the asset breaks above a key resistance level. Exiting at the right time, before the momentum fades, is equally important. Technical indicators like RSI and MACD can help traders time their exits.

#4 Technical Tools

Momentum traders rely heavily on technical tools like moving averages, RSI, and MACD to assess market trends and the strength of momentum. These tools provide objective data, helping traders make informed decisions about when to enter and exit trades.

9. Benefits of Momentum Trading

#1 Potential for High Returns

Momentum trading offers the potential for high returns in a short time frame.

By riding the wave of an asset’s upward momentum, traders can earn significant profits in a matter of days or weeks.

The ability to capitalize on rapid price movements makes this strategy appealing to traders looking for quick gains.

#2 Leveraging Market Volatility

Volatility is a friend to momentum traders. When markets are volatile, prices move quickly, creating more opportunities for momentum trades.

Traders who can accurately identify and time these movements can profit from the market’s unpredictability.

#3 Simplicity of the Strategy

Momentum trading is relatively straightforward once traders understand how to use technical indicators.

The strategy is easy to implement, and traders can quickly identify potential trades by analyzing price trends and market momentum.

Unlike fundamental analysis, which requires in-depth research into a company’s financials, momentum trading focuses solely on price action.

10. Drawbacks of Momentum Trading

#1 High Risk

Momentum trading carries a high level of risk due to its reliance on price trends, which can reverse suddenly. If a trade moves against the trader, losses can accumulate quickly, especially in volatile markets.

Without proper risk management, traders can lose more than they initially invested.

#2 Requires Constant Monitoring

Momentum trading demands constant attention. Because price movements can change rapidly, traders need to monitor their positions closely to avoid missing critical entry or exit points.

This can be time-consuming and stressful, particularly for day traders who are making multiple trades throughout the day.

#3 High Transaction Costs

Frequent buying and selling can lead to high transaction costs, particularly in markets with large bid-ask spreads.

These costs can eat into profits, especially for traders making numerous small trades. Over time, high transaction costs may reduce the overall profitability of a momentum trading strategy.

11. Conclusion

Momentum trading is a powerful strategy that allows traders to capitalize on price trends in volatile markets. By focusing on assets with strong momentum, traders can earn high returns in a short period. However, the strategy is not without its risks, as sudden price reversals and high transaction costs can reduce profitability.

For traders willing to put in the time to monitor markets and manage risk, momentum trading can be a lucrative approach. Understanding price action, technical indicators, timing entries and exits, and maintaining strict risk control are essential for success in momentum trading.

Ultimately, momentum trading is best suited for experienced traders who can navigate the complexities of volatile markets and react quickly to price changes.