Swing trading is all about capturing the market’s short- to medium-term price movements, and timing is everything.

But how do you know when a stock is about to make its next big move?

This is where Bollinger Bands come into play.

Often referred to as a “trader’s best friend,” Bollinger Bands are one of the most reliable tools for spotting market volatility, potential breakouts, and reversals.

Whether you’re a seasoned swing trader or just starting out, understanding how to use Bollinger Bands can give you an edge in identifying high-probability trades.

In this blog, we’ll dive deep into how Bollinger Bands work and how you can integrate them into your swing trading strategy to make more informed trading decisions.

Ready to master the swings? Let’s get started!

Understanding Bollinger Bands

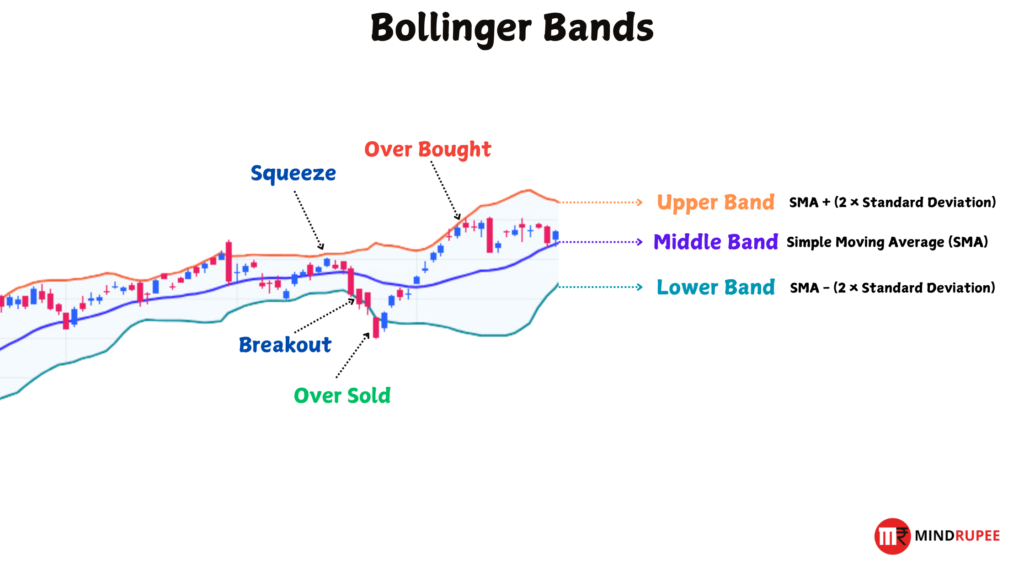

Bollinger Bands are a technical analysis tool consisting of three lines plotted on a price chart. To understand Bollinger bands we need to understand the components of Bollinger bands first.

Components of Bollinger Bands

Middle Band

A simple moving average (SMA) that represents the average price over a specified period (commonly 20 periods).

Upper Band

Positioned two standard deviations above the middle band, reflecting potential overbought conditions.

Lower Band

Positioned two standard deviations below the middle band, signaling potential oversold conditions.

Together, these bands help traders gauge price volatility and market conditions.

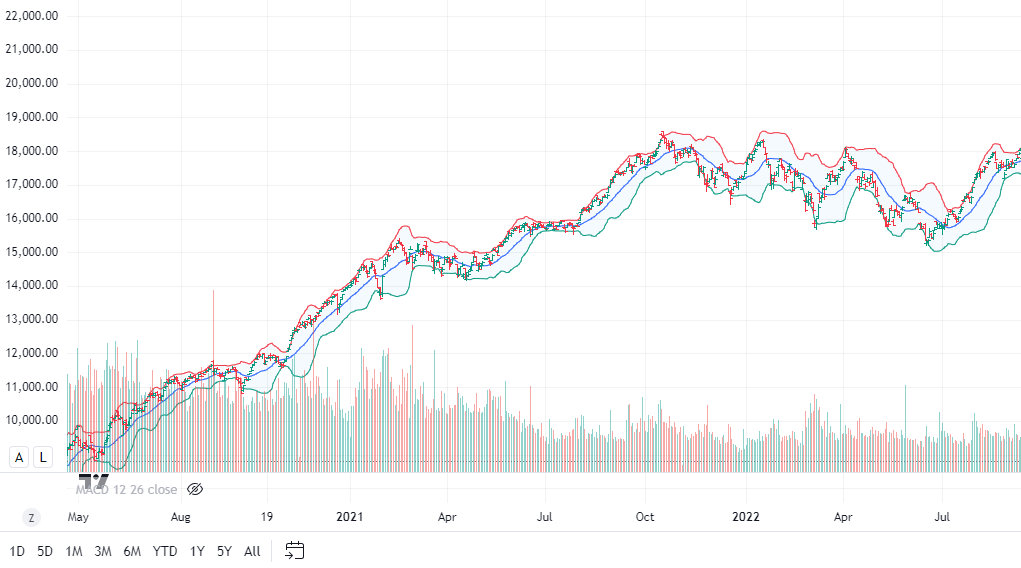

How Bollinger Bands Work?

Bollinger Bands dynamically adjust to market volatility:

Expansion

When the market becomes volatile, the bands widen. This signifies increased price fluctuations, which could indicate the potential for a breakout.

Contraction

When the market is less volatile, the bands contract. This “squeezing” effect often precedes a sharp price move, signaling a possible breakout or trend change.

This expansion and contraction allow swing traders to spot trading opportunities based on volatility.

Bollinger Bands Formula

The basic formula for Bollinger Bands is:

- Middle Band = Simple Moving Average (SMA)

- Upper Band = SMA + (2 × Standard Deviation)

- Lower Band = SMA – (2 × Standard Deviation)

The logic behind this formula is to plot the upper and lower bands at a distance of two standard deviations from the moving average, making it adaptable to various market conditions.

The standard deviation accounts for price volatility, helping to identify extreme price levels relative to the SMA.

How to Use Bollinger Bands in Swing Trading

#1 Identifying Overbought and Oversold Conditions

Bollinger Bands help traders identify potential overbought and oversold conditions.

Overbought

When the price approaches or touches the upper band, it may indicate that the stock is overbought, suggesting a possible pullback or reversal.

Oversold

When the price nears or touches the lower band, it can signal oversold conditions, implying a potential bounce or upward reversal.

Swing traders can use these conditions to spot entry and exit points, taking advantage of likely price reversals.

#2 Bollinger Band Squeeze

The Bollinger Band Squeeze is a powerful signal for swing traders.

Squeeze

When the bands contract tightly, it indicates low volatility in the market. This period of calm often precedes a significant price move in either direction.

Breakout

After the squeeze, a sharp breakout typically occurs, making this an ideal time to watch for trading opportunities. Traders can prepare to act when the price breaks above or below the bands, riding the resulting trend.

#3 Riding the Trend

Bollinger Bands can also help swing traders ride a trend:

Upper Band

In a strong uptrend, the price will often ride along or stay near the upper band. This can signal a continuation of the bullish momentum, giving traders confidence to hold their position.

Lower Band

Similarly, in a downtrend, the price may hug the lower band, signaling ongoing bearish momentum. Traders can use this as an opportunity to stay in a short position.

#4 Reversal Signals

Bollinger Bands are effective at spotting reversals.

Price Rejection

When the price moves away from the bands, it may suggest a reversal. For instance, if the price touches the upper band but then retreats, it could signal the end of an uptrend.

Crossing the Moving Average

A cross of the price through the middle band (SMA) can indicate a change in trend direction. Traders often use this as a confirmation for entering or exiting a trade.

By applying these techniques, swing traders can use Bollinger Bands to capitalize on volatility, identify trends, and capture potential reversals.

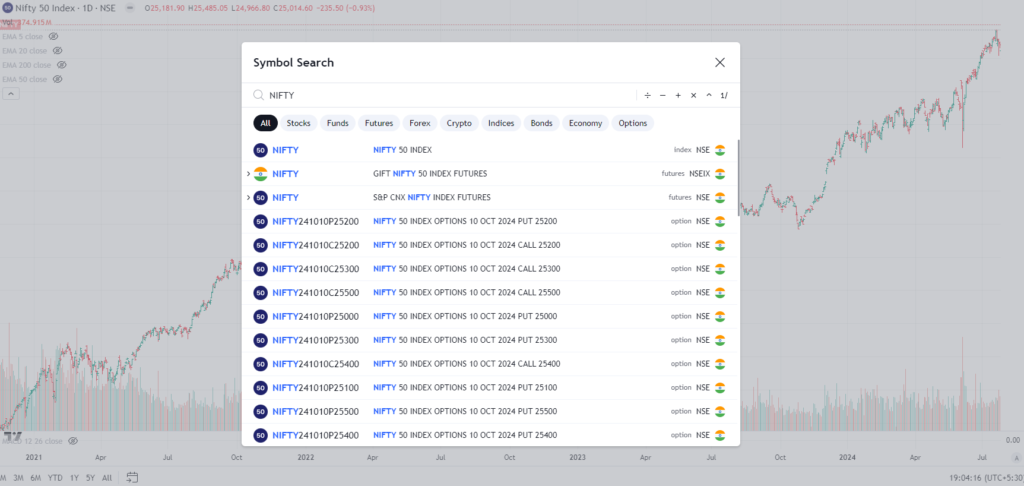

Setting Up Bollinger Bands in TradingView

Plotting Bollinger Bands on Charts

Here’s how to quickly set up Bollinger Bands in TradingView:

#1 Open a Chart

Navigate to the chart of the asset you’re trading.

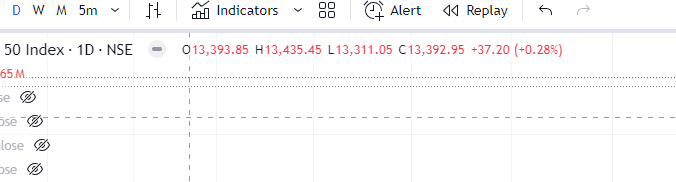

#2 Access Indicators

Click on the “Indicators” button at the top of the screen.

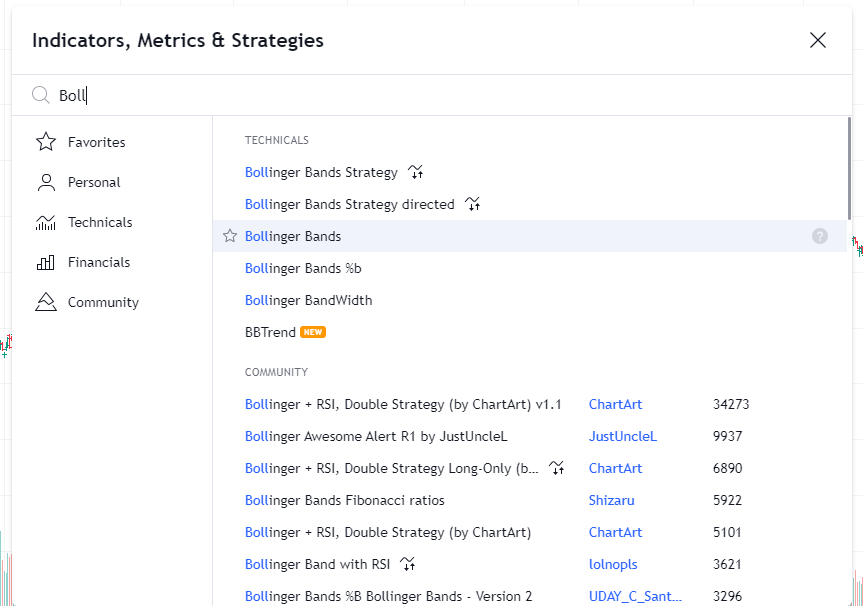

#3 Search for Bollinger Bands

In the search bar, type “Bollinger Bands”.Choose Plain Bollinger bands option.In image below its third option from the top..

#4 Add Bollinger Bands

Click on the Bollinger Bands indicator, and it will automatically be added to your chart.

The Bollinger Bands will appear as three lines: the middle moving average (usually set at 20 periods) and the upper and lower bands based on standard deviation.

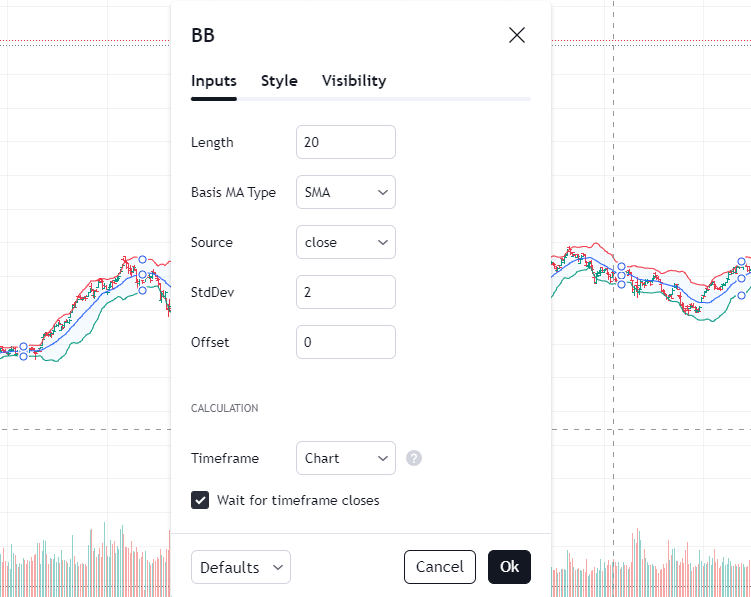

Customizing Band Settings

To fine-tune Bollinger Bands for your swing trading strategy:

Access Settings

Click on the settings icon next to the Bollinger Bands indicator on your chart.

Adjust Period

The default period is 20, which represents the moving average. You can adjust this to shorter periods (e.g., 14) for more sensitivity or longer periods for smoother trends.

Standard Deviation

The default setting is 2 standard deviations, which is common for most traders. Adjusting this higher (e.g., 2.5 or 3) will widen the bands, while lowering it (e.g., 1.5) will make the bands narrower.

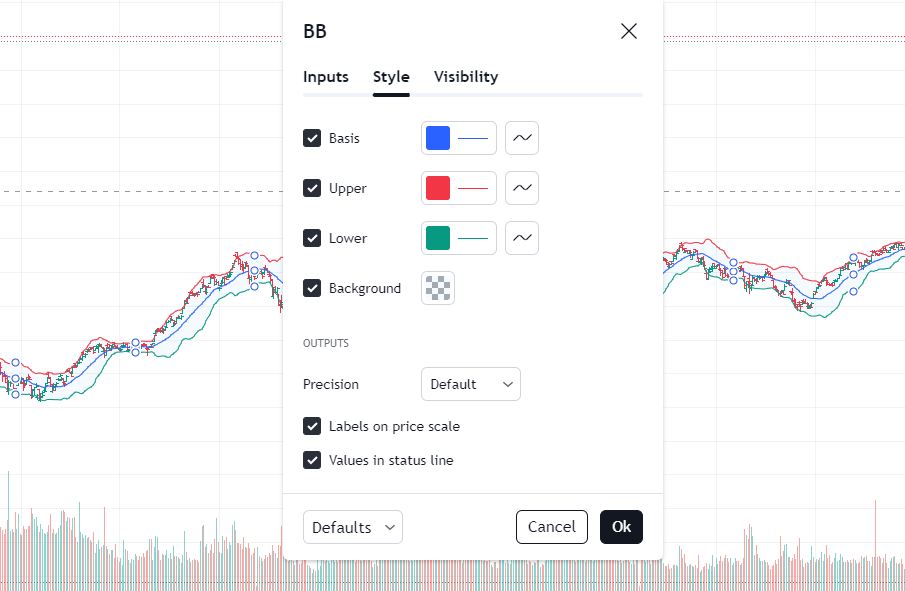

Style Customization

You can also adjust the color and thickness of the bands for better visibility according to your preferences.

These settings allow traders to optimize Bollinger Bands to align with their strategy and market conditions.

Combining Bollinger Bands with Other Indicators

Bollinger Bands and RSI (Relative Strength Index)

Pairing Bollinger Bands with the RSI can significantly enhance your swing trading strategy. Bollinger Bands identify overbought and oversold conditions by observing price action near the upper or lower bands. Meanwhile, RSI quantifies these conditions with a numerical value (generally, RSI > 70 is overbought, and RSI < 30 is oversold).

- Confirmation of Signals: When both Bollinger Bands and RSI indicate overbought or oversold conditions simultaneously, the chances of a reversal increase. For example, if a stock touches the lower Bollinger Band and the RSI reads below 30, it could be a solid entry point for a long trade.

MACD (Moving Average Convergence Divergence)

Using the MACD along with Bollinger Bands adds another layer of confirmation, particularly for spotting trend strength and reversals. The MACD measures the momentum of a trend and helps confirm whether a breakout indicated by the Bollinger Bands is valid.

- Trend Confirmation: If the price breaks above the upper Bollinger Band and the MACD line is moving above the signal line, it strengthens the case for a continued uptrend. Conversely, if the price dips below the lower band and the MACD crosses below the signal line, it indicates a potential downtrend.

Volume and Bollinger Bands

Volume is a crucial element to consider when analyzing Bollinger Band patterns. Large spikes in volume often accompany significant price moves, whether breakouts or reversals, giving traders extra confidence in the signal.

- Volume Spikes and Breakouts: A Bollinger Band squeeze (narrowing of bands) followed by a volume spike often signals a powerful breakout. High volume confirms that market participants are actively participating in the move, making it more reliable.

By combining Bollinger Bands with RSI, MACD, and volume, traders can better confirm their signals, improving accuracy and reducing false entries.

Bollinger Bands Swing Trading Strategies

1. Mean Reversion Strategy

The Mean Reversion strategy is based on the concept that prices tend to revert to the mean or average over time. In this strategy, traders assume that when the price reaches the upper or lower Bollinger Band, it will eventually return to the middle band (moving average).

- How it Works:

- Buy Signal: When the price touches or dips below the lower Bollinger Band, it indicates oversold conditions, and traders can look for a buying opportunity, expecting the price to revert to the mean.

- Sell Signal: Conversely, when the price touches or exceeds the upper Bollinger Band, it indicates overbought conditions, and traders can sell, anticipating the price will fall back toward the middle band.

- Risk Management: Traders often set stop-loss orders below the lower band (for long trades) or above the upper band (for short trades) to limit risk if the price continues beyond expectations.

2. Breakout Strategy

The Breakout Strategy revolves around the Bollinger Band squeeze—a pattern that occurs when the bands narrow, indicating a period of low volatility. A squeeze often precedes a significant breakout in price, making this strategy ideal for swing traders looking to capture explosive moves.

- How it Works:

- Entry: Look for a Bollinger Band squeeze, signaling a low-volatility period. The breakout occurs when the price moves decisively above or below the bands.

- Buy Signal: If the price breaks above the upper band during the squeeze, it’s a bullish signal, indicating that an upward breakout is likely.

- Sell Signal: If the price breaks below the lower band, it suggests a bearish breakout.

- Risk Management: Place stop-loss orders just outside the squeeze range to minimize losses if the breakout is a false signal or if the price retraces sharply.

3. Trend Following Strategy

In this strategy, traders use Bollinger Bands to follow trends by entering positions when the price hugs either the upper or lower band.

- How it Works:

- Uptrend: When the price consistently rides the upper band, it indicates a strong upward trend. Traders can enter long positions as long as the price stays near the upper band.

- Downtrend: When the price rides the lower band, it signals a downtrend, and traders can enter short positions or hold off on buying.

- Risk Management: Stop-loss orders can be placed near the middle band to exit the trade if the trend weakens, signaling a potential reversal. Traders can also use trailing stop-losses to lock in profits as the trend continues.

These strategies help swing traders leverage Bollinger Bands in various market conditions, enabling them to capture reversals, breakouts, and trends effectively while managing risk with stop-losses.

Advantages of Using Bollinger Bands in Swing Trading

1. Dynamic Adjustments to Market Conditions

One of the key advantages of Bollinger Bands is their ability to dynamically adjust to market volatility. The bands widen during periods of high volatility and narrow during periods of low volatility. This adaptability makes Bollinger Bands highly versatile for swing traders, as they provide real-time insight into how the market is behaving.

- How it Works: When volatility increases, the bands expand, signaling potential trade opportunities as the price may continue moving in the direction of the trend. When volatility contracts, the bands narrow, indicating a consolidation phase, which may precede a breakout.

2. Clarity in Trend Direction

Bollinger Bands offer traders a clear visual representation of trend direction and momentum. By observing how the price interacts with the upper and lower bands, traders can easily identify whether the market is in an uptrend, downtrend, or consolidation phase.

- Uptrend: When prices consistently touch or hover near the upper band, it signals a strong upward trend.

- Downtrend: When prices consistently touch or hover near the lower band, it indicates a strong downward trend.

This clarity helps traders make more informed decisions about entering or exiting trades based on the prevailing trend.

3. Early Identification of Volatility Breakouts

The Bollinger Band squeeze is a reliable indicator for early identification of volatility breakouts. During a squeeze, the bands contract, reflecting a low-volatility period. This contraction often precedes a breakout, either to the upside or downside, giving swing traders the chance to position themselves early for potential gains.

- How it Works: A breakout occurs when the price moves sharply beyond the upper or lower band following a squeeze. Traders can enter the market as soon as the breakout is confirmed, often capturing significant price movements as the market reacts to the release of built-up pressure.

These advantages make Bollinger Bands an essential tool for swing traders looking to optimize their strategy in both trending and ranging markets.

Common Mistakes to Avoid with Bollinger Bands

1. Mistaking Volatility for Trend Reversal

One of the most common mistakes traders make is misinterpreting expanded Bollinger Bands as a signal for an imminent reversal. Expanded bands simply indicate higher volatility, but they do not necessarily mean that the trend will reverse.

- Why It Happens: When the bands widen, it shows that the price is moving rapidly, which may lead some traders to think the market is overbought or oversold. However, price can continue to trend for extended periods during high volatility, leading to losses if traders act on premature reversal assumptions.

- How to Avoid: Instead of immediately assuming a reversal, look for confirmation through other indicators, such as RSI or MACD, before taking action. Only enter reversal trades when there is clear evidence of weakening momentum.

2. Ignoring Other Indicators

Bollinger Bands are a powerful tool, but they should not be used in isolation. Relying solely on them without incorporating other technical indicators can lead to false signals and poor trading decisions.

- Why It Happens: Traders sometimes become too focused on the visual appeal of Bollinger Bands and forget to cross-check their signals with other tools like volume, RSI, or MACD, leading to misinterpretation.

- How to Avoid: Always use additional indicators to validate Bollinger Band signals. For example, pairing Bollinger Bands with the RSI can help confirm overbought or oversold conditions, while MACD can be used to confirm trend strength.

3. Over-Reliance on the Bands for Reversal Signals

Another mistake traders often make is over-relying on Bollinger Bands for predicting reversals. Just because the price touches or crosses the upper or lower band does not guarantee a reversal.

- Why It Happens: Traders may believe that touching the upper band means the market is overbought, or touching the lower band means it’s oversold, expecting a reversal too soon. However, during strong trends, prices can stay near these bands for extended periods.

- How to Avoid: Instead of jumping into a reversal trade at the first sign of a band touch, wait for confirmation signals from other indicators like volume spikes, divergence in RSI, or price action at key support and resistance levels.

By being aware of these common mistakes, traders can better use Bollinger Bands as part of a comprehensive and reliable swing trading strategy.

Conclusion

Bollinger Bands are a highly versatile tool for swing traders, providing valuable insight into market volatility, trend strength, and potential reversals. By monitoring the bands’ expansion, contraction, and price interaction, traders can make more informed decisions about when to enter or exit a position.

Bollinger Bands are most effective when used in conjunction with other technical indicators like RSI, MACD, or volume analysis. This combination strengthens the reliability of signals and helps traders navigate different market conditions with confidence.

If you’re new to using Bollinger Bands, start practicing on platforms like TradingView. Experiment with different setups and use real-time charts to understand how Bollinger Bands interact with price movements.

To elevate your swing trading, explore other technical indicators and chart patterns that complement Bollinger Bands. Continuous learning will help you refine your strategies and improve trading performance over time.