In the fast-paced world of trading, volatility can work both for and against you. While the potential for profits is appealing, the risk of losses is just as real.

This is where a stop-loss strategy becomes essential. A stop-loss is a pre-determined point at which you will exit a trade to prevent further losses, safeguarding your capital.

For traders, especially those involved in swing or short-term trading, having a disciplined stop-loss approach is crucial.

It prevents emotional decision-making during market dips and ensures that one bad trade doesn’t wipe out the profits from previous ones.

Among the various strategies available, the 7% stop-loss rule stands out as a popular risk management tool.

This simple yet effective strategy involves selling a stock if its price drops by 7% from the purchase price, helping traders cap losses and protect their portfolio from severe downturns.

In this blog, we’ll dive into what the 7% stop-loss rule is, how it works, and why it’s a trusted method among seasoned traders for preserving capital.

What is the 7% Stop-Loss Rule?

The 7% stop-loss rule is a straightforward risk management strategy used by traders to limit potential losses.

It dictates that when a stock’s price falls by 7% from the purchase price, the trader should exit the position, regardless of market conditions or emotions. This automatic sell trigger helps traders avoid the emotional pitfalls of holding onto a losing position in the hope of a recovery.

The primary goal of the 7% stop-loss rule is to protect traders from significant losses while still allowing room for potential gains.

By capping the downside risk to just 7%, traders can stay in control of their investments without risking large portions of their portfolio on a single trade. This makes it particularly useful in volatile markets, where sudden price movements can quickly erode capital.

The rule was popularized by William J. O’Neil, a renowned stock market analyst and founder of Investor’s Business Daily.

It is an integral part of O’Neil’s CAN SLIM strategy, which combines both technical and fundamental analysis.

The 7% stop-loss rule fits into this strategy by ensuring that traders cut their losses early while still holding onto winning trades long enough to capture meaningful gains.

It serves as a safeguard against the inherent unpredictability of the markets, offering traders peace of mind and long-term portfolio protection.

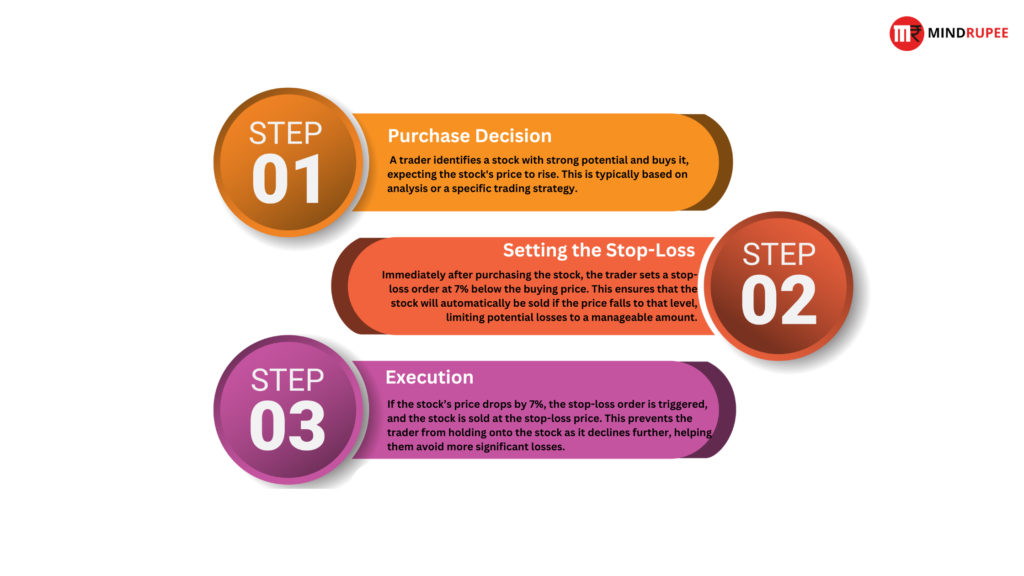

How the 7% Stop-Loss Rule Works?

Here’s a step-by-step breakdown of how the 7% stop-loss rule functions:

Purchase Decision

A trader identifies a stock with strong potential and buys it, expecting the stock’s price to rise. This is typically based on analysis or a specific trading strategy.

Setting the Stop-Loss

Immediately after purchasing the stock, the trader sets a stop-loss order at 7% below the buying price. This ensures that the stock will automatically be sold if the price falls to that level, limiting potential losses to a manageable amount.

Execution

If the stock’s price drops by 7%, the stop-loss order is triggered, and the stock is sold at the stop-loss price. This prevents the trader from holding onto the stock as it declines further, helping them avoid more significant losses.

Example

Suppose a trader buys a stock at ₹100. To apply the 7% stop-loss rule, the trader places a stop-loss order at ₹93 (7% below ₹100). If the stock’s price drops to ₹93, the order automatically sells the stock, thereby limiting the trader’s loss to ₹7 per share. If the stock rises, the trader can continue to hold the stock, benefiting from the gains.

By setting a predefined 7% stop-loss, traders are protected from emotional decision-making and market fluctuations, maintaining discipline in their trading strategy.

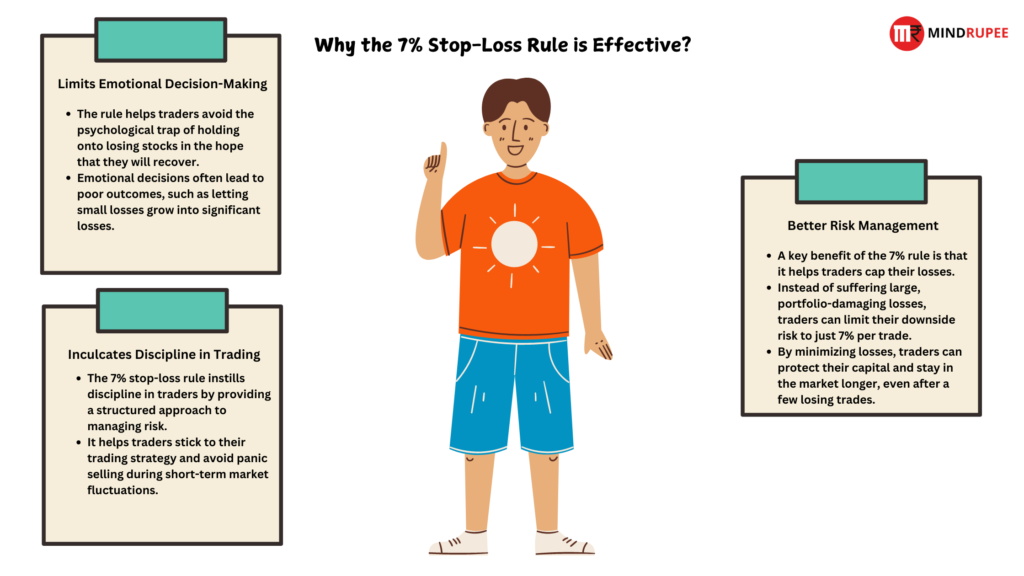

Why the 7% Stop-Loss Rule is Effective?

The 7% stop-loss rule is a powerful risk management tool for several reasons:

Limits Emotional Decision-Making

The rule helps traders avoid the psychological trap of holding onto losing stocks in the hope that they will recover. Emotional decisions often lead to poor outcomes, such as letting small losses grow into significant losses.

With a 7% stop-loss in place, traders automatically sell their stock when the price drops, removing the emotional aspect from the decision.

Risk Management

A key benefit of the 7% rule is that it helps traders cap their losses. Instead of suffering large, portfolio-damaging losses, traders can limit their downside risk to just 7% per trade. By minimizing losses, traders can protect their capital and stay in the market longer, even after a few losing trades.

Discipline in Trading

The 7% stop-loss rule instills discipline in traders by providing a structured approach to managing risk. It helps traders stick to their trading strategy and avoid panic selling during short-term market fluctuations. Knowing they have a safety net in place, traders can focus on finding winning trades without worrying about catastrophic losses.

The 7% stop-loss rule is effective because it encourages a systematic and disciplined approach to trading, helping traders manage risk and preserve capital in the long run.

When to Use the 7% Stop-Loss Rule?

The 7% stop-loss rule is most effective in certain trading scenarios, particularly in shorter time frames:

Ideal for Short-Term or Swing Trading

The rule is best suited for traders engaged in short-term or swing trading, where market volatility can lead to sudden price drops. In these cases, the 7% stop-loss helps traders protect their gains and capital during rapid market movements, allowing them to exit losing positions before the losses worsen.

Works Best in Trending Markets

In a trending market, where stock prices fluctuate quickly, the 7% stop-loss rule can be a useful tool for keeping small losses in check. It allows traders to benefit from the general upward or downward trend while providing a safety net if the market unexpectedly reverses.

Not Recommended for Long-Term Investors

For long-term investors, the 7% stop-loss rule may not be as suitable. These investors typically hold positions through market dips and fluctuations, focusing on long-term growth rather than short-term price movements. Using a 7% stop-loss in long-term strategies could result in selling stocks prematurely, missing out on potential future gains when the market rebounds.

In summary, the 7% stop-loss rule is most effective in active trading environments, especially in shorter time frames, and may not be suitable for long-term investment strategies.

Advantages of the 7% Stop-Loss Rule

| Advantages of the 7% Stop-Loss Rule | Description |

|---|---|

| Simplicity | Easy to implement and understand for both novice and experienced traders. The stop-loss order is automatically executed if the stock hits the 7% level, reducing the need for constant monitoring. |

| Prevents Big Losses | Helps avoid significant losses by automatically selling a stock once it drops by 7%, preventing emotional attachment and larger potential losses. |

| Promotes Consistency | Encourages traders to maintain discipline and follow a consistent risk management strategy, removing emotions and guesswork from trading decisions. |

Simplicity

One of the key advantages of the 7% stop-loss rule is its simplicity. It is easy to implement and understand for both novice and experienced traders. By setting a clear boundary (7% below the purchase price), traders don’t need to constantly monitor their positions. The stop-loss order will automatically execute if the stock hits the predetermined level.

Prevents Big Losses

The rule helps traders avoid significant losses by enforcing a strict sell point. It eliminates the emotional attachment to a stock, which can often lead traders to hold onto losing positions in the hope that they will rebound. By automatically selling when the price drops by 7%, the rule helps prevent a small loss from becoming a much larger one.

Promotes Consistency

The 7% stop-loss rule encourages traders to maintain discipline and follow a consistent risk management strategy, regardless of market conditions. It removes guesswork and emotions from the decision-making process, ensuring that traders stick to their plan and avoid making impulsive or irrational decisions in volatile markets. This consistency is key to long-term success in trading.

Disadvantages of the 7% Stop-Loss Rule

Risk of Premature Selling

In highly volatile markets, stocks often experience short-term price swings that may trigger the 7% stop-loss rule prematurely. A stock could drop by 7%, triggering the stop-loss, and then quickly recover, leaving the trader out of a position that could have turned profitable in the longer term.

Fixed Percentage Drawback

The one-size-fits-all nature of the 7% rule can be problematic for stocks with different volatility profiles. Highly volatile stocks may require a larger stop-loss margin to account for their natural price fluctuations, while less volatile stocks might benefit from a tighter stop-loss. The fixed 7% may not be optimal for every stock, limiting the flexibility of this rule.

Missed Opportunities

The stock may drop by 7%, triggering a sale, and then experience a significant rebound shortly afterward. In such cases, traders miss out on potential profits because the stop-loss was set too tightly for that particular stock or market condition, leading to regret over selling too early.

| Disadvantages of the 7% Stop-Loss Rule | Description |

|---|---|

| Risk of Premature Selling | In volatile markets, short-term price swings may trigger the 7% stop-loss prematurely, causing the trader to miss out on potential longer-term profits. |

| Fixed Percentage Drawback | The fixed 7% rule may not suit all stocks, as highly volatile stocks may need a larger margin, while less volatile stocks may benefit from a tighter stop-loss. |

| Missed Opportunities | The stock may drop by 7%, trigger the stop-loss, and then rebound significantly, resulting in missed profits from a quick recovery. |

Adapting the 7% Stop-Loss Rule for Different Market Conditions

For High Volatility Stocks

In markets where stock prices fluctuate more dramatically, such as with certain technology or small-cap stocks, the 7% stop-loss might be too tight. Consider increasing the stop-loss to 8-10% to account for the natural volatility while still protecting against significant losses. Alternatively, using a trailing stop-loss allows the stop to move upward as the stock price rises, locking in gains while providing room for fluctuations.

For Stable Stocks

Stocks with less price movement, such as large-cap or blue-chip stocks, may not require as much room for fluctuation. In such cases, sticking to the 7% rule helps maintain a solid risk management strategy by limiting potential losses without the need for adjustments.

Using Technical Analysis

To enhance the effectiveness of the 7% rule, combine it with technical indicators like support and resistance levels. For example, setting your stop-loss just below a key support level can provide additional protection against minor price fluctuations, increasing the likelihood that the trade will remain viable if the stock bounces back from support. Similarly, monitoring moving averages or other technical tools can help you adjust the stop-loss more intelligently based on market conditions.

Examples of the 7% Stop-Loss Rule in Action

A swing trader buys a stock at ₹1,000, expecting the price to rise. To protect against unforeseen losses, they set a 7% stop-loss at ₹930. Unfortunately, the stock price drops to ₹930, triggering the stop-loss, and the stock is sold. This prevents the trader from experiencing further losses if the stock continues to decline, demonstrating how the 7% rule effectively minimizes risk.

Another trader purchases a stock at ₹1,000. Shortly after, the price dips to ₹930, triggering the stop-loss. However, following the sale, the stock rebounds and reaches ₹1,050. In this case, the 7% stop-loss rule may seem too rigid, as the trader missed out on potential profits from the stock’s recovery. This highlights one of the key drawbacks of using a fixed percentage stop-loss in volatile markets.

Alternatives to the 7% Stop-Loss Rule

Trailing Stop-Loss

Instead of a fixed stop-loss, a trailing stop adjusts as the stock price moves higher. For example, if the stock price rises by 10%, the trailing stop moves up accordingly, ensuring profits are locked in while still protecting against downside risk.

Percentage-Based Stops

Customize stop-loss percentages based on the volatility of individual stocks or the broader market. For more volatile stocks, a 10% or even 12% stop-loss might be more appropriate, while less volatile stocks might work well with a 5-7% stop.

Technical Stop-Loss

Rather than relying on a fixed percentage, traders can set stop-losses based on technical analysis. This includes placing stops just below support levels, moving averages, or chart patterns, ensuring stops align with market dynamics.

To read more about Stop loss visit here.

Conclusion

The 7% stop-loss rule is an effective tool for managing risk in trading, especially for those looking to minimize losses and avoid emotional decision-making. While simple to implement and understand, this rule provides a consistent framework for traders to cap their potential downside.

However, like all strategies, the 7% stop-loss rule should be adaptable to different market conditions and individual stock volatility.

Combining it with technical analysis, or using alternative strategies like trailing stops, can enhance its effectiveness. Ultimately, integrating the 7% stop-loss rule into a disciplined trading strategy helps traders safeguard their capital and make more consistent trading decisions.