Swing trading offers exciting opportunities to capitalize on short- to medium-term market moves, but without a clear plan for managing risk, profits can quickly turn into losses.

The secret weapon?

A well-placed stop-loss.

While many traders focus on identifying the perfect entry and exit points, it’s the stop-loss that often determines whether you walk away with gains or losses.

In this blog, we’ll explore the smart strategies behind setting effective stop-losses in swing trading, so you can confidently navigate the market while protecting your hard-earned capital.

What is a Stop Loss?

A stop loss is a predefined order that automatically sells (or buys) an asset when it reaches a certain price level.

In swing trading, where traders hold positions for days or weeks, the purpose of a stop loss is to limit potential losses by closing the trade once the market moves against the position by a certain amount.

It acts as a safety net, preventing emotional decision-making and ensuring that traders stick to their risk management strategy.

Importance of Stop Loss in Swing Trading

In swing trading, markets can experience sharp and sudden price movements due to various factors such as earnings reports, economic news, or global events.

Without a stop loss in place, traders risk exposing themselves to significant losses that could wipe out profits or even their entire account.

By using a stop loss, swing traders can protect their capital, manage their risk effectively, and ensure that one bad trade doesn’t overshadow several good ones.

It allows traders to define their risk in advance and maintain discipline, which is crucial for long-term success in the volatile world of swing trading.

Types of Stop Loss in Swing Trading (Using Indian Market Examples)

Fixed Stop Loss

Definition

A Fixed Stop Loss is a set percentage or fixed rupee amount that you decide upon before entering the trade. This amount is based on your risk tolerance. If the price of the stock moves against you by this pre-decided margin, you exit the trade.

How It Works

For example, let’s say you buy shares of Tata Motors at ₹600 and set a 2% fixed stop loss. This means you will exit the trade if the stock price drops by 2%, or ₹12, bringing the exit price to ₹588. This stop-loss method remains constant regardless of how the stock performs, making it simple to follow.

When to Use

Fixed stop loss is beneficial when you have a clear idea of the maximum risk you’re willing to take. It’s useful in volatile markets where prices may fluctuate quickly, and you want to set a hard boundary on your losses.

Advantages

- Simple and Predictable: You can calculate your risk upfront, making it easy to plan your trade.

- Capital Protection: Ensures you won’t lose more than your predetermined risk amount.

Disadvantages

- Rigidity: Since it doesn’t adjust with the market, you might exit prematurely if the price hits your stop loss but then rebounds.

Trailing Stop Loss

Definition

A Trailing Stop Loss automatically adjusts as the stock price moves in your favor, maintaining a specific distance from the current price. This method helps lock in profits while limiting potential downside.

How It Works

Let’s say you buy Infosys shares at ₹1,400 and set a trailing stop loss of ₹50. If the price rises to ₹1,500, your stop loss moves to ₹1,450, ensuring that if the stock retraces, you still lock in a ₹50 profit. As the price continues to rise, the stop-loss adjusts automatically, but if the stock falls back to ₹1,450, the system will close your position. This is a very simplistic example but in actual this can be bit complex as per your system.

When to Use

Trailing stops are ideal in trending markets when you expect the price to continue moving in your favor. This technique allows you to ride upward trends without needing constant monitoring.

Advantages

- Profit Protection: It locks in gains as the stock price rises.

- Hands-Free Management: The trailing stop adjusts automatically, giving you flexibility without needing constant attention.

Disadvantages

- Choppy Markets: In volatile markets, a trailing stop may be triggered too early, cutting your profits short.

Volatility-Based Stop Loss

Definition

A Volatility-Based Stop Loss adjusts according to the stock’s market volatility, typically using indicators like the Average True Range (ATR).

This method helps you adapt to market conditions, setting stop-loss levels based on how much a stock’s price typically fluctuates. Helps avoid selling due to market noise.

How It Works

For example, if the ATR for the stock is ₹25, you could set your stop-loss 2 times the ATR (₹50) below your entry price to account for regular price movement. This way, the stop loss isn’t set too tight, giving the stock some breathing room in case of normal fluctuations.

When to Use

This type of stop loss is particularly useful for stocks that tend to have large price swings, such as those in the Nifty 50 index or volatile sectors like technology and energy.

Advantages

- Flexible: Adapts to different market environments, helping avoid unnecessary exits during high volatility.

- Customizable: You can choose the level of risk you’re comfortable with by adjusting the multiple of the ATR.

Disadvantages

- Complexity: Requires understanding of volatility indicators like ATR and regular adjustment based on changing market conditions.

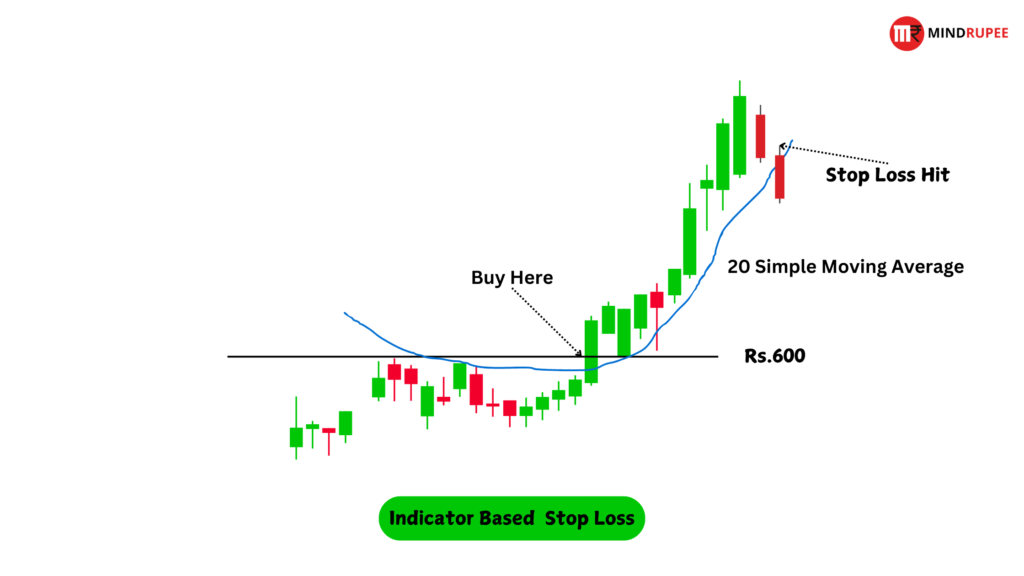

Technical Indicator-Based Stop Loss

Definition

This method uses technical indicators such as moving averages, trendlines, or support/resistance levels to determine where to place your stop loss. It is especially useful for traders who rely heavily on technical analysis to guide their decisions.

How It Works

For instance, if you’re trading HDFC Bank, you might place your stop loss just below the 50-day moving average. If the stock falls below this level, it could signal a breakdown of the trend, prompting you to exit. Alternatively, if you see strong support at ₹1,600, you could place your stop loss just below that level.

When to Use

This type of stop loss is ideal when your trading strategy revolves around technical indicators. It allows you to tie your risk management closely to the setup you’re trading.

Advantages

- Aligned with Strategy: Matches your stop-loss level with key technical indicators, providing a more rational exit strategy.

- Helps Avoid False Exits: By placing stops at critical levels, it avoids getting triggered by minor fluctuations.

Disadvantages

- Subject to Whipsaw Movements: In sideways or choppy markets, price can break through key levels temporarily, triggering your stop loss before resuming the trend.

Using these different types of stop-loss strategies in the Indian stock market enables you to adapt to various trading scenarios, whether you’re managing a position in Tata Motors, Reliance, or any other high-volume stock. By understanding and applying the appropriate type of stop loss, you protect your capital while optimizing your strategy for market conditions.

How to Set an Effective Stop Loss?

1. Define Your Risk Tolerance

Before entering any trade, it’s crucial to define the maximum amount you’re willing to lose. Typically, this is a small percentage of your overall portfolio (e.g., 1-2% per trade). Knowing your risk tolerance helps to avoid emotional decision-making and ensures you maintain a disciplined trading approach.

- Example: If your portfolio is worth ₹5 lakhs, and you’re willing to risk 2% per trade, your maximum loss per trade would be ₹10,000.

2. Use Support and Resistance Levels

Support and resistance levels are key technical tools that indicate potential price reversals. When setting a stop loss, place it just below a significant support level in an uptrend or above a resistance level in a downtrend. This helps prevent getting stopped out by temporary price fluctuations.

- Example: If ICICI Bank has strong support at ₹720, you could set your stop loss just below this level, around ₹715, to avoid being stopped out prematurely during minor dips.

3. Consider Volatility

Volatility can greatly impact price swings, so using volatility-based indicators like the Average True Range (ATR) helps you set stop losses that adapt to these fluctuations. This ensures that your stop loss isn’t too tight (leading to frequent exits) or too loose (causing larger-than-desired losses).

- Example: If the ATR for HDFC Bank is ₹30, setting your stop loss 1.5 times the ATR (₹45 below your entry price) allows the trade some breathing room during regular price fluctuations without stopping out too early.

4. Apply Moving Averages

Moving averages, especially the 50-day or 200-day, are often used as dynamic support and resistance levels. Traders set stop losses just below (in an uptrend) or above (in a downtrend) these moving averages to ensure they exit trades only when there’s a significant trend change.

- Example: If Tata Motors is trading above its 50-day moving average at ₹550, you might place your stop loss at ₹540, just below the moving average, to ensure that only a meaningful trend reversal triggers your exit.

5. Use Chart Patterns

Patterns like head and shoulders, double tops/bottoms, and triangles provide visual cues of trend reversals. These patterns can help you determine where to set your stop loss in relation to key levels on the chart.

- Example: If you’re trading Reliance Industries and spot a head and shoulders pattern forming, you can place your stop loss just below the neckline of the pattern, ensuring that a confirmed breakdown leads to an exit.

By incorporating these strategies, traders can set more effective stop losses, which not only protect their capital but also help maximize their profitability in swing trading scenarios.

You can also consider using Candlesticks for exiting trades.

Common Mistakes When Setting Stop Losses

1. Placing Stops Too Tight

One of the most common mistakes swing traders make is setting their stop losses too close to the entry point. While it’s understandable to want to minimize risk, overly tight stops can lead to being stopped out due to normal market fluctuations, even if the overall trade idea is still valid. This results in missing out on potential profits as the stock continues to move in the intended direction after hitting the stop.

- Example: Let’s say you bought Infosys at ₹1,500 and placed your stop loss at ₹1,490. The stock may fluctuate in its normal range by ₹20–₹30, stopping you out prematurely, even though the overall trend remains bullish.

2. Ignoring Market Volatility

Every stock has a different level of volatility, and ignoring this can lead to improper stop-loss placement. High-volatility stocks naturally have larger price swings, so placing tight stops on such stocks can be counterproductive. Using tools like the Average True Range (ATR) helps adjust stop levels according to volatility.

- Example: For a highly volatile stock like Adani Enterprises, if you set your stop loss too close, it could trigger frequently due to daily price fluctuations. Instead, using a volatility-based stop like ATR would allow more room for the price to move before exiting.

3. Moving the Stop Loss

Moving a stop loss during a trade without a strategic reason is a dangerous habit. It often happens when traders become emotionally attached to the trade, hoping the stock will recover. Instead of taking the intended small loss, this behavior can lead to much larger losses. Stop losses should only be adjusted when there’s a technical reason, such as a new support/resistance level forming or a shift in market sentiment.

- Example: You bought HDFC Bank at ₹1,600 and set your stop loss at ₹1,550. As the stock drops to ₹1,560, you might be tempted to move the stop loss to ₹1,520, hoping for a rebound. However, this could result in an even larger loss than initially planned if the stock continues to fall.

Tools for Setting Stop Loss in Swing Trading

1. Technical Analysis Tools

Technical analysis platforms like TradingView, MetaTrader, and Zerodha’s Kite provide powerful tools to help traders set accurate stop losses. These platforms allow you to plot support and resistance levels, calculate volatility, and apply technical indicators that are crucial in deciding stop-loss levels.

- Example: Using TradingView, you can apply Bollinger Bands to see volatility levels, and support/resistance lines to identify where the price might reverse, helping you place an informed stop loss.

2. Stop-Loss Calculators

Automated stop-loss calculators, available through various broker platforms and trading software, help traders calculate optimal stop-loss levels based on parameters like trade size, risk percentage, and volatility.

- Example: Zerodha’s Pi and Streak allow you to automate your stop loss using pre-defined conditions like “If the stock price falls 2% below the 50-day moving average, trigger stop loss.” This helps automate your risk management without emotional interference.

Best Practices for Stop Loss Placement

1. Never Risk More Than 1-2% of Your Capital

- Explanation: The golden rule of risk management is to avoid risking more than 1-2% of your total capital on any single trade. This prevents substantial losses from a single failed trade, protecting your overall trading account. For example, if your portfolio is ₹1,00,000, you should not risk more than ₹1,000 to ₹2,000 per trade.

- Example: Let’s say you enter a position in TCS at ₹3,500, and you’re willing to risk ₹2,000. You can calculate a stop-loss point by determining the maximum price drop that would lead to a ₹2,000 loss, ensuring your risk stays within limits.

2. Keep a Consistent Approach

- Explanation: A consistent approach to setting stop losses ensures long-term trading success. Many traders make the mistake of varying their stop-loss strategies based on emotions or short-term market behavior. Sticking to your predefined strategy, whether it’s using technical indicators or volatility-based stops, helps remove emotional decision-making.

- Example: If you consistently use the ATR indicator for volatility-based stops, stick to that method rather than switching to fixed stops or adjusting your strategy based on market noise.

Conclusion

Stop losses are not just a tool for minimizing losses; they are an essential part of a trader’s risk management strategy. Without stop losses, traders expose themselves to potentially catastrophic losses that could wipe out their account. Having a well-defined stop-loss strategy helps protect your capital and ensures you survive in the long run.

Consistent risk management is key to profitable swing trading. While setting a stop loss might seem like a straightforward task, its correct application can make or break your trading career. Always follow your stop-loss strategy, avoid emotional decision-making, and focus on long-term success rather than short-term wins.

.