What is Algorithmic Trading?

Algorithmic trading, sometimes referred to as automated trading, black-box trading, or algo-trading, is the process of placing a trade using a computer program that executes an algorithm—a predetermined set of instructions. In theory, the trade can make money faster and more frequently than a human trader could.

Timing, cost, quantity, or any mathematical model can be used to specify the sets of instructions.

By eliminating the influence of human emotions on trading activities, algo-trading not only increases trader profits but also makes markets more liquid and trading decisions more methodical.

However theoretical profits are converted to actual profits or not is another mystery. Let us keep it for some other time.

Let me tell you a story that helps explain algorithmic trading concepts better.

In the bustling city of Mumbai, there lived a trader named Raj. Despite his sharp market insights, Raj often struggled with the emotional rollercoaster of trading.

Trading without trading plan is a hobby. But Raj was a serious trader hand had a fixed set of rules that he followed.

Best Trading plan and trade logging Software : Edgewonk .I personally use it so you can take my words for it.

One sunny morning, Raj woke up to the news that a major tech company had missed its earnings expectations. Panic gripped the market, and the stock price began to plummet.

Raj had a position in that company’s stock. Raj, feeling the pressure, decided to sell his shares in a hurry, fearing further losses. Later that day, the company announced a new product launch, and the stock rebounded sharply, leaving Alex with regret and frustration.

When Raj shared this frustrating experience with his friend Priya, she suggested him to explore algorithmic trading.

“Why not let machines handle trades? They don’t feel fear or greed,” Priya advised.

Intrigued, Raj set up a simple algorithm based on his predefined rules, devoid of emotions.

Raj’s trading strategy involves “golden cross”—when a company’s 50-day moving average crosses its 200-day moving average.

Raj’s strategy is as follow :

Buy Decision : Buys as 50-day moving average crosses its 200-day moving average.

Sell Decision : Sells once price closes below 50-Day Moving average.

Over a cup of chai, Raj shared his amazement with Priya. “The algorithm stays calm and collected, unlike me,” Raj remarked. Priya smiled, “That’s the beauty of it. Algorithms follow logic and data, not emotions.”

With the algorithm, Raj’s trading became more consistent and successful. He realized that while human intuition is valuable, staying unemotional and disciplined is crucial. Algorithmic trading offered the perfect blend of human intelligence and machine precision, leading Raj’s trading career to new heights.

On Youtube i found this video which can help you further understand Algorithmic trading.

Key Takeaways

- The definition of algorithmic trading is the process of carrying out trades more quickly, efficiently, and without emotions by using computer programs that follow a predefined set of instructions.

- By executing trades faster than a human can, Algo Trading improves market liquidity, makes trading decisions more deliberate, and may even increase profits.

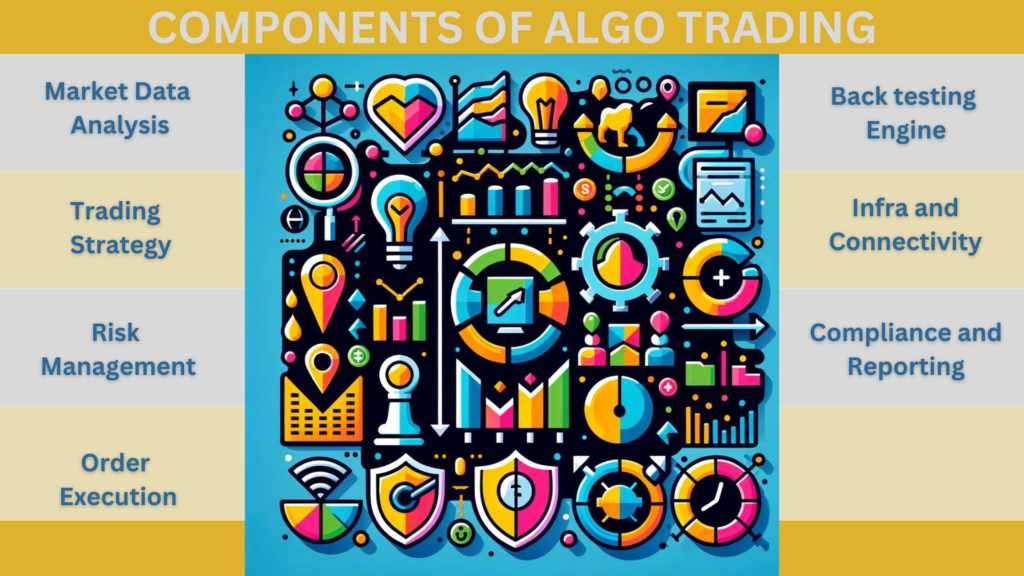

- Important Elements of Algorithmic Trading comprises analysis of market data, a clear trading plan, strong risk control, accurate order execution, thorough back-testing, dependable infrastructure, and adherence to reporting and compliance requirements.

- Strong strategies, high-quality data, low-latency execution, efficient risk management, technology infrastructure, ongoing optimization, regulatory compliance, and strategy diversification are all necessary for algorithmic trading success.

- How to Begin Trading Algorithms includes reading books, taking online classes, and participating in discussion forums. It also entails learning a strong foundation in programming, ideally with Python, setting up an algorithmic trading environment, selecting a platform and broker that work well together, and realizing how much time it takes to learn and apply strategies.

- Market volatility, the risk of overfitting, systemic risks like flash crashes, technological malfunctions, regulatory changes, and the possibility of market manipulation are among the risks associated with algorithmic trading.

- The most popular computer language for algorithmic trading is Python. Python is preferred because of its community resources, large library support, and ease of use, which make data analysis, back-testing, and strategy development more effective.

How Does Algorithmic Trading Work?

By converting vast amounts of market data into tradeable decisions in milliseconds, algorithmic trading allows computer programs to execute trades according to predefined criteria.

To get a feel for it, let’s take a look at what goes into an algorithmic trading system.

All of these parts are interdependent and essential to the smooth, accurate, and cost-effective execution of transactions.

Components of Algorithmic Trading Systems

#1 Market Data Analysis

Parts of algorithmic trading systems assess market data. In order to function, an algorithmic trading system must first analyze market data, both current and past. Important market statistics, such as volume, price movements, and more are included in this. With the help of the algorithm’s technique, the system meticulously examines this data in search of buy or sell trades.

Picture below exemplifies one of the data input types.

Success of this step depends on the quality of data. And quality of data depends on following tow steps .

1. Data Collection

- Sources: Market data can be collected from exchanges, financial news, online resources, and economic reports.

- Types of Data: This includes price data (open, high, low, close prices), volume data, order book data, and sentiment data.

2. Data Preprocessing

- Cleaning: Removing noise, handling missing values, and correcting errors in the data.

- Normalization: Standardizing data to ensure consistency and comparability.

- Feature Engineering: Creating new variables or features from the raw data to enhance the model’s predictive power.

#2 Trading Strategy

As the blueprint for the algorithm, the trading strategy details the proper way to initiate, process, and finalize trades.

Moving average crossovers and other simple strategies are just one example; more complex models utilizing machine learning and artificial intelligence are another.

As we discussed earlier one such strategy is “golden cross”—when a company’s 50-day moving average crosses its 200-day moving average.

Golden cross strategy is as follow :

Buy Decision : Buys as 50-day moving average crosses its 200-day moving average.

Sell Decision : Sells once price closes below 50-Day Moving average.

#3 Risk Management

In algorithmic trading, risk management is essential. This involves laying out the rules for position or trade size, and stop-loss orders to control the trading strategy’s exposure to risk. The system’s resilience in the face of market volatility and adverse events is dependent on its ability to handle risk effectively.

In case of Golden cross the stop loss is a trailing stop loss. Whenever the price closes below 50 Day moving average its a sell signal.

Lets take an example for some other strategy.

If we have a strategy to trade range breakout then one of the followings could be methods to take stoploss

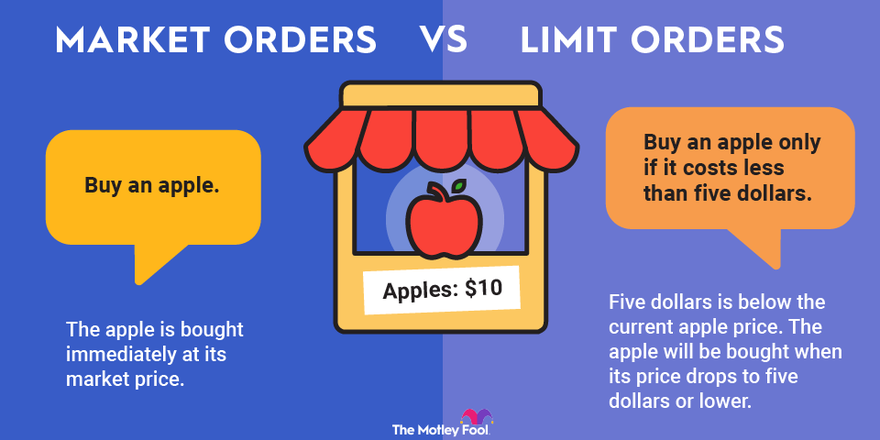

#4 Order Execution

After a trading opportunity is detected, the system is obligated to carry out the deal in the market. In order to execute trades at the best possible price and minimize slippage—the difference between the predicted and executed prices of a trade—the order execution logic component regulates the process.

Among these tasks is deciding when to put the order and what kind of order to buy and sell orders to use (market, limit, stop).That is part of your strategy and can be easily integrated in your algorithm.

Python programming can be used to build your order execution system.

#5 Back-testing Engine

Trading strategies need to be back tested against historical market data to make sure they work before they go live. The back-testing engine estimates the strategy’s potential gain or loss based on its simulation of its success in the past when the market was in a different state.

For me biggest advantage of back testing is that it helps build conviction in the strategy. This conviction is most utilized in your loosing streak. Because this is the time we start doubting our strategy.

But if we know that in our strategy facing 12 Consecutive losses is normal, we wont panic when we face such streak.

One of the ways to back test your strategies is on Tradingview using pinescript.

#6 Infrastructure and Connectivity

For efficient and timely transaction execution, a solid infrastructure and quick connectivity to market exchanges are essential. Because milliseconds constitute the difference between profit and loss, latency significantly affects the efficacy of high-frequency trading strategies.

As a user you need a robust infrastructure to avoid any misplacements and slippages.

Criteria for Algorithmic Trading Strategies

Financial markets are now operated at speeds and quantities that human traders could never achieve all that because of algorithmic trading. But a number of crucial elements that need to be well thought out and put into practice are essential to its success. Comprehending these fundamental components can greatly augment the efficacy and financial gain of algorithmic trading tactics.

Success Factors for Algorithmic Trading

#1 Sturdy Strategy Architecture

Developing a strong trading strategy is the cornerstone of algorithmic trading success. Finding market trends or inefficiencies that can be capitalized on financially entails doing this. To an investment strategy and guarantee its viability and likelihood of success, the plan needs to be carefully studied, founded on solid financial concepts, and extensively back tested using past data.

#2 Data Quality

For algorithmic trading systems to be effective, timely, accurate, and high-quality market data is essential. The information should be accurate and devoid of inaccuracies, covering a wide range of market situations. Inaccurate market analysis stemming from poor quality data can lead to erroneous trade decisions and possible losses.

#3 Low Latency Execution

When it comes to algorithmic trading, speed is crucial, particularly for methods that react quickly to changes in price. In order to minimize the danger of slippage and guarantee that the strategy performs as intended, low latency solutions make sure that transactions are performed virtually instantly.

#4 Risk Management Procedures

Effective risk management procedures are necessary to guard against market volatility and reduce possible losses. This entails establishing suitable stop-loss orders, controlling position sizes, and putting regulations in place to avoid becoming overexposed to a certain asset or market. A well-thought-out risk management plan helps protect investment and guarantee the trading system’s durability.

#5 Technical Infrastructure

Algorithmic trading systems run smoothly when there is a dependable and effective technology infrastructure in place. Strong processing capabilities, dependable and quick internet connections, and direct access to exchange servers are all included in this. The security of financial and commercial data must also be guaranteed by the infrastructure.

#6 Constant Optimization and Monitoring

To make sure algorithmic trading systems are operating as planned, constant optimization and monitoring are necessary. Strategies that were profitable may eventually lose their effectiveness due to changes in the market. To stay profitable and competitive, ongoing optimization is required, which includes changing algorithms and responding to shifting market conditions.

#7 Regulatory Compliance

When it comes to algorithmic trading, following ethical and regulatory guidelines is essential. By ensuring that trading activities are carried out within legal bounds, compliance protects against market manipulation and upholds the integrity of financial markets.

#8 Diversification

Risk can be decreased and profits can be increased by utilizing a variety of methods across various markets and asset classes. By spreading out exposure, diversification reduces the negative effects of underwhelming results in any one strategy same asset, or market.

The success of algorithmic trading initiatives depends on these elements. Through careful consideration of every detail, traders may create and manage effective algorithmic trading systems that are also able to withstand market fluctuations and obstacles.

Getting Started with Algorithmic Trading

How to Learn Algorithmic Trading

There is a certain amount of excitement and fear that comes with venturing into algorithmic trading. The power of automated trading systems may be unleashed by anyone with the correct strategy, resources, and frame of mind. Below, we’ve laid out a plan for beginners, including where to find the necessary materials, how to set up your own trading algorithms and environment, and how to choose a broker and platform.

Courses and Learning Materials

Writings in Print and Online: To lay a theoretical groundwork, I recommend reading works that introduce the concepts of algorithmic trading and the financial markets. Additionally, academic publications can shed light on state-of-the-art methodologies and research.

Numerous online platforms provide classes for all skill levels, from absolute beginners to those with more experience. Find a school that will teach you the ins and outs of programming and strategy development in addition to the more theoretical parts of financial management.

Community and Forums

If you’re interested in algorithmic trading, you might find some good advise, talk about strategies, and make some connections by joining a community or forum online.

Ability to Code

Creating and testing trading algorithms requires a solid understanding of computer languages like Python or C++. Learn the ropes faster with the help of resources like coding bootcamps, online tutorials, and practice platforms.

How to Start Algorithmic Trading

The First Steps in Creating an Algorithmic Trading Environment

The first step is to select the software and development tools you will need to code and conduct backtests of your strategy. Python is a popular choice among traders because of its robust library (such as NumPy, backtrader, and pandas) and supportive community.

Good historical market data is essential for backtesting your ideas, so be sure you have access to it. The data is broad and clean, and several systems offer it.

Hardware and Internet

Get yourself a solid computer and an internet connection that can keep up with your demands. To improve processing power and decrease latency, advanced techniques should think about using cloud computing resources.

When picking a broker and a platform, look for one that allows algorithmic trading and gives you access to the markets you want to trade in. When deciding where to host your trading algorithms, you should think about things like API availability, execution speed, and commission prices.

Your algorithmic trading configuration and the trading platform you choose should be compatible. Backtesting and algorithmic trading tools may be pre-installed on some systems, while they may need to be integrated specifically for others.

To practice trading without taking any financial risk, sign up for a demo account. You can improve your strategy before investing actual money by doing this.

When Starting Out in Algorithmic Trading, How Much Time do You Need?

Your level of expertise in trading, programming, and finance will determine how steep the learning curve is for algorithmic trading. It could take a few months of focused instruction for someone with a basic understanding of these topics to reach a level where they can develop and apply simple solutions. It may take years of dedicated study and practice to become an expert at more complicated techniques and to grasp the subtleties of various markets.

To succeed at algorithmic trading, you need to be patient and dedicated to learning new things. There are new strategies and technology appearing all the time, thus the field is always changing. Keep asking questions, be ready to fail, and tweak your strategy as you go.

Exploring Algorithmic Trading Practices

Benefits and Drawbacks of Trading Algorithmic

The trading environment has been profoundly altered by algorithmic trading, which presents both rewards and hazards in addition to its many benefits. Navigating the complexity of automated trading systems can be made easier for traders and investors by having a thorough understanding of them. Additionally, studying how profitable algorithmic trading companies like Renaissance Technologies operate might yield insightful information. In addition, to guarantee compliance and moral trading practices, the legal and regulatory aspects of using algorithmic systems for trading are fundamental.

Pros of Trading Algorithms

#1 Efficiency and Speed

Algorithmic trading allows for the practically instantaneous capture of market opportunities by executing orders at a rate and frequency that human traders are unable to match.

Trade algorithms adhere to pre-established guidelines, which minimizes the possibility of irrational emotional judgments and guarantees uniformity in trading tactics.

#2 Back-testing Capability

Before committing actual money, traders can test a trading strategy against previous market data to see if it is viable and make necessary adjustments.

#3 Reduction in Transaction Costs

Algorithmic trading can reduce trading expenses like slippage and fees by automating the trading process.

Algorithms may trade and monitor many markets and instruments at the same time, reducing risk and increasing possible rewards. This is known as diversification and risk management.

The Drawbacks of Trading Algorithmic

#1 Systemic Risk

Automated and high-frequency trading can increase market volatility and cause flash crashes, in which prices abruptly drop and then bounce back.

#2 Over-optimization

Algorithmic trading is heavily dependent on technology, which makes it vulnerable to connectivity problems, power outages, and software bugs. There is also a risk of creating overly complex models that perform well on historical data but fail in real-world market conditions, a phenomenon known as curve fitting.

#3 Market Manipulation

In order to maintain the integrity of the market, there are worries that algorithms may be utilized for manipulative techniques such as quotation stuffing and spoofing.

Example : A Case Study of Renaissance Technologies

The height of achievement in the field of quantitative finance is Renaissance Technologies, which was founded in 1982 by mathematician and former code breaker James Simons. Said to be the world’s most successful hedge fund, the hedge fund is especially well-known for its Medallion Fund. Set distinct from other investing firms by a number of critical practices and inventions, Renaissance Technologies, and more especially the Medallion Fund, has been successful because of these practices and innovations. A closer examination of the factors influencing its success is provided below:

Advanced Algebraic Models

Renowned for utilizing intricate mathematical models capable of accurately forecasting fluctuations in financial markets, Renaissance Technologies is well-known for this approach. Rigidly analyzing large datasets that include non-traditional variables that could influence the market price movements in addition to financial market data is how these models are created. To examine patterns that are invisible to the human sight, the company employs methods from several fields of mathematics, statistics, and physics study.

Rich Talent Pool

Renaissance Technologies’ approach to hiring is one of its distinctive features. At Renaissance, we prioritize employing mathematicians, statisticians, physicists, and computer scientists over candidates with credentials in finance and economics, as opposed to traditional hedge funds. Because of its varied skill pool, which prioritizes data and analytical rigor over traditional financial research, this talent pool offers financial markets a unique viewpoint. The company’s culture of in-depth quantitative analysis is influenced by James Simons’ own experience in mathematics.

Customized Trading Methodologies

Renaissance’s unique trading algorithms have been the key to its success. These algorithms, which are constantly updated and improved to accommodate shifting market conditions, are highly held trade secrets. The firm has a major competitive advantage due to its capacity to create and implement algorithms that can execute deals quickly and effectively. The Medallion Fund can profit from transient market inefficiencies that other traders are unable to take advantage of as skillfully due to its technological superiority.

Magnificent Results

With an average yearly return of almost 66% before fees and 39% after costs over a 30-year period, the Medallion Fund is well-known for its incredible returns. In the world of hedge funds, the fund stands out due to these returns, which are far greater than typical. Remarkably high earnings are mainly enjoyed by the firm’s employees, as the fund is predominantly held by its employees and has not allowed outside investors in recent years.

Controlling Risk and Utilizing Credit

Renaissance Technologies’ success can also be attributed to their commitment to risk management. The company uses advanced algorithms to control trade risk in addition to finding lucrative trading opportunities. To maximize profits while minimizing losses, this entails precisely adjusting the leverage employed in its trading tactics.

Constant Innovation

As new data sources, analytical methods, and processing technology appear on a regular basis, the discipline of quantitative finance is always changing. Renowned for its cutting-edge strategies and technologies, Renaissance Technologies keeps its competitive advantage through significant investments in research and development.

Government Inspection and Confidentiality

The public and authorities have scrutinized Renaissance Technologies despite its success, especially in relation to its tax tactics and its opaque business practices. Employees of the company are known to work under stringent non-disclosure agreements to safeguard its intellectual property, and the company’s algorithms and investing plans are cloaked in secret.

The success of algorithmic trading and quantitative analysis in contemporary financial markets is demonstrated by Renaissance Technologies. The company has shown unmatched success in the cutthroat world of hedge funds by utilizing sophisticated technology, mathematical models, and a highly qualified staff.

Does India Allow Algorithmic Trading?

Yes, India allows algorithmic trading. To guarantee fair and open trading procedures within its markets, the Securities and Exchange Board of India (SEBI), which oversees the country’s securities markets, has established rules and standards for algorithmic trading. After realizing that a regulatory framework was required due to the growing usage of advanced trading technology, SEBI introduced algorithmic trading to the Indian stock market in 2008.

In order to stop market manipulation and guarantee fair competition for all players, SEBI has released a number of directives governing algorithmic trading. Order placement speed controls, the need for brokers to submit thorough documentation of their algorithmic trading systems and tactics, and the necessity that algorithms be tested in virtual settings before to being implemented in real markets are a few of these.

Furthermore, in an effort to alleviate worries about market integrity and fairness, SEBI has implemented policies like “co-location” facilities, which allow brokers to locate their servers inside exchange buildings to minimize algorithm execution latency. To guarantee that all market players have simultaneous access to market data, there are additional “tick-by-tick” data streams available.

For the purpose of addressing new issues and advances in technology, SEBI keeps an eye on and updates the laws pertaining to algorithmic trading. In order to make algorithmic trading a practical and regulated method of completing trades in India, these initiatives seek to improve the efficiency, transparency, and fairness of the nation’s securities markets.

Algorithmic Trading Strategies and Techniques

Quantitative, fundamental, or mixed approaches make up the vast majority of algorithmic trading strategies and methodologies. It is essential for anyone aiming to succeed in algorithmic trading to have a good grasp of its components, when to utilize them, and the risks that come with them. Let’s explore these topics further to give you a better idea.

The Art and Science of Algorithmic Trading

In quantitative analysis, mathematical and statistical models play a significant role in locating potential trading opportunities. Statistical arbitrage, market making, high-frequency trading (HFT), and mean reversion strategies are some of the most common quantitative techniques. Algorithms that can sift through mountains of data in search of patterns or market inefficiencies are commonplace in these approaches.

Financial statements, industry trends, and economic variables are the mainstays of fundamental analysis, which differs from quantitative tactics that prioritize numerical data. A possible use of fundamental analysis in algorithmic trading is the automation of the process of monitoring economic indicators, news feeds, and earnings reports in order to make trades with an eye toward the future.

Some algorithmic traders optimize market efficiency and company-specific value by combining quantitative and fundamental tactics. Combining quantitative models with fundamental analysis could help identify assets with high intrinsic value, while also screening opportunities based on market data.

When to Use Algorithmic Trading?

If you need to evaluate massive amounts of data quickly, precisely, and efficiently, algorithmic trading is the way to go. For what it’s good at,Opportunities may only last a few hundredths of a second in high-frequency trading.

Take advantage of pricing differences across several markets or instruments to make money through arbitrage.

The term “systematic trading” refers to trading methods that minimize human emotion by adhering to a set of predetermined criteria.

To diversify a portfolio and control exposure and risk, it can be programmed to make adjustments in real time using market data.

Information Essential to Algorithmic Trading: Central to algorithmic trading strategies is the analysis and interpretation of market data, both historical and current.

Making educated guesses and using models to foretell how the market will behave or spot promising trade opportunities is the process of strategy formulation.

Back-testing is the process of evaluating a trading strategy’s performance using past data before putting it into action in real-time.

Trades, including the management market timing and placement of orders, are automatically executed by the execution system in response to signals from the strategy.

To manage risk is to set criteria that control exposure, limit losses, and make sure the approach stays within certain risk limits.

Risks of Algorithmic Trading

A trader runs the danger of losing money if the market goes against their holdings.

Systemic Risk: Systemic catastrophes, such as flash crashes, can be exacerbated by high-speed algorithmic trading, which in turn increases market volatility.

There is a technical risk that substantial losses could occur if algorithms, hardware, or software were to fail. For example, problems may arise and cause you to make a bad trade or lose out on a great opportunity.

Risk from Regulation: The efficacy or legality of an algorithmic trading technique can be affected by changes to rules and regulations that influence such practices.

When algorithms are overfit, they work great with past data but can’t predict how the market will behave in the future.

Successful algorithmic trading systems are the result of thorough research on these tactics, their potential uses, and the dangers that come with them. Expert traders develop trading algorithms by integrating quantitative research with fundamental and technical analysis. Nevertheless, in order to minimize losses and get the most of gains in trading, it is essential to constantly assess the market and adjust these tactics according to new technologies.

The effectiveness and efficiency of your algorithmic trading involves and operations are greatly affected by a number of realistic factors that must be considered while developing and selecting an algorithmic trading system. If you are seeking guidance through the maze of algorithmic trading, here are a few things to keep in mind and do.

Practical Considerations and Tips

Developing Trading Systems through Algorithms

#1 Plan Your Actions It is obvious

Have a solid trading plan in place before you start buying systems or writing code. Knowing your assets, the markets you want to trade in, and the reasoning behind your entry and exit points are all part of this.

#2 Pick the Appropriate Equipment

Choose the programming languages and environments that best suit your requirements. For example, Python is well-suited for data analysis and backtesting due to its community support and large library (Pandas, NumPy, scikit-learn).

#3 Ensuring High-Quality Data

Back-testing and live trading rely on accurate, high-quality market data. Both the accuracy of back test results and the efficiency of actual trading can be negatively impacted by inaccurate data.

Use previous data to do a comprehensive back test of your plan to confirm its efficacy. Keep an eye out for overfitting, which happens when your model does very well on historical data but badly in real-world markets.

#4 Establish Strict Rules for Risk Management

To Prevent Serious Losses, Establish Strict Rules For Risk Management. Things like controlling position sizes, keeping an eye on portfolio exposure, and establishing stop-loss orders are all part of this.

#5 Maintain Compliance

Learn about the rules and regulations that apply to algorithmic trading in your country, and follow them to the letter. Fair dealing practices, reporting, and registration may be required.

Identifying a Trading Algorithm That Works with Your Strategy

Verify if the system can handle the volume and complexity of your trading plan. There are systems that excel at high-frequency trading and others that are more suited to longer-term strategy.

User-Friendliness

Think about how the service interacts with data sources, brokers, and other apps. Your ability to trade efficiently can be hindered by a system that is difficult to use.

Examine the whole cost of the system, taking into account not only the original investment but also ongoing membership payments, data fees, and the average price of of any new features or upgrades.

Find a system that has both active community members and solid user support. For problems solving, strategy sharing, and keeping up with updates, this can be priceless.

Performance and Scalability

Pick a platform that can grow with your trading demands. Especially for high-frequency strategies, performance is key in terms of how quickly and accurately they execute.

Tips for Successful Algorithmic Trading

#1 Lifelong Education

Maintain a level of expertise by keeping up with industry news, algorithm updates, and technology developments. There is a constant state of flux in algorithmic trading.

#2 Optimize and Monitor

Check in on your system’s progress on a regular basis and be ready to make changes in response to shifting market conditions. Results may vary from day to day.

#3 Spread Your Bets

Avoid Placing All Your Eggs in One Market or Strategy. Risk can be reduced and returns can be stabilized with diversification.

#4 Be Aware of Your Own Boundaries

Do not overestimate your system’s capabilities. The use of algorithms in trading does not ensure success, but it does increase the likelihood of profit.

When dealing with large sums of money, it is extremely important to ensure that your trading systems are secure. Safeguarding your trading algorithms and preventing unauthorized access are all part of this.

With these factors in mind, you’ll have a better shot at creating and selecting an algorithmic trading system that fits your trading objectives and comfort level with risk, increasing your chances of making money in the markets.

Technical Aspects and Tools

Python has become the most widely used and popular programming language among algorithmic traders, though they use a variety of other languages as well. Developing and applying trading algorithms is a particularly good fit for it because of its ease of use, adaptability, and vast ecosystem of libraries and tools. C++, Java, C#, and R are some of the other languages that are used; each has advantages for particular trading strategies or computational needs.

Why Algorithmic Trading with Python Is Beneficial

#1 Versatility and Usability

Because Python has an easy-to-understand syntax, even beginners can use it, and traders can concentrate on creating winning trading strategies instead of figuring out intricate programming code.

#2 A Wide Range of Libraries

Python has a rich ecosystem of libraries, including scikit-learn, Pandas, NumPy, and Matplotlib, which are all specifically designed for data analysis, manipulation, and visualization. The development of trading algorithms takes a lot less time and effort thanks to this ecosystem.

#3 Versatile Data Handling

Python’s robust data manipulation libraries make handling and processing big datasets simple. Employing sophisticated trading strategies and evaluating historical data require this capability.

#4 Community Support

There are many tutorials, forums, and discussions available for Python due to the language’s large and vibrant community, which also makes it easier to stay up to date on algorithmic trading news and difficulty solving problems.

#5 Connectivity with Trading Platforms

A lot of brokerages and trading platforms provide Python-friendly APIs, making it easier to connect automated trading systems with order execution and real-time market data feeds.

#6 Python backtesting frameworks

Backtrader and Zipline are two examples of backtesting libraries that give traders the ability to thoroughly test their strategies against historical data before taking a real-money risk.

Python’s adaptability makes it suitable for a wide range of tasks, including machine learning, artificial intelligence, web scraping, and quantitative analysis as well as backtesting. This versatility lets traders experiment with and put a variety of trading strategies into practice.

#7 Rapid Prototyping

Python’s readability and simplicity facilitate the quick development and iteration of trading models, allowing traders to quickly adjust to shifting market conditions.

Python’s cross-platform compatibility, which allows it to function on a variety of operating systems including Windows, macOS, Linux, and others, is beneficial for traders who need flexibility in their development environment or who use multiple systems.

Altogether, Python’s community support, extensive library, and ease of use make it the perfect programming language for algorithmic trading. Due to its capabilities, traders can create and backtest strategies in real-time trading environments, process data efficiently, and execute those strategies.

FAQs and Further Insights

How Big is Quantitative Trading?

With a sizeable share of daily trading volumes in stock, futures, and other financial markets, quantitative trading has grown to be a powerful force in the world’s financial markets. Multiple perspectives can be used to comprehend its scope, including trade volume, assets under management (AUM), and its impact on market dynamics.

Quantity of Trades

Many markets have large percentages of daily trading volume that are accounted for by quantitative trading strategies, particularly high-frequency trading (HFT) strategies. For instance, it’s estimated that HFT makes up about 50% of equity market volume in the US. This percentage varies depending on the market and the area, but it shows how much quantitative trading affects price discovery and market liquidity.

Quantitative hedge funds oversee a significant amount of assets; the leading quant funds handle hundreds of billions of dollars in total assets under management (AUM). Among the major players are companies like Renaissance Technologies, Two Sigma, and Citadel, each of which oversees tens to over one hundred billion dollars in assets under management (AUM). They are able to significantly impact the markets in which they operate thanks to this capital.

Impact on the Dynamics of the Market

Quantitative trading has a significant influence on market dynamics in addition to trade volume weighted average price, and managed asset size. Because quantitative trading creates liquidity and reduces bid-ask spreads, it has been said to improve market efficiency. Its involvement in market events, like flash crashes, where quick sell-offs by algorithms can result in sharp price declines, has drawn particular attention, though.

Technological Progress

With each new technological development, quantitative trading’s scope and complexity expand. More sophisticated and flexible trading strategies are now possible thanks to the growing application of artificial intelligence and machine learning in algorithm development. Furthermore, quants can now analyze data more thoroughly and execute trades more quickly than ever before thanks to advancements in computational power and data availability.

Worldwide Reach

Quantitative trading is a worldwide phenomenon that is not restricted to any one area. Although quant trading is concentrated in major financial hubs like New York, London, Hong Kong, and Singapore, its impact can be seen in almost every market on the planet. This expansion has been made possible by the globalization of financial markets and electronic trading, which makes it simple to implement quantitative strategies internationally.

Quantitative Trading’s Future

It is anticipated that the scope of quantitative trading will keep expanding due to upcoming technological advancements and a growing volume of data accessible for examination. The growing adoption of quantitative methods by more firms and the expansion of established players on the global financial markets will likely increase their influence and possibly bring about changes to the regulation and structure of the market.

In summary, quantitative trading is a massive and expanding industry that is distinguished by its sizeable portion of market volumes, sizeable assets under management, and significant influence on market dynamics. Because of its market impact and the close relationship between its development and technological breakthroughs, quantitative trading is always at the forefront of financial market innovations.

Can You Make Money with Algorithmic Trading?

Algorithmic trading does indeed have the potential to be profitable. Algorithmic trading strategies have proven to be profitable for numerous institutional investors, hedge funds, and individual traders. Nevertheless, a number of variables, such as the effectiveness of the trading plan, risk control procedures, and the capacity to adjust to shifting market circumstances, affect algorithmic trading’s success. A closer examination of the factors and difficulties associated with successful algorithmic trading is provided here.

Pingback: Manual Trading vs Algorithmic Trading: An In-Depth Analysis to Inform Your Strategy -

Could you pls elaborate your question?

Pingback: Mastering Algorithmic Back-testing: A Comprehensive Guide to Enhancing Your Trading Strategies -

Yes it is a very very important step.Most importantly it helps you build conviction in your strategy.