There are millions of transactions happening every second on the financial markets, so it’s very important that trading is honest and fair. Among the things that are looked at to see if they hurt market transparency is a trick called “spoofing.” Even though this strategy isn’t well known outside of the financial world, it has big effects on traders and investors, changing the way the market works in ways that aren’t always clear at first glance.

When you trade, spoofing means placing large orders to buy or sell a security but not planning to carry them out. To trick other people in the market into thinking and acting in a certain way by giving them a false impression of demand or supply.

By manipulating the market in this way, spoofers hope to make money from the price changes they cause. If the market responds to these fake signals, the spoofer cancels the big orders and places smaller orders on futures contracts on the opposite side of the other side of the market to make money from the price changes they caused.

It’s important for traders and investors to understand spoofing. Traders who know how to spot the signs of spoofing can make smart decisions instead of being fooled by fake market movements. Investors need to be aware of spoofing because it can have a big effect on their strategies and the health of the market as a whole.

This is especially true for stocks and for those who use market depth and order flow analysis. People who are aware of and knowledgeable about these kinds of dishonest practices help level the playing field. This makes it easier for people to navigate the markets and protects their investments from being stolen.

As technology and rules change the financial markets, the fight against spoofing and other forms of fraud goes on. Market participants should know about these practices not only to avoid problems, but also to help make the market a place where honesty and fairness rule. The purpose of this blog is to explain what and what is spoofing in trading really is, what it means, and how it goes against the ideas of fair and honest trading.

Understanding Spoofing

Definition of Spoofing in the Context of Trading

Some traders trick others into buying or selling an instrument by sending a lot of large orders at once, even though they have no intention of following through with these orders. This is called “spoofing.” This method is used to create a false impression of how the market feels, which tricks other market participants into thinking that supply and demand are changing for the asset in question.

The main goal of spoofing is to give false picture and get the market to move in a way that benefits the spoofer. This lets the spoofer make money from trades that are based on how they think the market will react to these fake signals.

How Spoofing Works: A Step-by-Step Explanation

- Identifying the Target: The spoofer selects a financial instrument and decides on the direction they wish to manipulate its price—upwards or downwards.

- Placing Large Orders Without Intention to Execute: With the target and direction decided, the spoofer places large buy or sell orders, far from the current market price, to avoid actual execution. These orders create an illusion of impending market movement due to perceived changes in supply and demand.

- Impact on Market Price and Perception: Other traders and algorithms, noticing the large pending orders, interpret them as genuine indicators of future market movement. This perception may lead to a change in market behavior, with participants adjusting their own orders accordingly, thus moving the market in the direction favorable to the spoofer.

- Withdrawing the Large Orders: Once the desired market movement is achieved, and the spoofer’s smaller, genuine orders are positioned advantageously, the spoofer quickly cancels the large, non-genuine orders. This step is crucial as it removes the illusionary pressure on the market without these orders ever having been executed.

- Capitalizing on the Manipulated Market: With the market now moved to a more favorable position, the spoofer executes their real trades, which were positioned based on the anticipated reaction to the spoofed orders. By buying lower than the manipulated market price or selling higher, the spoofer secures a profit that stems from the temporary and artificial market conditions they created.

The Mechanics Behind the Manipulation

Spoofing is a lot like a high-stakes game of lies, where the person doing it plays with the minds and strategies of other people in the market. By making it look like there is a change in the way the market works, the spoofer takes advantage of day traders’ quick response times and the way the market acts as a herd.

The large orders are carefully timed to be canceled before they are discovered and before they are actually carried out. This way, the spoofer’s true intentions stay hidden until they have made multiple orders and taken advantage of the market movements that were caused by them.

Spoofing is a practice that brings down the efficiency and transparency of financial markets. It shows how hard it is for regulators and market participants to keep trading environments fair. If you want to protect your company and yourself from the effects of spoofing in trading and help create a market where real supply and demand dynamics rule, you need to understand how it works.

Historical Context and Legal Framework

Brief History of Spoofing: When Did It Become Prominent?

There have been dishonest trading practices for a long time, but spoofing became more popular when electronic and algorithmic trading became popular in the early 21st century. When traders switched to digital platforms, it became easier for them to quickly place and cancel fake orders themselves, which is a key part of spoofing. This time in trading was great for these kinds of dishonest practices to grow because electronic orders were fast and anonymous, making it hard to recognize and stop them.

Legal Status and Regulatory Changes Over Time

At first, the laws and rules that govern electronic trading weren’t clearly made to deal with the specifics of activities like spoofing. However, as it became clearer that spoofing hurt the integrity of the market, regulators started to act.

Dodd-Frank Act and Its Impact on Spoofing

The Dodd-Frank Wall Street Reform and Consumer Protection Act, which was signed into law in the US in 2010, was a big step forward in the fight against spoofing. Spoofing was clearly illegal in this broad financial reform bill, which defined it as “bidding or offering with the intent to cancel the bid or offer before execution.”

Clearly identifying spoofing as an illegal act under U.S. law for the first time gave a strong legal basis for prosecuting people who do this dishonest activity. The Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) were given the power by the Dodd-Frank Act to take strong action against spoofers. This led to a number of high-profile investigations and fines.

Other Global Regulations Addressing Spoofing

It’s not just the United States that doesn’t allow spoofing. A lot of other countries and regulatory bodies have also realized that they need to stop people from manipulating the market. For example, the European Union’s Markets in Financial Instruments Directive (MiFID II), which went into effect in January 2018, includes rules that are meant to make financial markets more open and accountable. These rules include ways to find and stop market abuse like spoofing. For the same reason, financial hubs like the UK, Hong Kong, and Singapore have added to or changed their rules to protect markets from different types of price manipulation, such as spoofing.

Evolving Legal and Regulatory Landscape

As new technologies and trading strategies come out, the laws and rules that govern them continue to change. More and more, regulators around the world are relying on advanced surveillance technologies to better spot spoofing and other forms of fraud. Additionally, because financial and commodity markets are now global, they need international regulatory bodies to work together to solve these problems completely.

Implications of Spoofing

Impact on Market Integrity and Efficiency

Spoofing poses a significant threat to the integrity and efficiency of financial markets. By creating false signals about supply and demand, spoofing distorts the price discovery process, which is the cornerstone of market integrity. This distortion can lead to misallocation of resources and undermines the confidence of participants in the fairness and transparency of the market. Furthermore, the efficiency of markets is compromised as prices reflect artificial conditions rather than genuine trading intentions, leading to potential inefficiencies in the allocation of capital and risk.

Effects on Retail and Institutional Investors

Both retail and institutional investors are adversely affected by spoofing, for example, albeit in different ways:

- Retail Investors: These investors may find themselves at a significant disadvantage when competing against sophisticated entities that deploy spoofing tactics. Retail investors typically lack the tools and information to identify and react to spoofing, which can lead to them making trading decisions based on misleading information. This can result in financial losses and a decreased trust in the fairness of the markets.

- Institutional Investors: While better equipped to handle market complexities, institutional investors still face challenges due to spoofing. Their large order sizes can be manipulated by spoofers to trigger desired market movements. Additionally, institutional investors often rely on algorithmic trading strategies that can be exploited by spoofers, leading to increased transaction costs and potential impact on their investment strategies.

Challenges in Detecting and Preventing Spoofing

Detecting and preventing spoofing is a complex challenge for several reasons:

- Speed and Sophistication: Modern trading is characterized by high speed and sophisticated algorithms, making it difficult to distinguish between legitimate market activities and manipulative practices like spoofing.

- Evolving Tactics: Spoofers continuously refine their strategies to avoid detection, exploiting the latest technologies and gaps in regulatory frameworks.

- Global Markets and Jurisdictional Challenges: Financial markets operate globally, but regulatory authorities are typically bound by national borders. This can create jurisdictional challenges in investigating and prosecuting spoofing activities that span multiple countries.

- Resource Constraints: Regulatory bodies often face resource constraints, making it challenging to monitor markets comprehensively and act swiftly against spoofing.

Despite these challenges, ongoing efforts by regulatory bodies, exchanges, and market participants focus on enhancing surveillance capabilities, refining regulatory frameworks, and fostering cooperation across jurisdictions to combat spoofing effectively.

Real-world Examples

Case Studies of Notable Spoofing Incidents

The Sarao Case (2010)

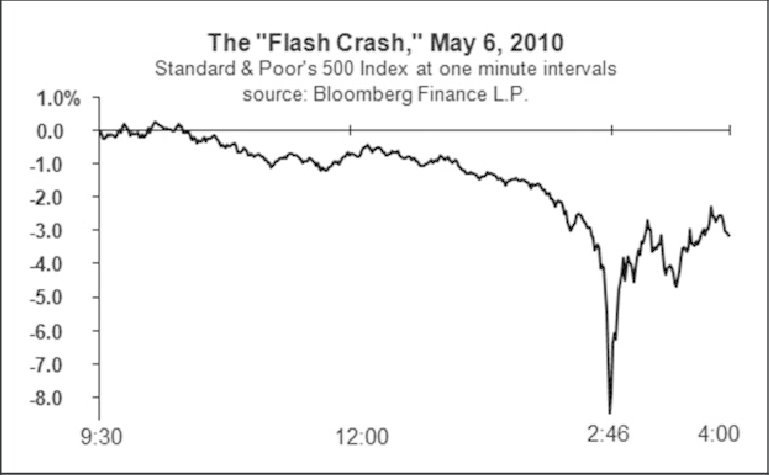

One of the most famous cases of spoofing involved Navinder Singh Sarao, who was implicated in the 2010 Flash Crash. On May 6, 2010, the Dow Jones Industrial Average suffered a rapid decline, losing nearly 1,000 points in minutes before quickly recovering. Sarao was found to have used an automated trading program to manipulate the market by placing large spoof orders that he had no intention of executing. His actions contributed to the stock market in volatility that day. In 2016, Sarao pleaded guilty to wire fraud and spoofing charges and was sentenced to one year of home detention.

The Coscia Case (2013)

Michael Coscia became the first person in the United States to be convicted of spoofing in October 2015. Coscia was found guilty of placing large orders in the futures market that he intended to cancel before execution. His strategy was designed to move other orders and manipulate market prices in his favor, and he realized significant profits from this activity. In 2016, Coscia was sentenced to three years in prison, emphasizing the legal system’s growing seriousness about combating spoofing.

Legal Actions and Penalties Imposed on Spoofers

The legal framework for addressing spoofing has evolved, particularly with the implementation of the Dodd-Frank Act in the United States, which explicitly prohibited such practices. Regulatory bodies like the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) have taken decisive actions against individuals and firms engaged in spoofing.

- Financial Penalties: Fines have been a common penalty, with firms and individuals paying millions of dollars to settle spoofing charges. These fines are intended both to penalize the guilty parties and to deter future misconduct.

- Criminal Sentences: In more severe cases, like those of Sarao and Coscia, spoofers have faced criminal charges leading to prison sentences. This underscores the seriousness with which authorities view market manipulation.

- Trading Bans: Individuals found guilty of spoofing may also be banned from trading in financial markets, effectively ending their careers in trading and serving as a deterrent to others.

- Restitution: In some cases, spoofers are ordered to pay restitution to victims who suffered financial losses due to the manipulative practices.

These legal actions highlight the increasing focus of regulatory authorities worldwide on maintaining market integrity and protecting investors from manipulation and unfair trade practices.

Detecting and Preventing Spoofing

Tools and Techniques Used by Exchanges and Regulators to Detect Spoofing

Exchanges and regulatory bodies have developed sophisticated tools and techniques to identify and investigate potential spoofing activities:

- Market Surveillance Systems: Advanced software systems analyze trading patterns in real time to identify anomalies that may indicate manipulative practices, including spoofing. These systems use complex algorithms to flag suspicious activities for further investigation.

- Pattern Recognition Technologies: By employing pattern recognition technologies, regulators can detect unusual order placements and cancellations that deviate from typical market behavior, which may suggest spoofing.

- Data Analytics and Machine Learning: The use of big data analytics and machine learning allows for the analysis of vast amounts of trading data to uncover patterns indicative of spoofing, improving over time as the system learns from new data.

- Cross-market Analysis: Spoofing can involve multiple markets or products. Regulatory authorities and exchanges perform cross-market analysis to identify manipulation that exploits the interconnectedness of different trading venues.

Role of Technology in Combating Spoofing

Technology plays a pivotal role in both the execution and detection of spoofing. As spoofers leverage sophisticated algorithms, exchanges and regulators counter with equally advanced technologies. The ongoing technological arms race between spoofers and market overseers underscores the critical importance of continuous innovation in surveillance and enforcement mechanisms.

How Traders Can Protect Themselves from the Effects of Spoofing

- Education and Awareness: Traders should educate themselves about the tactics used in spoofing and other forms of market manipulation to better recognize potentially manipulative patterns.

- Use of Advanced Trading Tools: Employing advanced trading tools that can filter out noise and potentially manipulative activities can help traders make more informed decisions.

- Risk Management Strategies: Implementing robust risk management strategies, including setting stop-loss orders and diversifying holdings, can mitigate the impact of spoofing on individual trading outcomes.

- Staying Informed: Keeping abreast of the latest regulatory developments and known cases of spoofing can alert traders to the evolving tactics used by spoofers.

Conclusion

Spoofing represents a significant challenge to the integrity and efficiency of financial markets. It not only distorts price discovery but also undermines investor confidence in the fairness of the rules and the trading environment. The battle against spoofing is multifaceted, involving regulatory oversight, technological advancements, and the vigilance of market participants.

Regulatory bodies and exchanges worldwide continue to enhance their surveillance and enforcement mechanisms to detect and penalize spoofing, reflecting a global commitment to maintaining market fairness and integrity. Meanwhile, technology plays a crucial role in both facilitating and combating market manipulation, emphasizing the need for continuous innovation in market surveillance.

For traders, awareness and education about spoofing and its effects are key to navigating the markets effectively. By understanding the tactics used by spoofers and employing strategies to mitigate their impact, traders can better protect themselves and contribute to a more transparent and fair market.

The ongoing efforts to detect, prevent, and penalize spoofing underscore the importance of collective action in safeguarding the foundations of market integrity. As financial markets continue to evolve, the commitment to combating spoofing and other forms of manipulation to manipulate markets will remain central to ensuring a level playing field for all market participants.

FAQ Section

Is Spoofing Illegal?

Yes, spoofing is an illegal practice in many jurisdictions around the world. In the United States, the practice was explicitly outlawed under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Similarly, in Europe, the Markets in Financial Instruments Directive II (MiFID II) includes provisions that address market manipulation, including spoofing. Various other countries have their own regulations and laws that make spoofing a punishable criminal offense too, reflecting a global consensus on the need to combat this form of market manipulation.

What are the consequences for those who engage in spoofing practices?

Individuals and entities caught engaging in spoofing can face severe penalties, including:

- Criminal Charges: In jurisdictions like the United States, individuals can face criminal charges, leading to imprisonment for significant periods.

- Financial Penalties: Regulators can impose hefty fines on individuals and firms found to be involved in spoofing activities, often amounting to millions of dollars.

- Trading Bans: Those found guilty of spoofing may be banned from trading on financial markets, either temporarily or permanently, effectively ending their trading careers.

- Reputational Damage: Beyond legal and financial consequences, being implicated in spoofing can cause significant reputational harm to individuals and institutions, affecting their future business prospects.

Resources for Further Reading

For readers interested in exploring the topic of spoofing stock markets and market manipulation further, the following resources offer valuable insights:

- “Flash Boys: A Wall Street Revolt” by Michael Lewis: This book provides an engaging look into the world of high-frequency trading (HFT) and touches on practices that can include spoofing.

- “The Law of Securities Regulation” by Thomas Lee Hazen: Hazen’s work is a comprehensive resource on securities law, offering insights into the legal frameworks surrounding market manipulation.

- CFTC’s Official Website: The U.S. Commodity Futures Trading Commission regularly publishes information on enforcement actions against spoofing, providing real-world examples of how the law is applied.

- SEC’s Official Website: The U.S. Securities and Exchange Commission also offers resources and updates on cases of market manipulation, including spoofing.

- “Market Manipulation and Its Regulation” in the Journal of Financial Regulation: This academic article discusses various forms of market manipulation, regulatory responses, and the challenges of enforcement in a global market.

These resources offer a starting point for anyone looking to deepen their understanding of spoofing, its implications for financial markets, and the regulatory landscape designed to combat such practices.