Imagine your financial life as a sturdy house.

No builder would skip a strong foundation, support pillars, or a reliable roof.

Likewise, for personal finance for professionals, the foundation is an emergency fund, the support comes from insurance, and the structure is held together by disciplined budgeting.

Each of these three pillars is critical: together they protect you from financial storms.

In this article, we’ll use an analogy of building a secure house to explore Emergency Fund, Insurance, and Budgeting – defining each, explaining why it matters, and giving tips and scenarios to make them relatable.

Think of your salary as the bricks and savings as the mortar: by planning carefully you build a home (your wealth) that can weather any storm.

Emergency Fund: Laying the Financial Foundation

A solid emergency fund is like the foundation of your home: when trouble hits, it keeps everything standing.

In finance terms, an emergency fund (or contingency fund) is cash set aside to cover sudden needs – job loss, medical bills, or urgent repairs.

It’s the money you only touch “in case of emergency,” not for everyday expenses.

For example, when your car breaks down or your city faces a flood, an emergency fund prevents you from raiding your investments or taking high-interest loans.

Save at least 6–9 months of living expenses

Experts generally advise keeping six to nine months’ worth of essential costs (rent, food, EMIs) on hand. In practical terms, if your monthly expenses are ₹50,000, aim for a fund around ₹3–4 lakh.

Many Indian banks and financial sites echo the “3–6 months minimum, preferably 6–12 months” rule of thumb. This range gives you a buffer to find a new job or recover from income loss without panic.

Use liquid, low-risk accounts

Park this fund where you can grab it quickly. Options include a separate savings bank account or short-term deposits. For instance, recurring deposits (RDs) earn a bit more (around 4–8% p.a.) and fixed deposits (FDs) can yield ~5–7% (current SBI FDs are roughly 3–6.6% for 1 year, but remember FDs may penalize early withdrawals.

Most optimized solution is use of ultra-short debt funds or liquid mutual funds – these invest in very short-term securities, giving slightly higher returns than savings accounts with easy access.

The key is safety and availability, not high returns.

Build it step by step

If you’re starting with nothing, begin with a smaller target.

Treat your emergency fund like the most important expense.

For example, set up an automatic transfer of even 5–10% of your salary into a separate account each month.

Over time this disciplined saving – aided by systematic plans (SIPs) into liquid funds – will grow your fund.

Key insight: Your emergency fund should be your first financial goal. It acts as a shock absorber for life’s surprises. Without it, even a single accident or job loss can derail everything (like having no pillar for your house, letting the whole structure collapse).

Insurance: Your Safety Net and Roof

In our house analogy, insurance is the protective roof and walls. It keeps out the rain (costly disasters) so you can live normally underneath.

Insurance transfers the financial risk of life’s big events to an insurer. For professionals and HNIs, this means two main types:

Life/Term Insurance

Protects your family if you’re the breadwinner. Imagine your dependents relying on your income for living costs. Life insurance ensures they still have funds (like liquidating an investment) if you pass away unexpectedly.

Financial planners recommend that your sum insured be roughly 8–12 times your annual income. For example, if you earn ₹10 lakh a year, a ₹1–1.2 crore term cover gives a safety net for debts (home loan, etc.) and future needs.

A quick rule: the insurance should fund your family’s expenses and obligations (loans, education fees) for many years. No need to name schemes or promise returns – but do note term plans are pure protection, and premiums are generally affordable, especially when you’re young.

Health Insurance

Covers medical emergencies. Even with good income, a serious illness can rack up lakhs in hospital bills. In India, the Insurance Regulatory and Development Authority (IRDAI) now requires all insurers to offer a standard health product called “Arogya Sanjeevani”, with sum insured from ₹1 lakh up to ₹5 lakh.

But experts advise higher coverage.

A family floater plan (one sum shared by all family members) equal to at least 50% of your annual income is a good baseline.

For example, Kotak Life notes that if you earn ₹12 lakh/year, a ₹6 lakh policy is a start, but in metros (where treatment is costlier) you might need ₹10–15 lakh.

Don’t forget OPD or critical-illness riders where needed. Keep in mind all family members: a senior citizen parent or young children may each need additional cover (often 10–20 lakh cover for seniors is suggested).

Other Insurance

Personal accident and critical illness policies can plug gaps. HNIs often insure assets (home insurance, auto insurance, etc.), but as a salaried professional, start with life and health first.

Key insights: Insure first, invest later. Adequate insurance should be non-negotiable. In India, health insurance premiums even qualify for tax deduction under Section 80D (so you save tax while safeguarding health). Without life cover, your family might struggle financially in your absence.

Without health cover, an expensive surgery could wipe out your savings. Remember IRDAI norms like mandatory coverage limits and benefits (e.g. all insurers must cover AYUSH and 30-day pre/post hospitalization, OPD up to 5% of sum insured, etc.). Following these ensures you aren’t left out in the rain during medical emergencies.

Budgeting: The Pillars and Discipline

Once the foundation (emergency fund) and roof (insurance) are in place, budgeting is like the walls and beams that hold your house up.

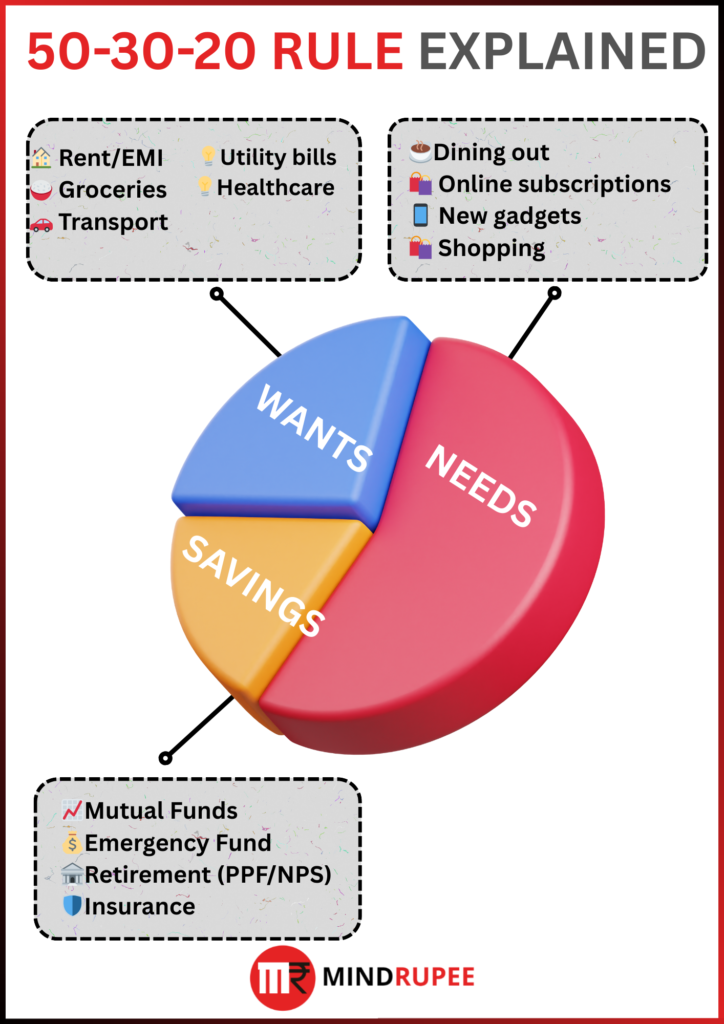

Budgeting means planning your spending, so you don’t splurge and leave yourself uncovered. For Indian salaried professionals, budgeting is especially vital with rising costs and family responsibilities. A helpful guideline is the 50/30/20 rule:

50% for Needs

Essentials you must pay – home rent/EMI, groceries, utilities, loan EMIs, commute. In our example, if you earn ₹60,000/month, about ₹30,000 should go here.

30% for Wants

Discretionary spending – eating out, movies, shopping, vacations. These make life enjoyable, but can be trimmed if needed.

20% for Savings/Investments

This is your future’s building block. It includes contributions to your SIPs or mutual funds, PPF/RDs, insurance premiums, and topping up the emergency fund.

This simple split keeps life balanced. For example, the rule shows 20% savings going into SIPs, PPF, insurance and emergency fund.

In practice, you can tweak it – maybe 60/20/20 if your rent is high – but always pay yourself first. Treat savings (including your emergency fund deposits) as a mandatory expense.

Important point is not to fall for get rich quick schemes and stay the course.

Automate & Track

Use apps or spreadsheets to track expenses and automate payments. For instance, note your salary and fixed bills (rent, utilities, EMIs) first. Then set up automatic transfers: a SIP for your mutual fund, a recurring deposit for contingencies, insurance premiums.

This “set-and-forget” approach makes saving effortless. Many Indians use apps like Walnut, Moneyfy, or even UPI reminders to stay on track.

Top 5 Flexi-Cap Funds in India | A 10-Year Performance Face-Off

Cut non-essentials

If you find you’re overspending (e.g. heavy credit card bills, takeaway dinners), move more money to needs/savings. Even dropping one subscription or one vacation a year can add 5–10% to savings.

HNIs might have larger spends, but the rule still applies – align lifestyle to goals. Remember, even in glamour jobs, doctors/engineers have fixed expenses (school fees, club memberships, EMIs) that must fit a plan.

Key insight: “Make a plan and stick to it.” Without a budget, you’ll be like a home without walls – vulnerable to leaks (overspending) and collapse. A disciplined budget ensures your income is directed to what matters: family needs and future goals. If you can manage with 20% savings consistently, you’re doing great; if not, aim to gradually increase from 5–10% upwards, as one finance blog advises.

FAQs

Q1: What is an emergency fund and why do I need one?

An emergency fund is a dedicated savings account for unexpected costs (job loss, illness, repairs). It acts as a financial cushion so you don’t have to borrow or liquidate investments under stress. For Indian professionals, this means peace of mind: if salary is cut or a family medical issue arises, you have 6–9 months of expenses tucked away. Without it, even middle-class families can slip into debt quickly.

Q2: How much should my emergency fund be?

Experts say at least 3–6 months of expenses, but aiming for 6–9 months is safer. Calculate your monthly needs (rent, food, EMIs, tuition, utilities) and multiply by 6–9. For instance, if you spend ₹40,000/month, a ₹2.4–3.6 lakh fund is ideal. If you have dependents or work in a volatile field, err on the higher side (closer to 9–12 months). Start building it gradually: even small monthly deposits add up.

Q3: How much health insurance should I buy?

At minimum, ensure each adult has a few lakhs of coverage. A common starting point is 50% of annual income, on a family floater plan. For example, a family earning ₹10 lakh/year should look at ₹5–10 lakh cover. In metro cities with high medical costs, you may need more (₹10–15 lakh).

Don’t forget parents: senior citizen plans (typically 10–20 lakh cover) are wise. IRDAI’s standard Arogya Sanjeevani plan even offers ₹1–5 lakh cover if nothing else is available. The key is ensuring you can pay big hospital bills without wiping out savings.

Q4: How much life insurance do I need?

A common rule is 8–10 times your annual salary (some suggest up to 12×). This sum insured should cover outstanding debts (home/car loans) and provide for your family’s living costs for many years.

For example, if you earn ₹15 lakh/year, aim for ₹1.2–1.5 crore cover. The idea is that the lump sum, if invested, would generate enough returns (e.g. ₹50,000/month) to replace your income and clear liabilities.

Use term insurance (pure protection) rather than savings plans, so premiums stay low.

Q5: What are some simple budgeting tips for salaried employees?

Start by dividing your in-hand salary: needs vs wants vs savings. The 50/30/20 rule is popular. Track your expenses (use apps or even a notepad) to spot leaks.

Automate your savings: as soon as salary arrives, send a fixed amount to your savings account or mutual fund SIP (treat it as an essential bill).

Pay mandatory expenses (rent, EMIs) next. Finally, only spend your “wants” money after covering savings. And review every month: small changes (like cooking more at home or buying fewer clothes) free up money for goals. Over time, this discipline builds wealth without sacrificing lifestyle.

Q6: Are there any additional tips or tax benefits?

Yes. In India, life and health insurance premiums qualify for tax deductions (Section 80C/80D). So covering yourself actually reduces your tax outgo. Also, professional planning: since income may grow, regularly reassess your budget, fund target, and insurance cover each year.

For HNIs especially, remember that higher income often brings higher tax brackets, so efficient budgeting and using legal tax-advantaged instruments (PPF, NPS, etc.) is wise. Finally, avoid relying on loans – use your emergency fund instead of credit cards. The more disciplined your budget and savings habits, the sooner you’ll achieve financial security.

By building your financial house on these three sturdy pillars – a solid emergency fund, adequate insurance protection, and a disciplined budget – you ensure your finances stand strong for the long term. Start today: secure your foundation, raise your walls, and you’ll be well-prepared for whatever life throws your way.