Salary day is the most awaited day of the month – your phone pings with that credit alert, and suddenly life feels brighter.

But before you splurge on a celebratory dinner or that gadget sitting in your wishlist, take a pause.

How you handle money on salary day can make or break your financial future. In fact, many young Indians struggle to save consistently – household savings rates have fallen to less than 20% of income today from about 25% a decade ago.

The good news?

By following a simple 5-step payday routine, even a first-jobber can build disciplined money habits.

This checklist is informal, practical, and tailor-made for Indian salaried professionals (especially those in their 20s).

From automating savings to budgeting for fun, we’ll cover five key things to do every salary day to set yourself up for long-term financial success.

Let’s dive in!

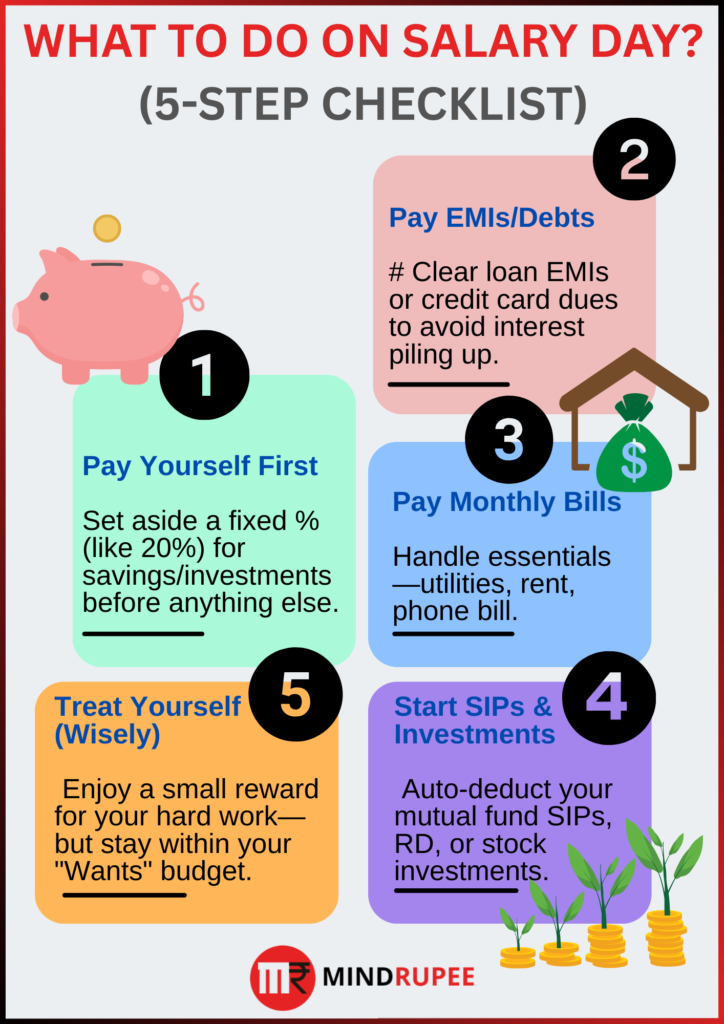

# 1. Pay Yourself First

The first person you should pay on payday is you – your future self.

“Paying yourself first” means saving a chunk of your salary before you start spending on anything else. Think of it as treating your savings like an important bill that must be paid.

Why?

Because if you wait until month-end to save what’s left, there’s often nothing left!

How much to save?

A common rule of thumb is to set aside 20% (or more) of your take-home pay for savings and investments. For instance, if your monthly salary is ₹50,000, aim to immediately move about ₹10,000 into savings/investments – that’s 20% of your income.

If you can push this to 25–30%, even better.

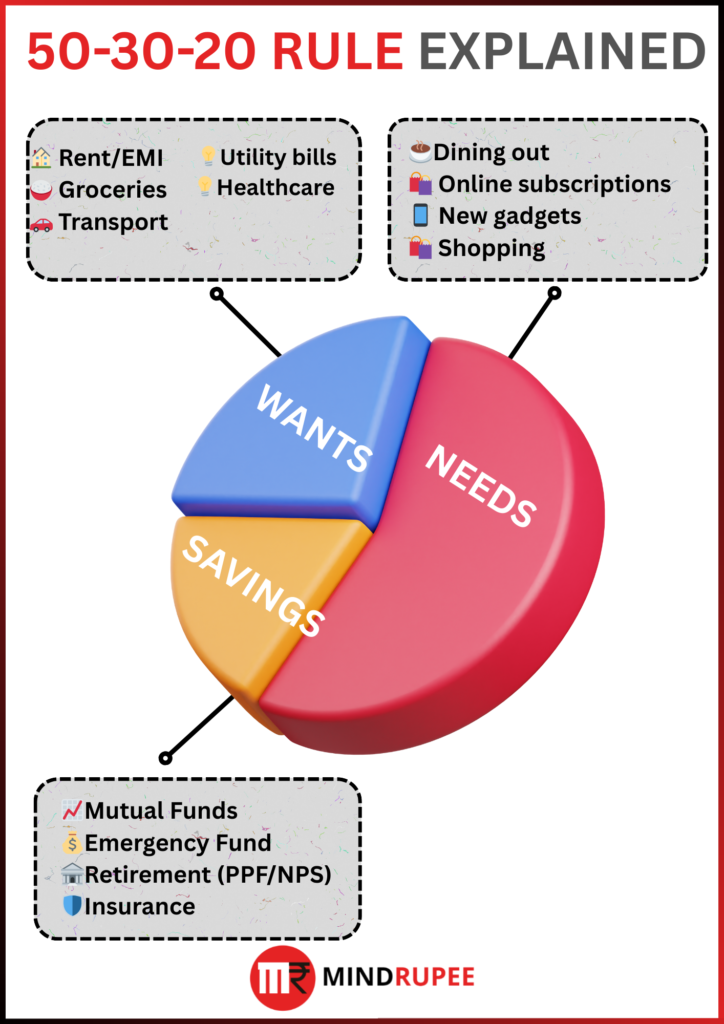

The popular 50-30-20 budgeting rule suggests 20% for savings, 50% for needs, and 30% for wants. (On ₹50,000, that breaks down to roughly ₹25k for needs, ₹15k for wants, and ₹10k for savings.)

Automate it

Don’t rely on willpower alone.

Set up an automatic transfer or standing instruction on salary day that sweeps your designated savings amount into a separate account or investment.

This way, you remove the temptation to spend that money.

For example, Priya, a 24-year-old software engineer earning ₹60,000, set up auto-transfers from her salary account as soon as she gets paid.

Every month on payday, ₹12,000 goes into her equity mutual fund SIP, ₹6,000 to a fixed deposit (her emergency fund), and ₹2,000 into her PPF account. Priya “pays herself” ₹20k first, and lives on the remaining ₹40k. By automating this, she saves 33% of her income without even thinking about it.

This approach ensures you prioritize your own financial goals.

It might feel odd at first to see a chunk vanish on payday, but you’ll thank yourself later.

Your savings will grow quietly in the background, helping you build an emergency fund, afford big future purchases, and invest for wealth creation – all while you handle your regular expenses with the rest.

# 2. Pay Your EMIs and Debts

Once you’ve paid yourself, the next step is to pay your dues.

Take stock of any EMIs, credit card bills, or loan payments you have and clear them immediately or set aside the amount required.

Keeping debt under control is crucial for financial health – especially high-interest debt like credit cards.

Credit card interest rates in India typically range from 15% to 40%+ per annum (yes, that’s not a typo – some cards charge ~3% per month!).

Letting these balances roll over is very costly. So, if you swiped your card last month, make it a priority to pay the full bill by the due date.

Consider using apps like CRED for credit card bill payments – it not only reminds you of due dates but even rewards you for timely payments.

Prioritize high-interest loans

If you have multiple loans or card balances, tackle the costliest debt first.

This is often called the debt avalanche method – focus extra payments on the loan with the highest interest (often credit cards), while paying minimum on others.

By knocking out high-interest debt sooner, you save on interest overall.

For example, if you have a credit card at 36% APR and an education loan at 10%, try to pay more than the minimum on the card until it’s cleared.

On salary day, you might decide to throw an extra ₹5,000 at your credit card bill to hasten its payoff – a smart move that will save you money in interest. (On the flip side, never just pay the credit card minimum due – that’s a trap leading to years of debt.)

Stay organized with EMIs

Most Indian salaried folks have some EMI – be it for a car, bike, or that new iPhone. It’s wise to schedule your EMIs right after salary credit or in the first week of the month.

This way, you’re using fresh funds to clear dues before spending. Many banks allow you to choose your EMI date – aligning it with just after payday can ensure you don’t accidentally spend that money elsewhere.

And if possible, enable auto-debit for EMIs and loan payments so you never miss them (just maintain sufficient balance).

Missing EMI payments can dent your credit score and incur late fees, so it’s best to be prompt.

Bonus tip: If you find extra cash (say a bonus or a freelance gig payment), consider using part of it to pre-pay loans or credit card balances. Becoming debt-free is one of the best feelings and frees up your income for future investing.

The bottom line is: use your salary day enthusiasm to knock out debt obligations first, and you’ll gradually break out of the debt cycle. Staying debt-free (or at least keeping debt low and manageable) is key to financial freedom.

# 3. Pay Your Monthly Bills

With savings and debts taken care of, next up is handling all your essential monthly bills.

These include rent, utilities (electricity, water, gas), phone/internet bills, insurance premiums, or any other recurring charges like DTH/Netflix subscriptions.

The idea is to settle your fixed expenses as soon as salary comes so that you know exactly how much is left for everything else.

This practice prevents the nasty surprise of realizing you’ve spent bill money on shopping or dining out. Essentially, you’re earmarking funds for necessities upfront.

Make a list

On or before payday, list out all bills due for the month and their approximate amounts.

For example: Rent ₹15,000, Electricity ₹2,000, Wi-Fi ₹800, Netflix ₹500, etc. The total might be, say, ₹20,000. Once your salary arrives, go ahead and pay these or set them aside immediately.

If your rent is due later, you could transfer ₹15k to a separate “bills” account or withdraw in cash and keep it if your landlord prefers cash.

Many people in India use the envelope method (digitally or with actual envelopes) – where you partition your salary into different buckets (rent, bills, groceries, etc.).

By doing this segmentation on salary day, you ensure bill money isn’t inadvertently touched.

Use technology to your advantage

Today you don’t have to manually remember every due date.

There are excellent expense tracking and bill management apps that can help.

Apps like ET Money, Axio (formerly Walnut), or Money View can auto-detect your recurring expenses from SMS and send reminders for upcoming bills.

For instance, Walnut/Axio reads your SMS alerts and might ping: “Electricity bill of ₹1,950 due on 10th.”

You can then pay it promptly through the app or your bank’s bill pay feature.

Setting up auto-pay for utilities and other subscriptions is even better – many banks and apps allow you to enable e-NACH or UPI autopay mandates so that bills get paid from your account on a set date.

Just be sure to keep track of those auto-debits and maintain sufficient balance.

Track your expenses

Salary day is also a great time to review last month’s spending.

Take 15 minutes to glance over your bank statements or expense app summary. Where did your money go? Maybe you spent ₹5,000 on eating out, or your Zomato orders shot up.

Identifying patterns can help you adjust this month’s budget. If you notice any unnecessary subscriptions or high expenses, you can course-correct early in the month (for example, downgrading a plan or setting a tighter limit on dining out).

There are plenty of free budgeting apps to visualize this for you.

The Indian Express even compiled top free apps where Axio, Wallet, Money Manager etc., help set budgets and track spends automatically. Using such tools can make it almost fun to manage money – like a game where you try to beat your own budgeting targets.

By paying all your must-pay bills first, you’ll avoid late fees or service cuts (nobody wants the Wi-Fi to suddenly go dead because you forgot to pay!).

It also gives you peace of mind – your roof over your head, utilities, and basics are secured for the month. What remains in your account after this is truly disposable for other needs and wants, which brings us to the next step.

# 4. Start SIPs and Investments

Now we get to the exciting part – growing your money.

Saving is the first step, but investing is how you beat inflation and build wealth over time.

If you followed Step 1 (Pay Yourself First), you’ve already set aside some money for investments.

Salary day (or just after) is the perfect time to deploy those funds into investment avenues through SIPs or other automated investments.

Read this to select your first mutual Fund : click here

SIPs (Systematic Investment Plans)

A SIP is an auto-investment into a mutual fund (usually equity or debt fund) that deducts a fixed amount from your bank account every month.

Think of it as an EMI to your future wealth. You can start SIPs with amounts as low as ₹500 or ₹1,000 per month in many mutual funds.

By scheduling your SIP for a date shortly after your salary, you ensure that investing happens before you have a chance to spend that money.

For example, if you set a ₹5,000 SIP on the 3rd of every month, ₹5k will go from your account into, say, an index fund or a large-cap fund, like clockwork.

Over time, these small monthly contributions can grow huge thanks to compounding.

To illustrate, investing ₹5,000/month at ~12% annual return can yield about ₹25 lakh in 15 years (out of which your own contribution was only ₹9 lakh; the rest ₹16 lakh is gains!).

The longer you continue, the more powerful compounding gets. So, starting early in your 20s is a massive advantage – your money gets more years to multiply.

Pick your investment mix

Apart from mutual fund SIPs, there are other great options for Indian savers:

- Public Provident Fund (PPF): A government-backed savings scheme with ~7% interest (varies each quarter) and 15-year maturity. You could, for instance, put ₹2,000 every month into PPF. Many banks allow auto-debit for PPF deposits.

- Recurring Deposits (RD): If you want a safe, guaranteed return and a shorter term, RDs let you deposit a fixed amount monthly (like ₹1,000 or ₹5,000) for a chosen tenure (say 1–3 years) and earn interest similar to FDs (~6–7% these days). It’s a disciplined way to save for short-term goals. You can start an RD linked to your salary account that pulls money every month.

- Stocks or ETFs: If you have the risk appetite, you might allocate a portion of your money to buy stocks or ETFs through platforms like Zerodha or Groww. Even ₹1,000-₹2,000 a month invested in a diversified portfolio of quality stocks or an index ETF (e.g., Nifty50 ETF) can yield good results over the long run. However, stock investing requires research, so beginner investors often start with mutual funds, which are managed by experts.

- Employee PF / NPS: Don’t forget the investments that might already be happening via your employer. If you’re in a corporate job, a part of your salary goes to EPF (Employee Provident Fund) automatically – that’s also “paying yourself” in a way. If you haven’t yet, consider contributing to NPS (National Pension System) which some employers offer – it’s another way to invest for retirement with tax benefits.

Automation and consistency

The key is to make investing a habit, just like any monthly expense.

Automating SIPs or other transfers ensures you stick to your investment plan. Many apps and brokerages (e.g., Zerodha’s Coin, Groww, PayTM Money, etc.) let you set up SIPs for mutual funds easily.

ET Money is an app that not only tracks your expenses but also helps you invest in direct mutual funds and even suggests how to plan your portfolio.

Using such apps, you can have a one-stop view of your finances – from what you spend to how your investments are doing.

On each salary day, review your investment plan briefly.

If you got a salary hike or bonus, consider increasing your SIP amounts (even a 5-10% increase yearly can accelerate your wealth). Ensure your scheduled investments went through successfully.

If you haven’t started investing yet, use this salary day to begin. Even a small start is great – as an old saying goes, “The best time to plant a tree was 20 years ago. The second best time is now.”

The same holds for investments. Start that SIP, open that PPF account, or buy that first stock with a portion of your pay. Your future self will be grateful.

# 5. Treat Yourself Wisely

You’ve saved, paid your dues, covered your bills, and invested – now comes the fun part: spending on yourself, guilt-free.

Personal finance isn’t about depriving yourself of all pleasures; it’s about balancing discipline and enjoyment. After taking care of the first four steps, you can confidently use the remaining money for your wants and lifestyle, knowing you’re on track with your goals.

This is where the “30” in the 50-30-20 rule comes in – roughly 30% of your income for “wants” or discretionary spending. It’s important to allocate some money to enjoy life so that you don’t feel burnt out by a strict budget.

Budget your fun

Let’s say your take-home pay is ₹50,000 and you followed the earlier steps:

You saved/invested 20% (₹10k).

Paid debts/EMIs maybe another 10% (₹5k for a small loan or credit card).

Paid essentials perhaps 50% (₹25k on rent, bills, groceries).

This would leave you with around ₹10k for discretionary spending that month. It’s perfectly fine to spend this ₹10k on things you value – whether that’s dining out, shopping, weekend trips, or hobbies.

In fact, because you’ve handled all responsibilities, you can spend it without guilt. You might even plan a little “treat” tradition on salary day – for example, buy yourself a nice coffee or dessert to celebrate payday, within a small budget. Some folks indulge in a movie night or a meal out during the first weekend after payday.

The key is “wisely”

Treating yourself wisely means enjoying within your means.

Don’t blow all your fun money in one go and then dip into savings for more. Also, be conscious of not letting the excitement of salary credit lead to impulsive splurges that sabotage your budget.

A good practice is the 24-hour rule – if you’re tempted by a big purchase (say a ₹30k gadget), wait 24 hours; often the impulse passes or you find a cheaper alternative.

Another trick: try to get deals or use rewards for your wants. For instance, if you’ve decided to buy new shoes with part of your fun budget, maybe purchase during a sale or using credit card reward points. You’ll feel even better about the purchase. Apps like CRED give offers on various brands if you have coins from paying your credit card bills, so that’s one way to treat yourself for less.

Enjoy, but keep the balance

Everyone’s “treat” will look different. It could be a solo trip you’ve been saving for, or as small as a monthly spa session. Allocate money for it explicitly. Some use the envelope method for this too – an envelope (or separate account) labeled “Fun” that they put money into on salary day.

This ensures you don’t accidentally overspend beyond what you decided. If at the end of the month some of your fun budget is unused, you can roll it over or add it to next month’s fun pot (or even channel it into savings, up to you!).

Remember, the goal of personal finance is to live a good life today and tomorrow. By handling your obligations first, you earn the right to spend on yourself with no second thoughts. Just keep it reasonable and in line with your overall plan (e.g., if you’re following 50-30-20, stick around that 30% for wants).

Over time, you might find that the peace of mind from financial security is the best “treat” of all. But meanwhile, go ahead and enjoy some of the fruits of your labor – you deserve it for being financially responsible!

Summary: Your 5-Step Payday Routine

To recap, here’s a quick checklist to run through each salary day:

- Pay Yourself First: Right when your salary comes in, siphon off 20-30% (or whatever you can) into savings/investments. Automate this transfer so saving happens before spending.

- Clear EMIs/Debts: Knock out any loan EMIs or credit card bills immediately. Prioritize high-interest debt (like credit cards) for repayment, and try not to carry forward any balance.

- Settle Your Bills: Pay all your essential monthly bills (rent, utilities, subscriptions) or set aside the funds for them. Use apps or auto-pay for reminders and to avoid missing due dates.

- Invest via SIPs & More: Put your saved money to work. Start or continue your SIPs in mutual funds, contribute to PPF/RD, or buy other investments. Do it right after payday so you stay consistent. (Even a ₹5k/month SIP can grow to ₹25 lakh in 15 years!)

- Treat Yourself (Within Budget): Finally, enjoy part of your money guilt-free on things you love. Follow the 50-30-20 rule – allocate around 30% of income for fun and personal wants– and spend that wisely without derailing your goals.

By ticking off these five steps, you’ll cover all bases: securing your future, meeting obligations, and living your life – all in one routine.

Conclusion: Consistency Over Perfection

Building financial discipline is like building a muscle – you strengthen it with consistent, repeated action. By following this 5-step salary day checklist every month, you’re developing rock-solid money habits that will compound over time, just like your investments.

Some months you might not follow the plan perfectly – maybe an emergency expense comes up or you save a bit less – and that’s okay. What matters is getting back on track next month. Consistency beats perfection.

Imagine yourself a year from now: if you stick to this routine, you could have a healthy emergency fund, zero high-interest debt, systematic investments growing in the background, and zero bill worries – all while having enjoyed your life along the way.

That’s the payoff of discipline. As the saying goes, “Discipline is choosing between what you want now and what you want most.” By prioritizing savings and investments now, you’re ensuring a secure, stress-free financial future for what you want most – maybe a house, your own startup, traveling the world, or retiring early.

So next salary day, as you sip on that celebratory cappuccino bought with your fun budget, give yourself a pat on the back. You’ve handled your money like a pro! Keep at it every month.

Over the years, these small steps will snowball into significant wealth and financial freedom.

Stay consistent, stay mindful, and remember that every rupee you save or invest is a seed for your future. Happy salary day, and happy saving!