What is High Frequency Trading?

Trading thousands of transactions per second is now possible thanks to sophisticated algorithms and lightning-fast data networks. Because of its power to affect market results, HFT has risen to the top of the financial industry.

This article will skim the surface of HFT to get to the meat of the matter: how it operates, the impact on the market, and the controversy surrounding its use.

Key Takeaways

- High Frequency Trading (HFT) is an integral aspect of contemporary automated trading strategies that utilize sophisticated algorithms and technology to carry out trades in milliseconds.

- Proponents of HFT point to increased liquidity and decreased bid-ask spreads as reasons to support it, while critics point to the high trade volumes it contributes as evidence that the market is unfair and volatile.

- The ethical consequences and possibility of market manipulation are ongoing debates, but regulatory frameworks such as those from the United States Securities and Exchange Commission (SEC) seek to guarantee fairness in HFT.

Unveiling High Frequency Trading (HFT)

An innovative approach to trading in the financial markets, High Frequency Trading (HFT) makes use of cutting-edge technology and complex computer algorithms to complete trades at lightning speed, frequently within milliseconds. A dramatic change from more conventional trading settings, the rise of high frequency trading (HFT) has highlighted the trend toward more automated trading on HFT platforms, employing HFT strategies.

Post-2005 regulatory shifts brought HFT into the spotlight, mainly as a tool of huge financial institutions like investment banks and hedge funds. Its importance in contemporary trading settings has only grown since then. These large organizations use HFT to their advantage so they can take advantage of cutting-edge technology, making a plethora of trades in a flash to grab short-lived market opportunities.

The Mechanics of High Frequency Trading

HFT is all about speed and efficiency at its core. There are a lot of high-frequency traders who use complex computer algorithms to look at the market and make a lot of trades very quickly. In HFT environments, trades can happen in as little as 10 milliseconds or even faster. This is faster than the blink of an eye and changes how the financial markets work.

In the world of HFT, Direct Market Access (DMA) is very important. This feature lets traders’ computer systems talk to the exchange’s order book directly, skipping the need for brokers and other middlemen. This direct interaction gives you a speed advantage, which is very important in the very competitive world of HFT.

The Role of Algorithms in HFT

In the world of high-frequency trading, algorithmic trading is all about algorithms. These complex programs are made to quickly look at important market data, pick out trading signals, and make trades based on what they think the market will do. They make it possible to handle a lot of trades in many markets at once, taking advantage of profitable trading opportunities quickly and letting high-frequency traders respond quickly to changes in the market.

Getting these algorithms set up correctly is very important for how well an HFT operation works. When it comes to HFT, mistakes can cost a lot of money, but well-tuned algorithms can accurately analyze market conditions and make trades. This is what makes deals happen quickly and efficiently.

Technology Behind the Speed

As amazing as the speed that HFT can reach is the technology that makes it work. High-frequency trading needs fast data feeds, like Bloomberg’s B-PIPE, to send real-time data with little delay. This lets trades happen as quickly as 10 milliseconds.

It’s not just about fast data feeds, though. HFT is faster because it uses cutting-edge hardware that can handle transactions in microseconds and strategically places its infrastructure. Servers are often co-located near exchange data centers so that signals don’t have to travel as far. This cuts down on latency and makes sure that all co-location clients experience the same amount of latency. Every millisecond counts in this speed game.

The Influence of HFT on Market Dynamics

High-frequency trading is a big part of the financial markets. It accounts for about half of all trading activity in U.S. stock markets, Treasury markets, and foreign exchange. This strong force is known for:

- A lot of turnover

- A preference for investing in short-term plans

- Causing more transactions to happen

- Changing the way modern financial markets work.

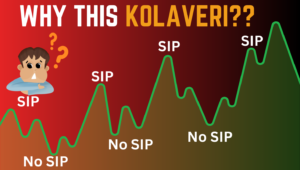

Still, people are still talking about how HFT changes the way markets work. Some people say that HFT’s speed benefits could hurt the fairness of the market, while others say that it makes the market work better by increasing liquidity and decreasing bid-ask spreads. Because of this argument, exchanges have put in place things like speed bumps to make the playing field more even, randomizing entry times, and delaying the processing of orders.

Liquidity and Market Efficiency

High-frequency traders keep the market liquid by placing buy and sell limit orders all the time. This makes sure that there is always someone willing to trade on the other side. As a result of HFT activities, there is more competition and more trades. This lowers the bid-ask spread, which makes the market more efficient and speeds up the execution of many trades.

In the world of HFT, things aren’t always good, though. Concerns about the following are raised by critics:

- “Ghost liquidity” is when trading happens quickly and liquidity appears for a short time. However, it often goes away before traditional investors can act on it.

- The chance that the market could be manipulated and that HFT firms could get unfair advantages.

- The chance of flash crashes and more market volatility.

Even with these worries, HFT is generally seen as a way to make markets more liquid and the financial industry more efficient. However, its real benefits to market stability are still being looked into.

HFT and Market Volatility

There is evidence that high-frequency trading makes the market more volatile. Events like the Flash Crash in 2010 have raised concerns about how this affects the stability of the market. The fast and large amount of trading that happens with HFT can make market changes worse, which could make both small and large market crashes worse.

The different types of high-frequency traders and the strategies they use also affect how volatile markets are and how well they work. For example, the ask side of HFT activities is better at predicting volatility levels and returns than the bid side, which doesn’t seem to have much of an effect. Because of this, financial researchers are interested in the link between high-frequency traders, frequency quoting, and short-term changes in bids and offers.

Strategies Employed by High Frequency Traders

A lot of different strategies are used by high-frequency traders to take advantage of market opportunities. Some of these are:

- Making markets

- Arbitrage of events

- Trading on indexes

- Bets based on statistics

- Arbitrage of latency

In the fast-paced world of HFT, each strategy has its own way of making money.

As an example, statistical arbitrage includes:

- Taking advantage of short-term price differences between asset classes or exchanges

- Taking market-neutral long and short positions to profit from securities that are correlated

- Large amounts of assets are bought and sold to take advantage of small price differences between exchanges.

High-frequency traders, who act as market makers in multiple markets, place buy and sell limit orders with the market maker in order to earn the bid-ask spread and keep the market liquid.

Arbitrage Opportunities Across Exchanges

Arbitrage is one of the most important strategies in the HFT playbook. High-frequency traders take advantage of short-term price differences between different exchanges for the same asset, quickly making money off of these differences. High-frequency trading (HFT) algorithms, which are made to make a lot of trades quickly, are always watching the markets for these arbitrage opportunities.

This strategy takes advantage of HFT’s speed and efficiency to make trades that make money before the market changes and the chances are gone. There are a lot of high-frequency traders (HFTs) racing against the clock to make money before the rest of the market does.

Market Making: Providing Continuous Trade Flow

High-frequency traders, in their capacity as market makers, facilitate a continuous flow of trades. They:

- Place simultaneous buy and sell limit orders to capture the bid-ask spread

- Act as counterparties for incoming market orders

- Ensure that trades can occur even when there might not be a natural buyer or seller immediately available.

This strategy aims to earn profits from the spread between buy and sell prices, executing a large number of trades that each generate a small amount of revenue. By using liquidity providers employing quote matching, HFT market makers ensure their orders are competitive and have a higher chance of being executed quickly in the stock market. The New York Stock Exchange (NYSE), for instance, has introduced designated market makers to facilitate price discovery and provide liquidity through electronic means, often involving HFT in exchange traded funds.

Ethical and Regulatory Considerations in HFT

Like any powerful tool, HFT comes with its own set of ethical and regulatory considerations. The U.S. Securities and Exchange Commission (SEC) has adopted rules requiring market participants that perform dealer functions to register as dealers, specifically targeting high-frequency trading firms. These rules define a dealer based on criteria that encompass the activities of HFT firms, such as:

- regularly showing trading interest at or near the best available prices for the same security on both sides of the market

- engaging in a substantial amount of trading activity

- holding themselves out as willing to buy and sell securities for their own account on a regular basis

These regulations aim to ensure transparency vital liquidity and fairness in the market and to prevent any potential manipulation or abuse of HFT strategies.

Dealers, under the SEC’s rules, earn revenue mainly from bid-ask spread capture or trading venue incentives for liquidity provision, which are common practices in HFT. As a result, HFT firms are now obligated to register with the SEC and must adhere to specific capital, reporting, and disclosure requirements, along with anti-manipulation and anti-fraud provisions.

The Debate Over Fair Market Play

There is a fair play debate in HFT about how big companies and financial institutions might be able to get an edge over individual investors. Some people say that HFT, which is mostly used by banks and other big financial institutions, gives them an unfair advantage because they can:

- Make trades at speeds that individual investors can’t reach

- Get to market data and information more quickly

- Put in orders before other people in the market

- Use price differences in the market more quickly that way.

People think that HFT has an unfair advantage, so they want stricter rules and more oversight to make sure that all investors, even big institutional investors, have the same chances when trading things like stock index futures.

Some high-frequency traders are said to use controversial strategies like “front running” and “market manipulation,” which have made this debate even stronger. These kinds of actions hurt the fairness of the market and investors’ trust, which makes people wonder what will happen in a future where math models and computers make more and more decisions.

Navigating HFT Regulations

A big part of HFT is understanding and following the rules set by regulators. Mathematical models that show the effects of fraudulent HFT activities have shown how important it is for regulatory bodies to keep an eye on things all the time to keep the market running smoothly. After events like the Flash Crash in 2010, some European countries have thought about banning HFT to keep the markets from going up and down and stop similar things from happening.

Because regulations are so complicated, high-frequency traders have to keep up with how the rules change and make changes to their strategies to fit. Following the rules set by regulators is important for more than just avoiding fines; it also helps keep the financial markets honest and investors trusting them.

Getting Started with High Frequency Trading

It might seem hard to set up an HFT operation, but with the right plan, it is possible. To start an HFT business, the first thing that needs to be done is to make a trading plan using a chosen strategy, like liquidity rebate capture, latency arbitrage, market making, or index tracking.

Getting permission from a clearing house is an important step to make sure that trade settlements go smoothly. Finding a prime broker or “mini prime” can help traders with things like trade settlements, lending securities, and giving them access to leverage. As soon as the server is set up and there is enough capital, traders can start doing business.

The Essentials of Building an HFT System

There is more to building an HFT system than just picking a strategy and getting money. A good HFT setup needs a front-end client with a dependable interface for setting up trading algorithms and servers from afar. Different parts can run on different servers, which helps with scalability and fault tolerance when you use a microservice architecture.

It’s very important to protect yourself from security threats like DDOS and broker attacks. The system should be designed with fault tolerance and scalability in mind so that it can keep working even when something goes wrong. Back office and bookkeeping must be done correctly for any automated trading platform or system in order to follow the rules and settle trades quickly.

Risk Management in High Frequency Operations

Effective risk management is a key part of HFT. Due to its high speed, HFT comes with a lot of risks that can cost a lot of money if they are not managed properly. For example, statistical arbitrage in high-frequency trading (HFT) is based on the idea that market prices will return to normal or expected levels, which depends on making trades when the market is temporarily less efficient. The market can change quickly, so this strategy comes with some risks.

Backtesting platforms, which compare strategies to past data before putting them into live markets, can help lower these risks. This method offers a safety net that lets traders test their strategies and make changes as needed before risking real money.

Summary

To sum up, High-Frequency Trading is the next big thing in financial trading. It uses cutting-edge technology and complex algorithms to make trades happen at speeds that have never been seen before. While HFT has changed the way trading is done and made markets more liquid and efficient, it has also caused arguments about whether the markets are fair and how volatile they are. Even though it is closely watched by regulators and people who care about ethics, HFT is still changing the way financial markets work by pushing the limits of speed, liquidity, and trading efficiency.

Frequently Asked Questions

Can you make money with high-frequency trading?

High-frequency trading can be profitable because it lets you make a small amount of money on each trade, which can add up to big profits because of small price differences.

Is high-frequency trading legal?

In short, yes, high-frequency trading is legal and follows all the rules.

What is an example of a high-frequency trade?

A trader uses a short time difference in prices between the New York and London markets to make quick money. This is an example of a high-frequency trade. To do this, prices for stocks are bought and sold within fractions of a second.

How does high-frequency trading works?

High-frequency trading (HFT) uses automated platforms, powerful computers, very fast connections, and complicated algorithms to trade a huge number of orders very quickly. It does this by taking advantage of price differences that happen very quickly in the financial markets where electronic trading is used. With trades happening in seconds or even milliseconds, HFT tries to make a small profit on each one.

What is High-Frequency Trading (HFT)?

High-Frequency Trading, or HFT, is a complex financial strategy that uses cutting-edge technology and complex computer algorithms to make trades happen very quickly.