From the old-fashioned floor trading method to more advanced electronic systems, trade methods in today’s financial markets have changed a lot.

Technology improvements have sped up and increased the number of orders that can be filled at once.

Using algorithms, fast data networks, and complex software, modern trading methods improve deal execution, lower risks, and take advantage of market inefficiencies.

Transactions in the financial sector have grown more competitive, efficient, and accessible to individuals financial institutions from all over the world as a result of these methods.

Introduction to High Frequency Trading (HFT) and Algorithmic Trading (Algo Trading)

High Frequency Trading (HFT) and Algorithmic Trading (Algo Trading) are at the front of this change in the financial markets caused by technology.

High Frequency Trading is an automated trading style that focuses on carrying out a lot of orders very quickly, usually in milliseconds or microseconds.

High-frequency trading (HFT) methods are made to take advantage of small price differences in the market by making a lot of trades.

Algorithmic Trading, on the other hand, includes a wider range of trading techniques that use computer programs to decide what to do.

HFT is a type of algorithmic trading. Algo trading can include methods that work over longer periods of time, from seconds to days, and aren’t always focused on how fast trades are executed.

Algorithmic trading strategies might look for different market dynamics, such as momentum, arbitrage chances, and inefficiencies in the market, without focusing so much on speed like HFT does.

Importance of Understanding the Distinction Between HFT and Algo Trading

Understanding the distinction between HFT and algo trading is crucial for several reasons.

First of all, it shows how different the strategies and tools that are used in today’s financial markets are, with each having its own distinct pros and cons.

For the second part, it shows what rules and morals guide these ways of trading. The fast nature of HFT, for example, has led to discussions about market fairness and the possibility of systemic risks, which has made policymakers pay more attention.

Setting these trading methods apart also helps investors, regulators, and market players understand how complicated the financial markets are and how technology affects how they behave.

Finding out how these trading strategies affect market liquidity, volatility, and the trading situation as a whole is also helpful. People who want to do well in the constantly changing financial markets will need to know the difference between their HFT trading and AI trading.

Understanding Algorithmic Trading

How Algorithmic Trading Works and What It Means?

A lot of people call this type of trading “algo trading.” It’s when computer programs carry out large numbers of trade orders quickly and based on set rules and mathematical models.

Automation is at the heart of algo trading. The goal is to keep people out of the trading process as much as possible, which makes it more efficient and less likely that someone will make a mistake.

Trading systems called algos look at market data, find trading chances based on rules set by the user, and make trades automatically.

These systems can handle many trade accounts and strategies at the same time, making choices based on past data, statistical analysis, and the way the market is doing right now.

What role do algorithms play in the stock market?

Algo trade is very important in today’s financial markets because it makes them more efficient, liquid, and clear.

It lets orders be carried out quickly, which helps keep prices the same across all trading venues and fixes market inefficiencies fast.

Market liquidity is also greatly improved by algorithmic trading, which often includes making a lot of trades very quickly.

This liquidity is very important for the easy running of financial markets because it has transaction costs and lets people buy and sell securities with little effect on their asset prices afterwards.

Different kinds of common algorithmic trading strategies

- Momentum trading: finds market trends and makes money off of them. It means buying stocks that are going up and selling stocks that are going down, with the hope that the trends will continue.

- Arbitrage strategies try to take advantage of price differences between markets or instruments that are linked. For instance, buying and selling a stock at the same time in different places to make money off of small price differences.

- Mean reversion is based on the idea that prices and returns will move back to the mean or average over time. This approach is based on the idea that the prices of securities that have recently moved a lot away from their historical averages will go back to normal.

- Market making means buying and selling stocks all the time to keep the market liquid and make money from the bid-ask spread.

- Sentiment Analysis: Analyzing news articles, social media, and other textual data to gauge market sentiment and make trading decisions based on public sentiment or specific events.

- Portfolio Optimization: AI models help in balancing risk and return by diversifying investments and adjusting portfolios based on changing market conditions.

- High-Frequency Trading (HFT): AI algorithms execute a large number of trades at extremely high speeds to capitalize on small price discrepancies.

Advantages and Challenges of Algo Trading

Advantages

- Speed and efficiency : Speed and efficiency are increased because algorithms can process and carry out orders much faster than human traders. This lets them take advantage of chances that would not be possible otherwise.

- Lower Costs: When dealing is automated, there is no need for human traders, which can lower the costs of running the business.

- Less Emotional Trading: Because algo trading follows set strategies, it lessens the effect of human feelings on trading decisions.

- Back-Testing : Doing back-tests Traders can test their strategies against past data before putting real money at risk. This lets them improve and make changes.

Challenges

- Problems to solve Complexity and Technical Risk: Creating and keeping complex algorithms takes a lot of skill and can put traders at risk of system failures or technical glitches.

- Effects on the Market and Over-Optimization: A lot of automated deals can sometimes make the market less stable. Flash Crash is one such example.

- Concerns about regulation and ethics: The fast rise of algorithmic trading has brought up concerns about market fairness, transparency, and the possibility of manipulation. This has led regulators to closely look at these activities.

Algo trading has many benefits for the whole financial system of markets, such as making them more flexible and efficient. However, it also comes with its own problems that need to be carefully handled. People who work in the increasingly automated world of business need to know both the pros and cons of the technology they use.

Demystifying High Frequency Trading (HFT)

Very fast speed, high change rates, and a high order-to-trade ratio are all things that define High Frequency Trading (HFT), a type of algorithmic trading.

Big traders take advantage of very small price differences in the market by putting orders into action in a matter of seconds.

Most importantly, HFT has the following traits: –

- Ultra-fast Trade Execution : HFT strategies use high-speed data connections and complex algorithms, along with other advanced technology, to analyze and make trades at speeds that human traders can’t even imagine.

- High Volume: To make small profits, high frequency traders place tens of thousands or even millions of orders every day.

- Short Holding Periods: In HFT, positions are usually only kept for milliseconds to a few seconds or minutes at most.

- Low Profit Margins Per Trade: High Frequency Trading (HFT) tries to make money from very small changes in prices. This means that the profit margin on every trade is small, but it adds up over a lot of deals.

- Market Liquidity: High frequency traders make the market more open by buying and selling of securities all the time.

How HFT Differs from Traditional Trading Methods

Unlike traditional trading methods, where decisions might be made based on fundamental analysis or longer-term market trends, HFT relies purely on quantitative models and the speed of execution.

Traditional traders might hold positions for hours, days, or even longer, while HFT strategies focus on short-term market inefficiencies, often holding positions for a fraction of a second.

This fundamental difference changes not only the whole trading strategy, but also the infrastructure required for trading, with HFT requiring significant investment in technology.

Key Strategies Used by High Frequency Traders

- Market Making: High frequency traders act as market makers by providing bid and ask quotes for securities, earning the spread between these prices.

- Arbitrage Opportunities: Exploiting price discrepancies of the same asset on different markets or between related assets on the same market.

- Statistical Arbitrage: Using mathematical models to identify short-term trading opportunities across multiple securities based on historical price relationships and patterns.

- Event Arbitrage: Capitalizing on price movements caused by specific events, such as earnings announcements or economic data releases, before other market participants can react.

How HFT Affect Trading Volume and the Market

So that buy and sell orders may be completed without producing substantial price changes, high frequency trading is vital for providing market liquidity.

Market efficiency is improved for all parties involved when high-frequency trading (HFT) companies continuously place a large number of buy and sell orders.

High frequency traders greatly increase market depth and liquidity by contributing to the total trading volume in the financial markets by the sheer amount of deals they execute.

But there’s still no consensus on how HFT affects market liquidity. All market participants profit from more efficient and liquid markets, according to HFT proponents. But some argue that HFT’s liquidity is only “phantom liquidity,” meaning it may vanish in an instant under market stress and make volatility even worse.

To sum up, High Frequency Trading is a major shift in trading tactics that takes use of volume and speed to take advantage of temporary market inefficiencies. There has to be continuous study and regulation in this field since, while HFT has been praised for improving market efficiency and liquidity, it also makes us wonder whether the market is stable and fair.

High Frequency Trading vs Algorithmic Trading: A Comparative Analysis

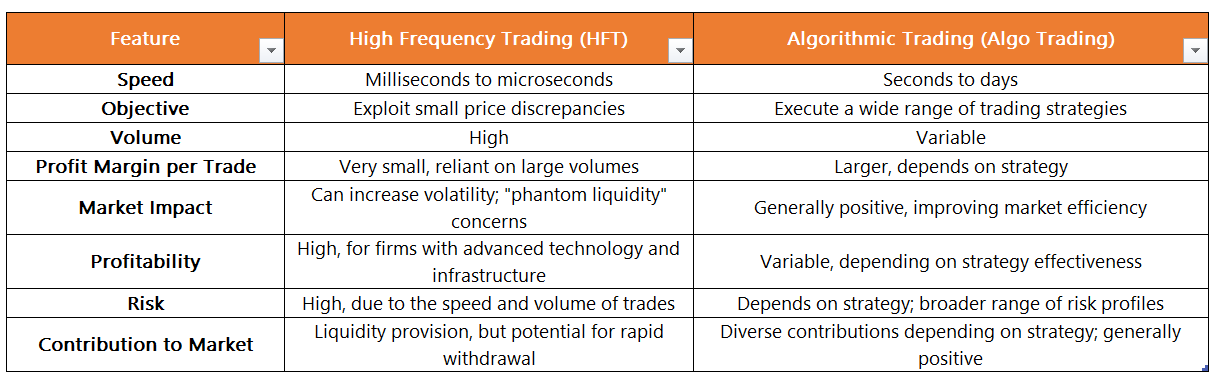

High Frequency Trading (HFT) and Algorithmic Trading (Algo Trading) are both cornerstones of modern financial markets, utilizing sophisticated technologies to execute trades. While they share some similarities, their distinct strategies, goals, and impacts on the stock market highlight the nuanced differences between them.

Fundamental Comparative Features of HFT and Algo Trading

Characteristics that are comparable Both are tech-driven in that they use sophisticated algorithms and computer systems to execute trades. With automated strategies, no human is involved in making trading decisions; instead, they are based on predefined criteria. Analyze market data in real time and use it to inform your trading decisions.

Core Similarities and Differences Between HFT and Algo Trading

Similarities:

- Technology-Driven: Both are tech-driven in that they use sophisticated algorithms and computer systems to execute trades.

- Automated Strategies: With automated strategies, no human is involved in making trading decisions; instead, they are based on predefined criteria.

- Market Data Analysis: Analyze market data in real time and use it to inform your trading decisions.

Differences:

- Speed of Execution: Algorithmic trading can take anything from a few seconds to several days, whereas HFT operates on a millisecond or microsecond scale.

- Objective: High-frequency trading (HFT) attempts to take advantage of small price discrepancies through large-volume trades, while algorithmic trading (ALGO) tries to efficiently carry out a predefined strategy, which can encompass many goals beyond immediate price arbitrage.

- Profit Margins: Algorithmic trading strategies may aim for bigger market movements, whereas high-frequency trading (HFT) profits from small but large-volume price movements.

- Market Impact: Algorithmic trading is commonly believed to increase market efficiency, while high-frequency trading (HFT) is frequently admonished for possibly increasing market volatility.

Both HFT and algo trading are integral to the functionality and efficiency of modern financial markets, each with its unique characteristics and contributions.

Understanding these distinctions is crucial for market participants, regulators, private exchanges, large institutional investors, and policymakers to navigate the complexities of the trading environment and to ensure the stability and integrity of financial markets.

High Frequency Trading: Execution

Execution Methods Used by HFT Firms

In order to accomplish their goals, HFT firms employ a variety of cutting-edge strategies and methods, including such systems as:

- Direct Market Access (DMA): High-Frequency Trading (HFT) firms can bypass brokers and engage with the exchange’s order book directly through Direct Market Access (DMA), which significantly reduces latency.

- Co-location: In co-location, businesses move their servers to be physically near or even inside the data center of the exchange in order to reduce the amount of time data has to travel.

- Ultra-Low Latency Data Feeds: Thanks to ultra-low latency data feeds, HFT algorithms can process market data much more quickly than their competitors.

- Advanced Order Types: Implementing advanced order types enables faster and more strategic trades by allowing them to be executed automatically under certain conditions.

The Significance of Trade Execution Speed in HFT

A trade’s success or failure in high-frequency trading (HFT) can hinge on milliseconds, or even microseconds. Quicker trade execution gives high-frequency trading (HFT) companies a leg up when it comes to seizing ephemeral market opportunities. Quickness is essential for:

- Minimizing Slippage: Trading at the desired prices with little movement is more likely to occur with faster execution, which reduces slippage.

- Exploiting Arbitrage Opportunities: In order to capitalize on arbitrage opportunities, you need to act quickly, as they often only last a moment before the market corrects itself.

- Efficient Market Making: High-frequency traders (HFTs) can respond quickly to changes in the market by adjusting their quotes and positions, reducing their exposure to risk.

Statistical Arbitrage and Market Making as Examples of HFT Strategies

- Statistical Arbitrage: The statistical arbitrage strategy is based on the simultaneous purchase and sale of a basket of historically correlated securities with the expectation that their price ratios will converge. To take advantage of the anticipated mean reversion, complex models detect short-term mis-pricings between these assets and execute trades.

- Market Making: High-frequency traders (HFTs) create market liquidity by constantly bidding up and down the price of securities, collecting the difference between the two. For real-time quote adjustments, inventory risk management, and the pursuit of profit from seemingly insignificant price changes, they employ predictive algorithms.

High Frequency Trading is an umbrella term for a variety of trading tactics that share the commonality of capitalizing on technological advancements and rapid execution to seize fleeting market opportunities. To maximize profit in a millisecond-sensitive environment, high-frequency trading (HFT) firms use execution methods that minimize latency. While high-frequency trading (HFT) helps make markets more liquid and efficient through tactics like statistical arbitrage and market making, it is also under scrutiny for the bigger picture of how it affects market dynamics.

Algorithmic Trading: Tools and Techniques

Common Tools and Platforms for Developing Trading Algorithms

Building efficient trading algorithms calls for powerful resources that can process massive volumes of data, carry out intricate mathematical computations, and carry out trades rapidly. Platforms and tools that are commonly used are:

- QuantConnect and Quantopian: Cloud-based algorithmic trading platforms like QuantConnect and Quantopian allow traders to create, test, and implement trading strategies based on historical data.

- MetaTrader 4/5 (MT4/5): The popular MetaTrader 4 and 5 platforms allow users to create their own trading bots and indicators using the built-in scripting languages (MQL4 and MQL5).

- Python with libraries like pandas, NumPy, and scikit-learn: Due to its user-friendliness and extensive library support for data analysis, machine learning, and financial computations, Python is a popular choice for algorithmic trading. Notable libraries in Python include pandas, NumPy, and scikit-learn.

- Interactive Brokers API: The Interactive Brokers Application Programming Interface (API) enables the automated trading of stocks, options, futures, forex, and bonds through direct market access on one of the most extensive electronic trading platforms.

Techniques for Back-testing and Optimizing Trading Strategies

By comparing a trading strategy to past results using historical data, a technique known as “back-testing” can be employed. Here are some techniques:

- Historical Simulation: For the purpose of simulating the strategy’s performance under previous market circumstances, historical simulation involves running the strategy against a dataset of historical data.

- Monte Carlo Simulation: This method models the likelihood of various strategy outcomes using randomized input data

- Walk-Forward Analysis: A more practical method, walk-forward analysis optimizes a strategy incrementally over time.

In order to maximize profitability, Sharpe ratio, or drawdown, among other performance indicators, optimization entails modifying strategy parameters. A strategy that is overly optimized for historical data often fails to deliver satisfactory results when applied to real-world trading scenarios, a phenomenon known as overfitting.

Role of Complex Algorithms in Identifying Trading Opportunities

When human traders miss out on short-lived or invisible trading opportunities, complex algorithms step in to fill the void. This is what these algorithms are capable of:

- Analyze Market Sentiment: This can be done by analyzing textual data such as news articles, social media feeds, and other similar sources.

- Pattern Recognition: Recognizing trends and patterns in prices through the use of technical indicators and machine learning models is known as pattern recognition.

- Statistical Arbitrage: Finding asset-to-asset correlations or cointegrations in order to take advantage of price differentials is known as statistical arbitrage.

Legal and Ethical Considerations

Discussion on the Legality of HFT and Algorithmic Trading

Even though high-frequency trading and algorithmic trading are not illegal, regulators are keeping an eye on them to make sure they don’t hurt other traders or compromise market integrity.

Though rules differ from one country to another, the three main goals of most regulations are openness, equal access to markets, and the prevention of market abuse.

Ethical Considerations and Market Fairness

The possibility that algorithmic and high-frequency traders may take advantage of market structures while regular investors lose out is at the heart of the ethical concerns.

Problems like quote stuffing, in which high-frequency traders (HFTs) artificially inflate market orders that are never going to be filled, can lead to an inflated perception of market activity and liquidity.

The Role of the Securities and Exchange Commission (SEC) in Regulating HFT and Algo Trading

In response to worries about algorithmic and high-frequency trading, the SEC and other international regulatory agencies have enacted regulations.

One such measure is the Market Access Rule (Rule 15c3-5), which mandates the implementation of risk controls on private exchanges and brokers in order to forestall manipulated markets and incorrect trades.

To further guarantee that all market participants enjoy equal access to market data and venues, the SEC investigates practices that might compromise market integrity and fairness.

With the help of high-frequency and algorithmic trading firms’ advanced platforms and tools, traders can methodically investigate trading strategies, test them against past data, and optimize them.

In addition to overcoming technological obstacles, the creation and implementation of these strategies must conform to the ever-changing ethical and legal requirements imposed by regulatory agencies in order to preserve market integrity, liquidity, and fairness.

Discussions regarding the moral weight and appropriate legal frameworks for algorithmic and high-frequency trading will persist so long as these practices are employed.

The Impact of HFT on Financial Markets

High Frequency Trading (HFT) has been a transformative force in financial markets, reshaping how trades are executed and influencing the overall market dynamics. Its impact is multifaceted, affecting market liquidity, price volatility, and the efficiency of markets, while also being a central figure in debates over market fairness and stability.

How HFT Influences Market Liquidity and Price Volatility

Market Liquidity: HFT is often credited with providing significant liquidity to the markets. By executing a large number of trades at very high speeds, HFT firms can supply a constant flow of buy and sell orders. This abundance of orders can make it easier for other market participants to execute their trades promptly and at their preferred prices, thereby enhancing market liquidity.

Price Volatility: The impact of HFT on price volatility is more contentious. Proponents argue that by increasing liquidity, HFT reduces price volatility since buy and sell orders can be matched more easily, avoiding large price swings. Critics, however, suggest that HFT can exacerbate volatility during times of market stress by rapidly withdrawing liquidity, as HFT algorithms might simultaneously pause trading due to adverse conditions, amplifying price movements.

The Debate on HFT’s Contribution to Market Efficiency vs. Market Manipulation

Market Efficiency: Advocates of HFT argue that it contributes to market efficiency. HFT enables traders who can quickly incorporate new information into prices, ensuring that securities are more accurately priced at any given moment. The high speed and volume of HFT trades can also help eliminate arbitrage opportunities, leading to more consistent pricing across different markets.

Market Manipulation: Conversely, there are concerns that HFT could be used for market manipulation tactics, such as quote stuffing or layering, where traders place and then cancel orders to create misleading market conditions. Critics argue that these strategies can unfairly advantage HFT firms at the expense of other investors, undermining market integrity.

The “Flash Crash”: A Case Study on the Potential Dangers of HFT

The Flash Crash of May 6, 2010, serves as a stark illustration of the potential dangers associated with HFT. On that day, the Dow Jones Industrial Average plunged about 1,000 points (about 9%) only to recover those losses within minutes. While the crash was attributed to a combination of factors, the role of HFT in exacerbating the price volatility was scrutinized. The rapid withdrawal of HFT liquidity, coupled with the aggressive selling by the automated trading algorithms, is believed to have accelerated the crash. This event prompted regulatory bodies to reevaluate the role of HFT in market dynamics and implement safeguards, such as circuit breakers and more stringent rules on algorithmic trading, to prevent similar incidents in the future.

The impact of HFT on financial markets is complex and multifaceted, with significant contributions to liquidity and efficiency but also potential risks to market stability and fairness. While HFT has been instrumental in modernizing trading practices, the debate over its comprehensive impact continues. The Flash Crash remains a critical case study in understanding these dynamics, highlighting the need for ongoing oversight and adaptive regulatory measures to safeguard against the inherent risks of highly automated, high-speed trading environments.

Future of High Frequency and Algorithmic Trading

The landscape of high frequency (HFT) and algorithmic (algo) trading is continually evolving, driven by technological innovations, regulatory changes, and the quest for improved profitability and risk management in financial industry. These dynamics suggest a future where these trading mechanisms become even more sophisticated, but also face greater scrutiny.

Technological Advancements Shaping the Future of HFT and Algo Trading

Connectivity and Speed: Future advancements in network and computing technology, such as quantum computing and 5G connectivity, are expected to further decrease latency, a critical factor for HFT success. This could lead to even faster trade executions, potentially opening new strategies that capitalize on microsecond advantages.

Data Processing and Analysis: The exponential growth of market data volume requires more efficient data processing capabilities. Technologies enabling faster data analysis will enhance the ability of algo traders to make informed decisions swiftly, leveraging real-time insights from a broader range of data sources.

The Role of Artificial Intelligence and Machine Learning

AI and machine learning are set to play pivotal roles in the future of trading by improving predictive accuracy and decision-making processes. These technologies can analyze vast datasets to identify patterns and market trends that are not immediately apparent, offering the following advancements in quantitative finance:

- Strategy Optimization: AI can help in refining and optimizing trading algorithms, ensuring they adapt to changing market conditions.

- Sentiment Analysis: Through natural language processing, AI tools can gauge market sentiment from news sources and social media, potentially predicting market movements based on public perception.

- Anomaly Detection: Machine learning models can identify unusual market behavior that may indicate opportunities or risks, enhancing the strategic response to market events.

Profitability and Risk Management

Analyzing the Profitability of HFT and Algo Trading

The profitability of HFT and algo trading is subject to market volatility, market crashes, competition, and technological advancements. As technology costs decrease and high frequency algorithmic trading strategies become more accessible, the competitive edge may diminish for some, while others who innovate continuously can maintain or even increase their profitability.

Risk Management Strategies for HFT and Algo Traders

Effective risk management remains a cornerstone for the success of HFT and algo, trading platforms, involving:

- Dynamic Risk Modeling: Incorporating real-time market data into risk models to dynamically adjust to market conditions.

- Diversification: Expanding the range of trading strategies to mitigate the risk associated with any single approach.

- Stress Testing: Regularly testing algorithms under extreme market conditions to ensure they perform as expected without causing undue market disruption.

Addressing the Challenge of Short-term Investment Horizons and Inventory Risk

HFT and algo traders often face the challenge of managing the risks associated with short-term investment horizons and holding inventory of assets. Advanced predictive models and real-time risk assessment tools can help traders better understand their risk exposure and make informed decisions quickly in order to trade ratios manage inventory risk effectively.

FAQs

Is High-Frequency Trading the Same as Algorithmic Trading?

High-frequency trading (HFT) is a subset of algorithmic trading. While both employ algorithms to automate trading decisions, HFT distinguishes itself by focusing on executing a large number of orders at extremely fast speeds, often within milliseconds or microseconds. Algorithmic trading encompasses a broader range of strategies, not all of which prioritize speed.

What Algorithms Are Used in High-Frequency Trading?

HFT uses various algorithms, including:

- Market Making Algorithms: To provide liquidity by buying and selling securities, earning the bid-ask spread.

- Arbitrage Algorithms: To exploit price discrepancies across different markets or between related financial instruments.

- Statistical Arbitrage Algorithms: Leveraging statistical models to predict future price movements based on historical data.

- Event Arbitrage Algorithms: To trade based on price movements triggered by news or economic events.

Is High-Frequency Trading Legal and Ethical?

High-frequency trading is legal in many jurisdictions, but it is subject to regulatory oversight to ensure fair and orderly markets. The ethical considerations of HFT often center around its potential to disadvantage other market participants who cannot trade as quickly and concerns over market stability. Regulatory bodies continue to evaluate and adjust rules to address these concerns.

Can Algorithmic Trading Remain Profitable in the Long Term?

Yes, algorithmic trading can remain profitable in the long term, provided traders continue to innovate and adapt their strategies to changing market conditions. Success in algorithmic trading comes from advanced traders not just executing existing strategies but also from continuously researching and developing new models, leveraging advancements in technology and data analysis.