“Nature is not in a hurry, yet everything is accomplished.”

This wisdom from the philosopher Lao Tzu might as well be about investing. In a world obsessed with instant results, it’s almost counterintuitive that moving slowly could lead to the greatest success.

But just like a giant sequoia growing silently over centuries into something magnificent, wealth, too, can grow quietly and astonishingly over time.

Welcome to the slow lane of investing – it might feel unhurried, even boring at times, but it’s the surest path to long-term riches.

Imagine you’re driving on a highway. One car zigzags through traffic, racing to get ahead, while another stays steady in the slow lane.

In the end, the reckless driver gains only a few minutes – or ends up stuck in an accident – while the calm driver cruises steadily to the destination.

Building wealth works in a similar way.

The fast lane (trying to get rich quick) is alluring and flashy, but it often leads to wrong turns and wrecks.

The slow lane – consistent, patient investing – may not raise your adrenaline, but it gets you where you want to go financially, with far less stress along the journey. Let’s explore why the slow lane is actually the fastest lane to lasting riches.

Time Beats Timing: Patience Over Speed

When it comes to investing, time in the market beats timing the market.

Staying invested for the long haul often trumps trying to buy low, sell high at just the right moments.

Why?

Because markets are unpredictable in the short term – they surge and swoon on news and emotions – but over the long term, they tend to rise with the growth of businesses and economies.

Warren Buffett, one of the most successful investors ever, put it simply:

“The stock market is a device to transfer money from the impatient to the patient.”

In other words, wealth flows to those who wait.

Consider this:

If you had put money in a broad stock index and just sat on it for decades, you’d likely be very pleased with the results.

The S&P 500 (a collection of 500 large U.S. companies) increased about 119-fold in the 50 years ending in 2018.

Yes, 119 times over! All you had to do was sit back and let your money compound.

No frantic trading, no clairvoyant market calls – just time and patience.

Of course, during those 50 years, there were plenty of scary downturns and reasons to panic.

But those who stayed patient and didn’t sell in fear were the ones who reaped the huge rewards.

As investors often say, “Time in the market > timing the market.”

Trying to hop in and out of investments to catch the “next big thing” or avoid the next crash can actually hurt more than help.

Many people end up buying high (when everyone is euphoric) and selling low (when fear sets in), which is the opposite of a good strategy.

In fact, studies show that the average investor’s returns significantly lag the market’s returns precisely because of poor market timing decisions.

One analysis found that over a decade, investors earned about 1.7% less per year than the funds they invested in, due to mistimed buys and sells.

The lesson?

Doing less – not more – often yields better results. Simply staying invested and adding to your savings consistently beats trying to chase every market twitch.

The Early Bird’s Big Advantage

Patience isn’t just about waiting out market swings – it’s also about starting early and giving your money the maximum time to grow.

A rupee invested today is far more powerful than a rupee invested a decade from now, thanks to the power of compounding.

To illustrate, let’s look at a simple scenario:

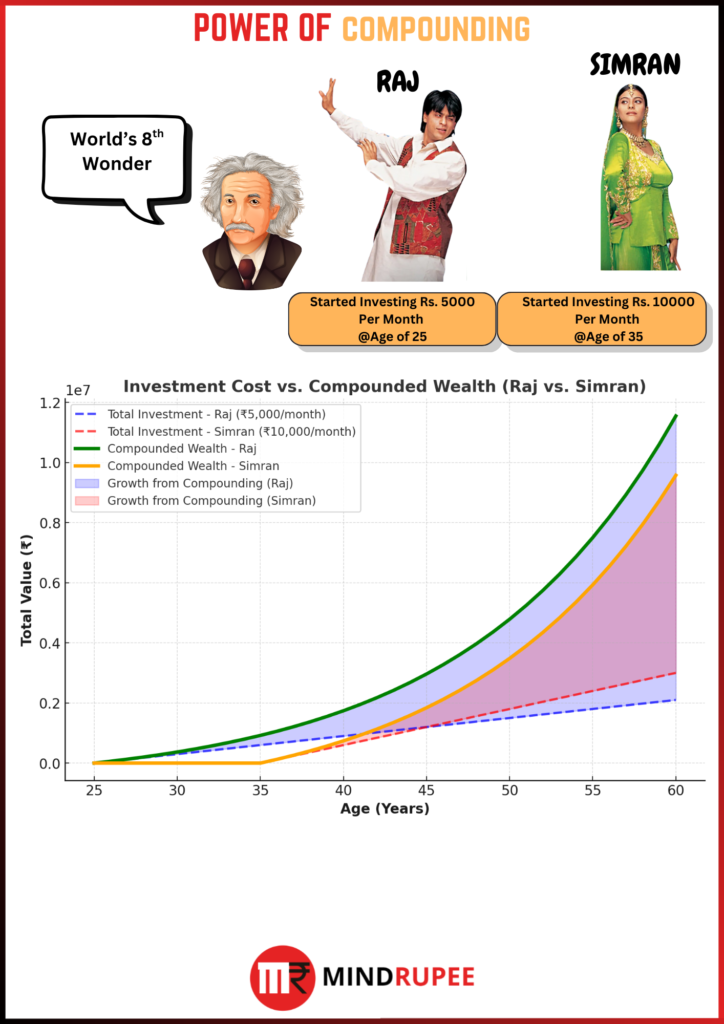

Imagine two friends, Raj and Simran : Raj begins investing at age 25, putting aside a modest amount every month.

Simran, on the other hand, delays investing until age 35 but puts in double the monthly amount of Raj.

Who ends up with more by the time they’re 60?

It might surprise you, but even though Simran invests more each month, Raj can come out ahead simply because he started 10 years earlier. Those extra years of growth give Raj’s money a huge head start.

Example: Starting early vs starting later – Raj invests from age 25 (Green line) and Simran from age 35 (Yellow Line). Raj’s slow-and-steady contributions compound over 35 years, surpassing Simran’s larger late-start contributions over 25 years. Time is a powerful investing asset!

The takeaway is clear:Time is your biggest ally in investing.

The earlier and longer you let your money work, the less you need to invest. Compounding – the process of earning returns on top of returns – is often called the “8th wonder of the world”.

It’s like a snowball rolling downhill, gathering more snow as it goes.

In the beginning it’s small, but give it enough time and it can turn into an avalanche.

As Charlie Munger (Warren Buffett’s long-time partner) famously said,

“The first rule of compounding is to never interrupt it unnecessarily.”

Let your money compound quietly for years, even decades, and it can accomplish extraordinary things.

The Magic of Compounding: Small Steps, Big Rewards

Let’s dig a little deeper into why the slow lane works so well.

The simple answer is magic of compounding.

Compounding is essentially earning interest on your interest, profits on your past profits. Over short periods, compounding can seem unimpressive – almost boring.

But over long periods, it’s like alchemy for your finances. Wealth grows in a non-linear, exponential way.

Think of planting a tiny seed.

For a long time, nothing seems to happen. You water it, you get maybe a little sprout. But with care and time, that little seed can grow into a towering tree.

The growth isn’t visible day by day, but one day you step back and marvel at how far it’s come.

Money works the same way. You might check your investment after a year and think, “Meh, that’s it?” But check after 10 or 20 years of steady growth and reinvestment, and you could be astonished at the forest that grew from your tiny seeds.

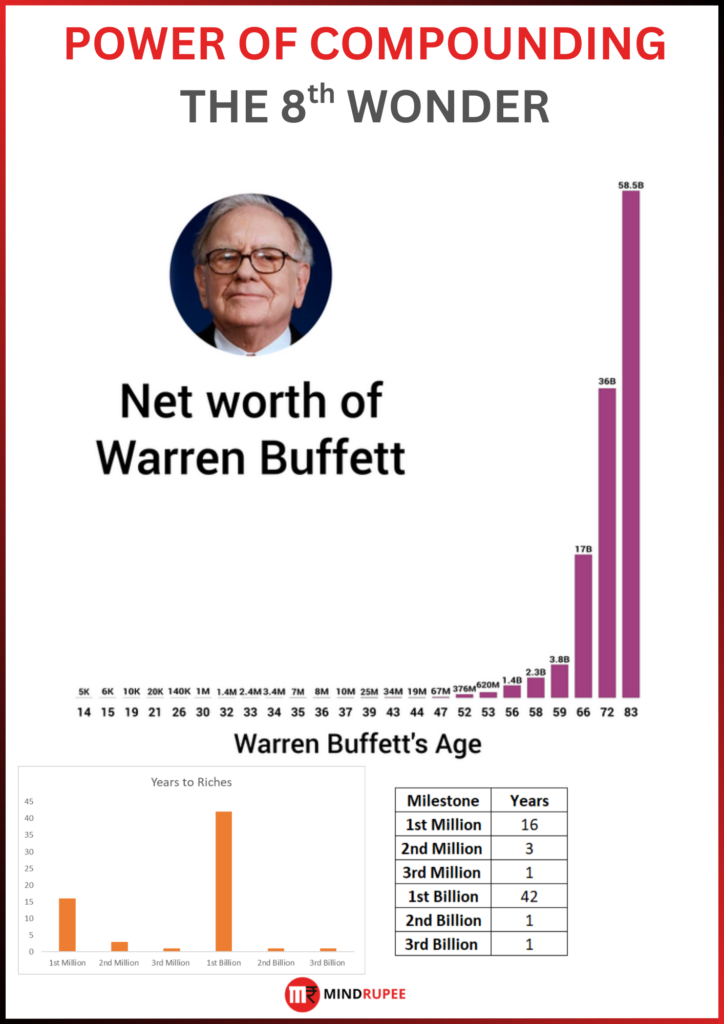

A powerful real-life example of compounding is the story of Warren Buffett.

Today Buffett is one of the richest individuals on the planet, but what’s truly interesting is how he got so rich. He started investing as a child – he bought his first stock at 11 – and he’s now in his 90s, still investing. Most of his wealth came very late in his life.

In fact, over 99% of Buffett’s wealth came after his 50th birthday .

Let that sink in: the vast majority of his billions materialized after he’d already been investing for nearly four decades. And more than $81 billion of his net worth accrued after he qualified for Social Security in his mid-60s.

Buffett is a brilliant stock picker, yes – but plenty of people are smart. What set him apart was time and consistency. He started early and never stopped.

As one analysis noted, if Buffett had started investing later in life or retired at 65, we probably wouldn’t even know his name . His secret was staying in the game for the long run, allowing compounding to work its quiet magic year after year.

You don’t need to be the next Buffett to make compounding work for you.

Even a small sum set aside regularly can grow shockingly large given enough years.

Remember Raj and Simran from earlier? Raj’s seemingly modest habit of investing each month grew into something impressive because he stuck with it.

The same story plays out in real life more often than you’d think. Every so often, you’ll read a news story about a school teacher, a taxi driver, or a clerk who passes away with a multi-crore portfolio that surprises everyone.

How did they do it? No lottery, no secret trading formula – they just quietly saved and invested for decades, letting their money compound in the background.

They lived below their means, put their money to work, and then left it alone. As Morgan Housel writes, these folks “never bragged, never flaunted” their growing wealth – they simply trusted the process and reaped the rewards in the end .

The magic of compounding is available to anyone with patience. You don’t need a high-paying job or advanced math skills.

You just need to start (the earlier the better), keep feeding your investments, and reinvest the earnings so that your money continually works harder for you.

It’s like planting a garden: you sow seeds, water them, and let nature do its work. You wouldn’t dig up your seeds every week to check their roots – likewise, resist the urge to constantly tinker with your investments.

As one saying goes, money is a lot like soap: the more you handle it, the less you’ll have.

So plant the seeds, give them sunshine and time, and watch the miracle of growth unfold.

When Doing Less Is More (Discipline Over Drama)

In investing, activity is often the enemy of progress. This is a hard lesson for many of us (myself included!).

When you first start out, you might feel you should be doing something all the time – checking your portfolio daily, reacting to news, buying and selling frequently to optimize returns.

The truth is, over-trading and constantly fiddling can backfire. Think of your investment portfolio like a bar of soap: the more you touch it, the smaller it gets .

Every time you trade impulsively, you usually incur costs, taxes, or you sell at a bad time due to fear or buy at a peak due to hype. It’s a bit like trying to get a sapling to grow faster by yanking on it – you end up doing more harm than good.

The best investors often make surprisingly few moves. They do their homework, choose investments they believe in, and then mostly sit on their hands.

It sounds simple, but it’s not easy – because our brains constantly tempt us to act, especially when the market gets volatile.

Charlie Munger hit the nail on the head when he said:

“The big money is not in the buying or the selling, but in the waiting.”.

By waiting, he means having the patience to hold good investments for a long time and let them compound, rather than chasing every short-term opportunity.

It’s the difference between investing and trading – investing is like watching paint dry or grass grow (slow and steady), whereas trading is trying to sprint back and forth (exciting, but exhausting and risky).

Munger’s point is that the real wealth in investing comes from inactivity, from resisting the urge to constantly do something. In a sense, successful investing is more about temperament than tactics.

So how do you practically “do less” with your investments while still making progress?

It comes down to discipline and a long-term plan:

- Set an investing routine – for example, contribute a fixed amount every month to a diversified portfolio (this could be a simple index fund or a retirement account). This automatic habit keeps you on track without requiring constant decision-making.

- Tune out the noise – daily market news, hot tips on social media, or your neighbor’s brag about a stock double can all tempt you into reaction mode. Remember that your goals are likely years or decades away; what matters is the long-term trajectory, not today’s headlines.

- Rebalance and review occasionally – “doing less” doesn’t mean “ignore forever.” It’s wise to check in perhaps once or twice a year to make sure your investments still align with your goals and risk tolerance. But resist the urge to make changes too often. Think like a gardener: water the plants and pull the weeds occasionally, but don’t dig up the whole garden on a whim.

By exercising patience and consistency, you avoid the common pitfalls that derail many investors.

The financial research firm Morningstar famously found that investors often earn less than the very funds they invest in because they buy high and sell low (chasing performance).

In other words, people’s behavior undermines their returns. The antidote is a boring one: stick to your plan, keep emotions in check, and do nothing most of the time. Or as another bit of wisdom puts it: “Don’t just do something, sit there!” – a reminder that sometimes the best action is inaction.

Behavior > Intelligence: Why Mindset Matters More than IQ

You might be thinking, “Okay, patience and compounding are great, but surely you need to be really smart about finance to get rich?”

Here’s some comforting news: you don’t need to be a math genius or a Wall Street whiz to build wealth. In fact, when it comes to personal finance, behavior and mindset matter far more than book smarts.

Morgan Housel, the author of The Psychology of Money, writes that doing well with money has little to do with how smart you are and a lot to do with how you behave. You can have a Ph.D. in economics and still panic-sell at the bottom of a crash, or conversely, you might never have gone to college but retire comfortably because you lived frugally and invested steadily. Financial success is a soft skill – it’s about habits, patience, discipline, and how you manage your emotions.

Real wealth isn’t about having the highest IQ; it’s about having the right temperament.

If you have challenges with staying consistent with your investments. Read This!

Can you stay calm when the market is down and everyone else is fearful?

Can you avoid greed when everyone else is chasing the next hot investment?

Those behavioral qualities will determine your outcomes more than picking the perfect stock or timing the next boom. As an example, think of two individuals:

- Investor A is highly educated and earns a big salary, but she spends most of it on an expensive lifestyle and tries to outsmart the market with frequent trades.

- Investor B has a modest income and no special finance training, but he consistently saves a chunk of his paycheck and puts it in simple investments, rain or shine, for 20-30 years.

Who do you think ends up wealthier in the end? More often than not, it’s Investor B – the one with the good habits – not the one with the fancy education or grand ideas.

There’s a well-known story of a man named Ronald Read, a janitor and gas station attendant who quietly amassed an over $8 million fortune by the time he died, simply by saving diligently and investing in blue-chip stocks over his lifetime.

Meanwhile, there have been hedge-fund managers and finance executives who made millions in income yet went bankrupt because of lavish spending or bad risks. The difference wasn’t intelligence – it was behavior.

The janitor stuck to a humble, disciplined path; the high-flyers fell prey to overconfidence and lack of self-control.

The good news is that anyone can cultivate the right financial behaviors. You can choose to live below your means (spend less than you earn), you can choose to save and invest a portion of every paycheck, and you can train yourself to be patient and not get swayed by the crowd.

It might not feel natural at first – our emotions can get loud when markets swing – but acknowledging that psychology plays a huge role is the first step.

As Morgan Housel emphasizes, financial success is not a hard science; it’s a mastery of self more than a mastery of markets. The smartest thing you can do is not necessarily to outwit everyone else, but to avoid being your own worst enemy. That means not letting fear, greed, or the need to impress others drive your decisions.

On that last point – not needing to impress others – remember that wealth is usually silent.

The flashy car or designer clothes might signal high spending, but they don’t tell you anything about someone’s net worth or financial security. True wealth is often what you don’t see: the money quietly compounding in someone’s accounts, the freedom they’ve built by not always upgrading to the latest gadget or the bigger house.

It’s OK (actually empowering) to not keep up with the Joneses. The most successful investors often purposefully dial down their lifestyle expectations so they can save more and invest more.

They find contentment in watching their freedom grow rather than indulging in every luxury.

One of the most valuable assets you can have is not needing to impress anybody and instead focusing on your own goals. When you adopt that mindset, it becomes much easier to stay in your lane – your slow and steady lane – and stick to the plan that’s building your future wealth.

Embrace the Slow Lane – Your Future Self Will Thank You

By now, you might be seeing a common thread: Patience, consistency, discipline, and humility are recurring themes in wealth-building.

These traits aren’t as exciting as a hot stock tip or a sudden windfall, but they are reliable.

Every great investor and financial thinker – from Buffett and Munger to modern experts like Morgan Housel – essentially preaches some version of this philosophy.

To sum it up in plain terms: Don’t rush, do the simple things really well, and wait.

Yes, the slow lane can feel boring at times. Watching paint dry, seeing grass grow – pick your metaphor.

In an era of hype and hustle, sticking to a long-term plan without constant action can even feel counter-cultural. But that’s also why it works. Most people won’t do it.

Many will give up, switch lanes, try shortcuts, or let emotions knock them off course. If you can be the tortoise in a world full of hares, you gain a tremendous edge. The tortoise’s journey isn’t flashy – it plods along – but we all know how that story ends.

Before we wrap up, let’s recap a few timeless investing truths that the slow lane teaches us:

- Time is your greatest asset: The longer you stay invested, the bigger the snowball can . Start as early as you can, but remember that today is still better than tomorrow if you haven’t begun yet.

- Consistent action beats heroic efforts: Regularly investing (even small amounts) trumps the occasional big move. Wealth is built paycheck by paycheck, not lottery tickets.

- Compounding is powerful but needs patience: Give compounding years or decades to unfold its magic. A year or two won’t show much – don’t be discouraged by slow starts.

- Avoid the noise and drama: Financial media and market chatter can tempt you to sprint when you should be jogging. Stay focused on your long-term goals, not the crowd’s short-term fears or fads.

- Your behavior determines your outcome: Maintain discipline in saving, stick to your plan during market ups and downs, and keep your emotions in check. These simple (not easy, but simple) habits will outperform most “genius” trading schemes over time.

In conclusion, the slow lane isn’t boring – it’s the most reliable road to financial freedom and wealth.

Every seed you plant, every small step you take in that slow lane, is bringing you closer to your dreams. It may not feel like you’re speeding ahead, but you’ll be amazed at the distance you’ve covered when you look back years later.

Your future self will be grateful that you chose the path of patience and wisdom over the tempting shortcuts.

So, embrace the journey. Invest regularly, live below your means, and let time do the heavy lifting. Trust the process even when progress seems imperceptible. Stay humble, stay focused. The riches that come slowly are the ones that last, and the freedom they give you is well worth the wait. Remember, in the game of wealth-building, slow and steady wins the race – and often wins big.