If you are new to investing, you’ve probably heard friends, colleagues, or financial advisors recommend mutual funds.

Even our Panwale Bhaiya is singing “Mutual Funds Sahi Hai”.

And we understand mutual Funds are flexible, regulated, and one of the best ways to grow wealth in India.

But when you sit down to actually choose your first mutual fund, things get tricky.

Finding good mutual funds is nothing less than “finding needle in haystack“.

There are over 1,500 mutual fund schemes in India, across different categories like equity, debt, hybrid, index, flexi-cap, small-cap, and more.

Expense ratios, NAVs, past performance, and risk profiles can feel overwhelming to a beginner.

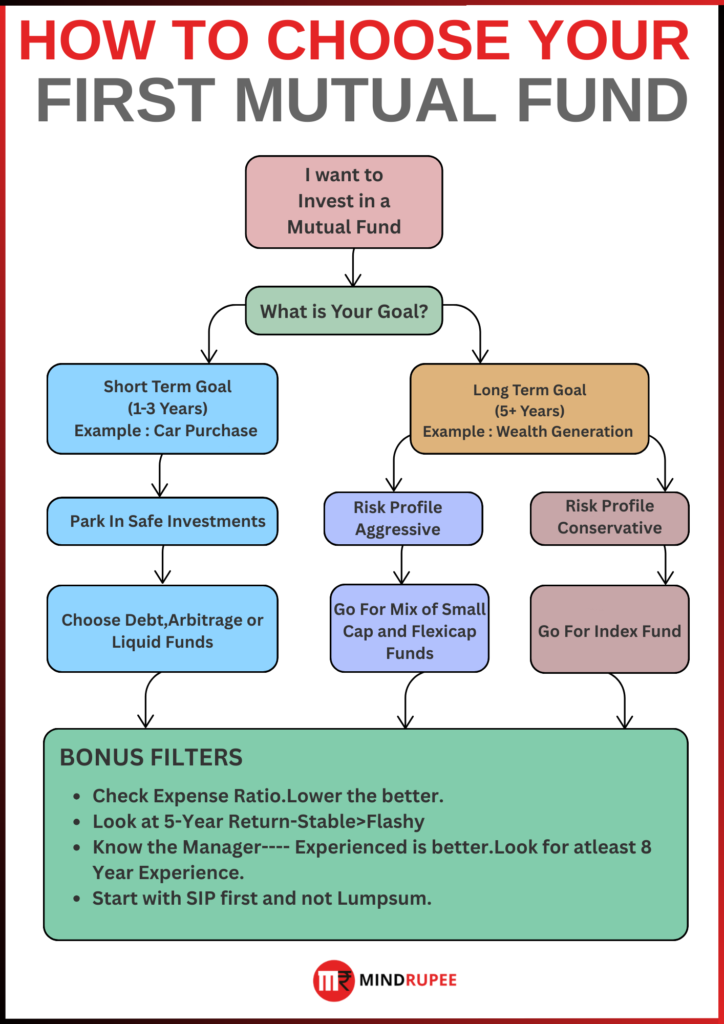

In this blog i have tried to simplify the mutual fund selection process. By the end, you’ll know exactly:

- How to identify the right fund based on your goals and time horizon.

- How to match your risk appetite with fund type.

- The bonus filters smart investors apply before finalizing a fund.

So, let’s decode the process step by step.

# Step 1: Begin With Your Goal

Mutual funds are not “one-size-fits-all.” Your investment goal decides which fund category is right for you.

In fact this is one of the most important step in your mutual fund selection journey. But unfortunately most people go wrong at this stage itself.

The first question to ask yourself is “What am I investing for, and how soon will I need the money?” Your goal and timeframe will guide what type of mutual fund makes sense.

Define your goal with as much clarity as possible. Even if it takes a day or two extra don’t miss this step.

If you have trouble defining it yourself, take help of professional advisors. Its about your financial well being don’t cut corners at this step.

Put your goals in two buckets.

- Short-term goals.

- Long-term goals.

1. Short-Term Goals (1–3 Years)

What are Short-term goals?

Goals with target timeline of less than 3 Years. Goals such as :

- Saving for a car payment

- Vacation

- Down payment for House purchase.

What kind of investment instruments suits Short-term goals?

Since the investment timeframe is shorter in this case, one should look for relatively more stable investment options.

In case of investing for short term goals our focus would be more on capital preservation than generating return.

Now the question arises if the focus is to preserve capital than why not keep it in savings account. The simple answer is to beat inflation.

Historically inflation has been ~4-5% in India and stable investment options offer 5~6% returns . Hence solving our purpose.

For short term goals one should stick to safe investments like Debt Funds, Arbitrage Funds, or Liquid Funds.

Debt funds, liquid funds, or arbitrage funds – basically, funds that act like better savings accounts.

For example, liquid mutual funds (a type of debt fund) in India offer about 5~6% annual returns on average, higher than a typical bank savings rate of ~3.5–4%.

They invest in things like treasury bills and bank deposits to earn a bit more interest while keeping risk low.

Another option is Arbitrage funds. Arbitrage funds are another low-volatility option – they exploit price differences in markets to get you stable returns, kind of like a savvy shopper who buys goods cheap in one market and sells in another for a tiny profit.

Example

- Goal : You plan to buy a car in 2 years costing ₹8 lakh.

- If you invest ₹30,000 per month in a liquid fund with ~6% returns, you’ll accumulate around ₹7.6 lakh—safe and close to your target without losing sleep over stock market swings.

Note : Investing for short term goal does not eliminate the need to keep an emergency fund.

If you are puzzled by the question of how to be consistent with your SIPs. Read Here

2. Long-Term Goals (5+ Years)

What are Long-term goals?

Goals with target timeline of more than 5 Years. Goals such as :

- Wealth creation

- Retirement Planning

- Child’s education

What kind of investment instruments suits Long-term goals?

Since the investment timeframe is longer in this case, one could take higher risk and try generate relatively higher returns.

When investing for long term goal one can tolerate some volatility since you have time to recover from market cycles.

For long term goals one can invest in Equity-oriented funds (Index Funds, Flexi-Cap Funds, Small-Cap Funds depending on risk appetite).

Example:

- Goal : Saving for your child’s College Education due in 20 Years.

- Suppose present value of College Fees is Rs. 20 Lakh. So the Future value in 20 Years @inflation of 5% would be ~Rs. 53 Lakh.

- If you invest ₹6,000/month in a flexi-cap fund for 20 years at ~12% CAGR, you could end up with over ₹54 lakh. Fulfilling your goal.

Key Takeaway from Step 1 : Always define your time horizon first. Short-term = capital protection. Long-term = wealth creation.

Quick analogy: Choosing between short-term and long-term funds is like deciding between taking a local city bus vs. a cross-country road trip.

If your destination is just a few stops away (short-term), you’d hop on a slow but sure bus that guarantees you’ll get there safely.

If you’re going cross-country (long-term), you might consider a faster car or even a roller coaster – you’ll reach farther places, but buckle up for some twists and turns!

# Step 2: Understand Your Risk Profile

Once you know your goal, the next step is to assess risk appetite.

This step is basically figuring out if you’re an “all-in adrenaline junkie” or a “better safe than sorry” type when it comes to money.

Conservative Investor

Maybe you’re the type who prefers a smooth drive at the speed limit rather than drag racing.

You want growth, sure, but you also want to sleep at night without worrying about big crashes.

For a long-term conservative investor, mix of debt fund and index funds are a fantastic choice .

A Debt Mutual Fund is like the cautious driver on a busy road. Instead of racing through volatile stock markets, it invests in relatively “safe” instruments like government bonds, corporate bonds, treasury bills, and money market securities.

Since debt funds don’t chase the thrill of beating the stock market, their goal is simple: steady, predictable returns with lower risk. They’re content with playing defense rather than offense.

An index fund is basically a mutual fund on autopilot: it simply copies a market index (imagine a basket of top companies) and tries to mirror its performance.

Since it’s not trying to beat the market, it’s content with being the market.

The upside? Index funds tend to be less volatile than specialized funds, and they come with very low fees .

For example, an index fund tracking a broad market index will likely include many large, established companies – these are your reliable blue-chips that might not double your money overnight, but historically they’ve provided solid returns.

The long-term average stock market return is often around 12~15% annually (give or take) in many markets.

In India, a Nifty 50 index fund or a Sensex fund has delivered roughly that kind of return over long periods, and in the U.S., the S&P 500 has historically done ~8-10% per year on average.

Index funds won’t usually top the performance charts in boom years, but they also won’t crash as hard as riskier funds in bad years.

It’s the “slow and steady wins the race” approach. For a beginner or conservative long-term investor, an index fund is like a dependable sedan – not as flashy as a sports car, but it gets you to your destination with fewer hiccups.

Traits of Conservative Investor :

- You prefer safety and predictability.

- You dislike market swings and panic during volatility.

- Best Fit: Index Funds (low-cost, broad market exposure, less risky than actively managed small-cap funds) and Debt Mutual Funds.

- 50 : 50 for Debt MF and Index MF is a good proportion.

Aggressive Investor

Let’s say you don’t mind the ride getting bumpy if it means potentially higher returns. You’re the kind who’d ride a roller coaster twice or add extra chili to your food for that extra kick. In that case, keep a mix of small-cap and flexi-cap funds for long-term goals.

Small-cap funds invest in smaller companies – think of these like the scrappy underdog startups of the stock market.

They can grow really fast (some small-cap funds have even delivered over 20% average annual returns in recent years, but they can also be very volatile.

One year you might see spectacular growth, and the next year could swing the other way – it’s the price of that adrenaline rush.

Meanwhile, flexi-cap funds (also called multi-cap funds) are like the all-you-can-eat buffet for fund managers – they can invest in companies of any size, big or small. This gives them flexibility to shift between large-cap, mid-cap, and small-cap stocks depending on where they see opportunities.

In simpler terms, a flexi-cap fund is free to chase gains wherever they are, which can balance some of the risk of pure small-caps.

By combining a small-cap fund (for high growth potential) with a flexi-cap fund (for diversified growth), an aggressive investor aims to maximize returns over the long term. Just remember, aggressive funds can be a wild ride.

It’s like planting mango trees – they might yield sweet fruit but you could also face some bad seasons. If you go this route, be mentally prepared for the value of your investment to jump around quite a bit on its journey upwards.

Traits of Aggressive Investor :

- You are comfortable with volatility for higher growth.

- You can handle short-term losses in exchange for long-term gains.

- Best Fit: Small-Cap Funds (high-growth potential, high risk) + Flexi-Cap Funds (dynamic allocation across large, mid, and small caps).

👉 Pro tip: Your risk profile can change over time. Start conservative, and as your financial literacy grows, gradually shift into more aggressive options.

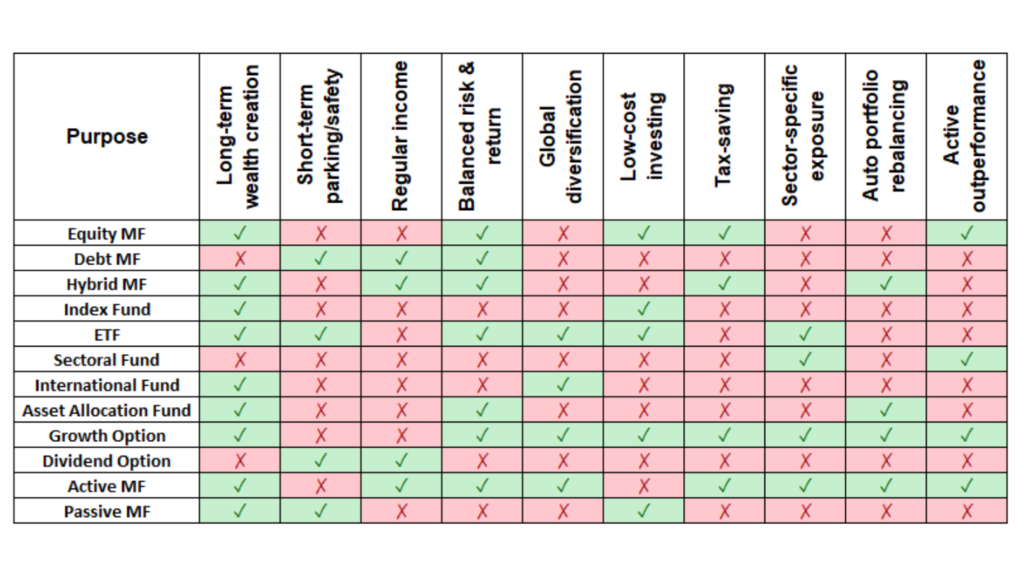

# Step 3: Match Goal + Risk With the Right Fund Type

Here’s how the combinations work:

- Short-Term Goal (1–3 years): Debt, Arbitrage, or Liquid Funds.

- Long-Term Goal + Aggressive: Mix of Small-Cap and Flexi-Cap Funds.

- Long-Term Goal + Conservative: Index Funds and Debt Funds.

Use the following matrix to make your decision easier.

# Step 4: Apply the Bonus Filters

Even within the right category, not all mutual funds are equal. Apply these bonus filters before you finalize:

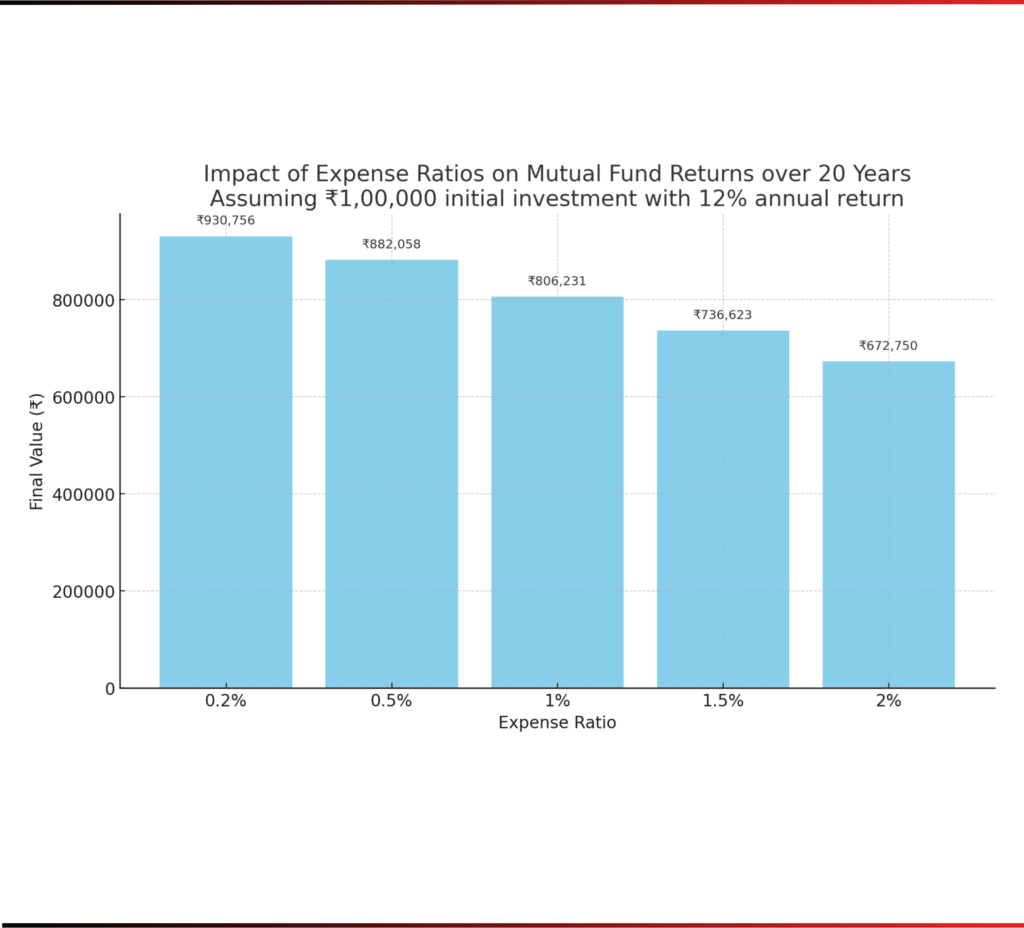

A. Expense Ratio

This is the annual fee charged by the fund house. Lower = better.

Example: An expense ratio of 0.5% vs 1.5% over 20 years can mean lakhs of difference in returns.

Below you can see the impact of expense ratio on Returns over time.

B. 5-Year Performance Stability

Don’t just look for the “top performer of last year.” Choose funds with consistent performance over at least 5 years. Stability > flashiness.

C. Fund Manager’s Experience

A skilled, long-serving manager matters. Look for 8+ years of experience in fund management.

D. Mode of Investment

Always begin with SIP (Systematic Investment Plan) instead of lump sum. SIPs average out volatility and build discipline.

Case Study Examples

Case 1: Rohan, 28, saving for a car in 2 years

- Goal: Short term (2 years).

- Risk: Low.

- Choice: Liquid Fund or Arbitrage Fund.

- Outcome: Safe, moderate returns better than FD.

Case 2: Priya, 30, planning for retirement in 25 years

- Goal: Long term.

- Risk: Moderate to high.

- Choice: Flexi-Cap + Small-Cap mix.

- Outcome: Wealth compounding via equities.

Case 3: Rajesh, 40, conservative investor

- Goal: Retirement corpus in 15 years.

- Risk: Conservative.

- Choice: Index Funds and Debt MF.

- Outcome: Low-cost, steady compounding, less stress.

Common Mistakes Beginners Make

1. Chasing “Last Year’s Top-Performing Fund”

This is like picking a cricket team based only on who hit the most sixes last season. Just because a fund was on fire last year doesn’t mean it will repeat the magic.

Why it’s a problem

Markets are cyclical. A fund that tops the charts in a bull run may tumble during a downturn. If you enter late (after the big run-up), you could be buying at the peak.

Example

Many small-cap funds in India delivered 40–50% returns in 2021, attracting a flood of new investors. But when 2022 brought corrections, those same funds dropped 15–20%. The late entrants panicked and exited at a loss.

Lesson

Look for consistency over hype. A fund steadily delivering 10–12% over 5 years is far healthier than one-off superstars.

2. Ignoring Expense Ratios

The expense ratio is the fund manager’s fee for handling your money. Ignore it, and you could be leaking returns without realizing.

Why it’s a problem

A difference of even 1% annually compounds into a huge gap over 10–15 years.

Example

Suppose you invest ₹5 lakh for 15 years.

- A fund with a 1% expense ratio grows to ~₹19.6 lakh (assuming 12% returns).

- A similar fund with a 2% expense ratio grows to only ~₹17 lakh.

- That’s a ₹2.6 lakh loss, purely due to fees!

Lesson

Always compare expense ratios, especially between regular vs. direct plans. Direct plans cut out distributor commissions and typically have lower costs.

3. Investing Lump Sum in Volatile Equity Funds

Throwing all your money at once into equity funds is like diving headfirst into a swimming pool without checking the depth.

Why it’s a problem

Equity markets fluctuate daily. If you invest a lump sum at a market high, you could face immediate losses.

Example

Many investors poured lump sums into equity funds in early 2020, just before COVID-19 hit. Within weeks, markets fell over 30%, and panic selling wiped out long-term potential.

Lesson

Start with SIPs (Systematic Investment Plans). They spread your investment across market cycles, reduce timing risk, and average your cost of buying.

4. Not Aligning Investment with Actual Goals

Investing without a goal is like packing for a trip without knowing the destination.

Why it’s a problem

Each goal (short-term vs. long-term) needs a different type of fund. Using the wrong one can leave you stranded.

Example

Parking your child’s tuition money (needed in 2 years) in an equity fund is a recipe for disaster. A sudden market dip could wipe out a chunk just when you need it. For short-term needs, debt or liquid funds are safer.

Lesson

Always ask: “When do I need this money?” and choose funds accordingly (short-term → debt, long-term → equity).

5. Stopping SIPs During Market Crashes (When They Should Continue)

This is the biggest mistake beginners make. Market dips scare investors into pausing or stopping SIPs – exactly when they should be buying more!

Why it’s a problem

Crashes offer you units at a discount. Stopping SIPs means missing out on “buying low.”

Example

During the 2020 crash, many paused SIPs in fear. But those who continued actually benefited as markets rebounded sharply by late 2020 and 2021. In fact, SIP investors who stayed invested saw double-digit gains thanks to cost averaging.

Lesson

SIPs are like gym memberships – the results only show if you keep showing up, even when it feels hard. In investing, downturns are your chance to accumulate more units cheaply.

To sum it up choosing your first mutual fund is not about picking the “best” scheme in the market. It’s about finding the right fund for your goal and risk profile.

Remember, mutual funds are not a get-rich-quick scheme. They are a disciplined, long-term approach to building wealth. With the right choice today, you’ll thank yourself 10–20 years down the line.

FAQs

Q1. Should I pick a fund based only on returns?

No. Look at risk-adjusted returns, consistency, expense ratio, and fund manager’s track record.

Q2. What is better for a beginner: Index fund or Flexi-cap fund?

Start with an Index Fund if conservative. If you’re okay with moderate risk, a Flexi-cap Fund is a good option.

Q3. Can I invest in multiple funds at once?

Yes, but don’t over-diversify. 2–3 funds are enough initially.