Once Jeff Bezos asked Warren Buffett.

“Warren your strategy is so simple ;Why doesn’t everybody just copy you and get Rich”

Warren Buffett Replied.

“Because nobody wants to get rich slowly”.

Systematic Investment Plans (SIPs) are one of the most powerful wealth-building tools for salaried individuals.

SIPs bring discipline, remove emotions from investing, and let compounding do the heavy lifting.

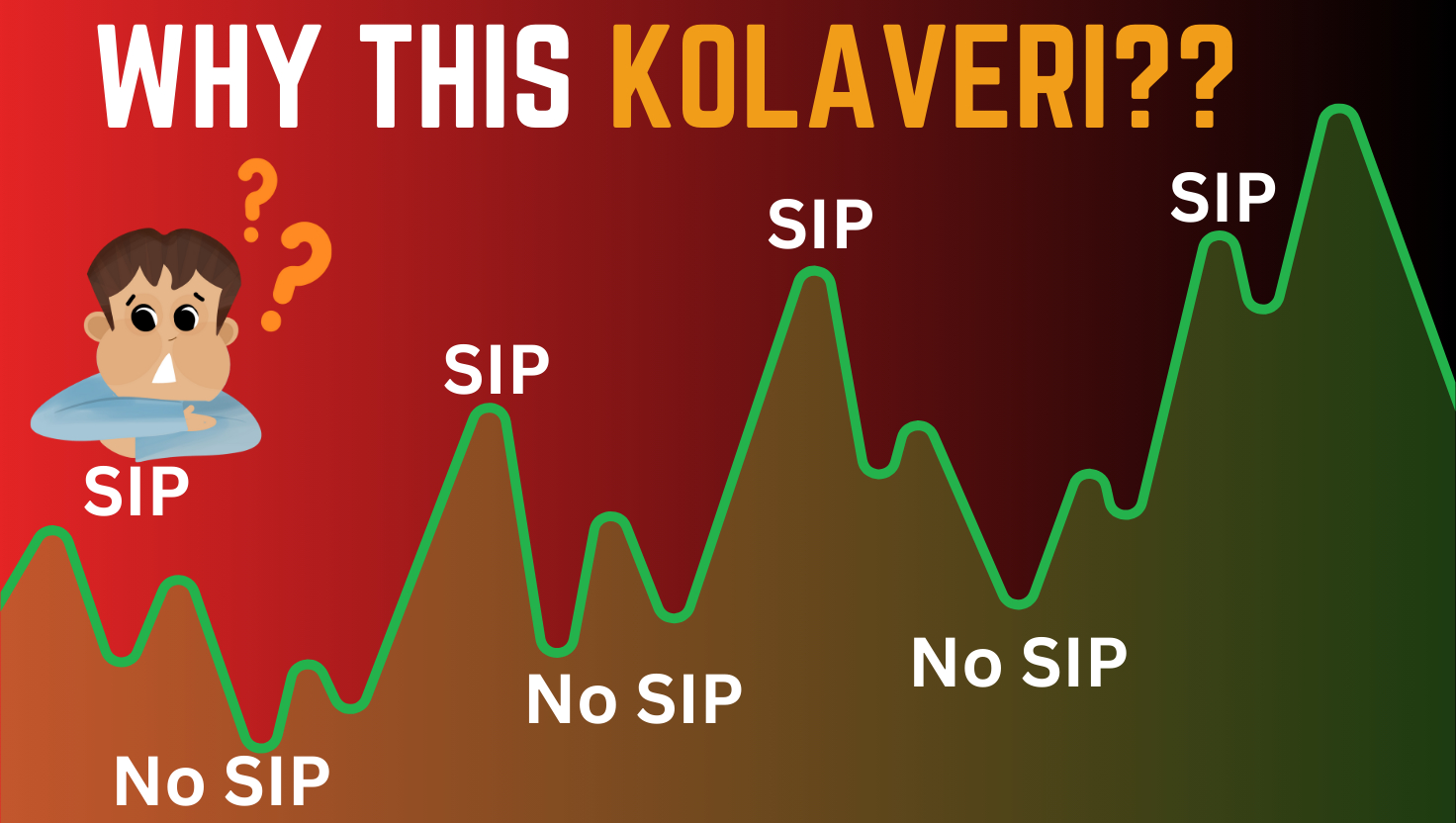

Yet, many investors start SIPs enthusiastically… and then stop halfway.

Why does this happen? Let’s dig deep.

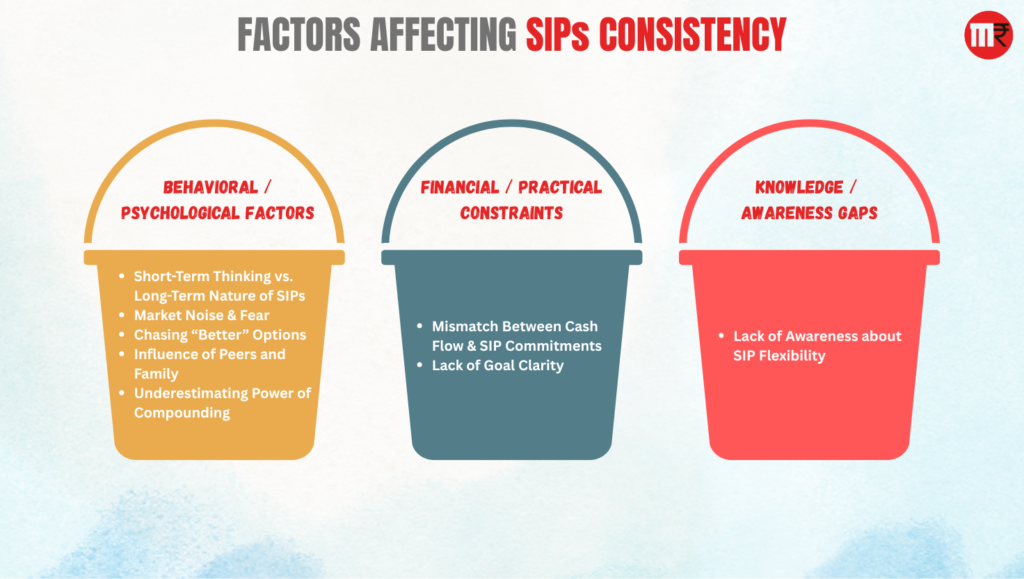

For ease of understanding I have categorized factors influencing SIP categorization in 3 buckets.

1. Behavioral / Psychological Factors

- Short-Term Thinking vs. Long-Term Nature of SIPs

- Market Noise & Fear

- Chasing “Better” Options

- Influence of Peers and Family

- Underestimating Power of Compounding

2. Financial / Practical Constraints

- Mismatch Between Cash Flow & SIP Commitments

- Lack of Goal Clarity

3. Knowledge / Awareness Gaps

- Lack of Awareness about SIP Flexibility

Lets understand each bucket one by one.

Download Free SIP-Self Assessment Sheet

Bucket 1 : Behavioral / Psychological Factors

1. Short-Term Thinking vs. Long-Term Nature of SIPs

SIPs are designed to create wealth over 10–15 years, not 10–15 months.

But investors often expect instant results. When markets dip or returns look “low” in the short run, panic sets in.

Result is SIPs are stopped and investors are not able to gather courage to invest again.

Let’s back it with some data.

Current year markets have not been very kind and the returns are timid to say the least.

And In February 2025, the SIP stoppage ratio was ~122.76%, meaning more SIPs were discontinued than new ones started that month.

This is ironic.

Why?

Imagine Someone starts a ₹5,000 SIP in 2023, sees their portfolio dip in 2024, and stops. That’s when they should have continued rather aggressively— because falling markets mean buying more units at cheaper prices.

2. Market Noise & Fear

News headlines scream “Markets crash 1000 points” or “Recession ahead”. Social media adds more fear. Many investors equate volatility with risk, forgetting that volatility is the tuition fee for long-term wealth generation.

Nifty has given 10%+ CAGR over the last 20 Years.

And in these last 20 years we have seen the Sub-prime Crisis,Covid,Russia-Ukrain War,Tariffs and what not.

In fact these crises are opportunities for a long-term investor. It’s like the market is on sale.

Tell me if you get a jacket worth Rs 10000 at Rs. 7000 would you not buy it or you would wait for it to go back to Rs. 10000 to buy it.

A major reason why short term noise bothers us is because of our own mistakes such as not doing goal based investing.

Let me explain it with an example.

Suppose I have saved Rs.100000 for my kids next year tuition fees. Shall i invest it in Equity related instruments?

Big NO!!

But people commit such mistakes and the moment the market corrects 10~15 % they panic and sell it.

So be very specific about your financial goal and choose an instrument accordingly.

Remember this Mantra :

I AM A LONG-TERM INVESTOR AND CRISIS IS MY FRIEND.

3. Chasing “Better” Options

When you are stuck in traffic you always feel that other lane is moving faster and the moment you shift to that lane, now the previous one starts moving faster.

Same treatment we give to our investments.

Many investors hop from one mutual fund to another, or shift to stocks, gold, or FDs when short-term returns look better elsewhere.

We take calls on shorter time frame performance.

What it does is two things.

First it breaks the flow and second it creates exhaustion researching and finding new funds and investing.

So STOP DOING IT!!

4. Influence of Peers and Family

“How much have you made in this SIP?” — If the answer isn’t exciting, relatives or peers may push you towards other “hot” options. This external influence often breaks consistency.

Why do we get swayed by peer pressure?

Because of unjustified expectations.

Historically, average returns over decades are close to 10-12% for equity class. Less than 1% of investors have generated returns more than 20%.

But we are under the impression that we are different. We have a tendency to by default put ourselves in that 1% investor category. I am not contesting that you are not amongst those 1% investors but the odds are stacked against you.

Remember one thing you can either harness thrill or wealth from markets. Choice is yours.

Another mistake people make is to extrapolate the results. If one of your relatives generated 50% return in one year. We have a tendency to extrapolate that to the next 10 years and imagine how much money we can make. But that one year return could be fluke and not the skill of that relative.

The probability of returns made by fluke is more than 99%.

“Suno sab ki,Karo apni”

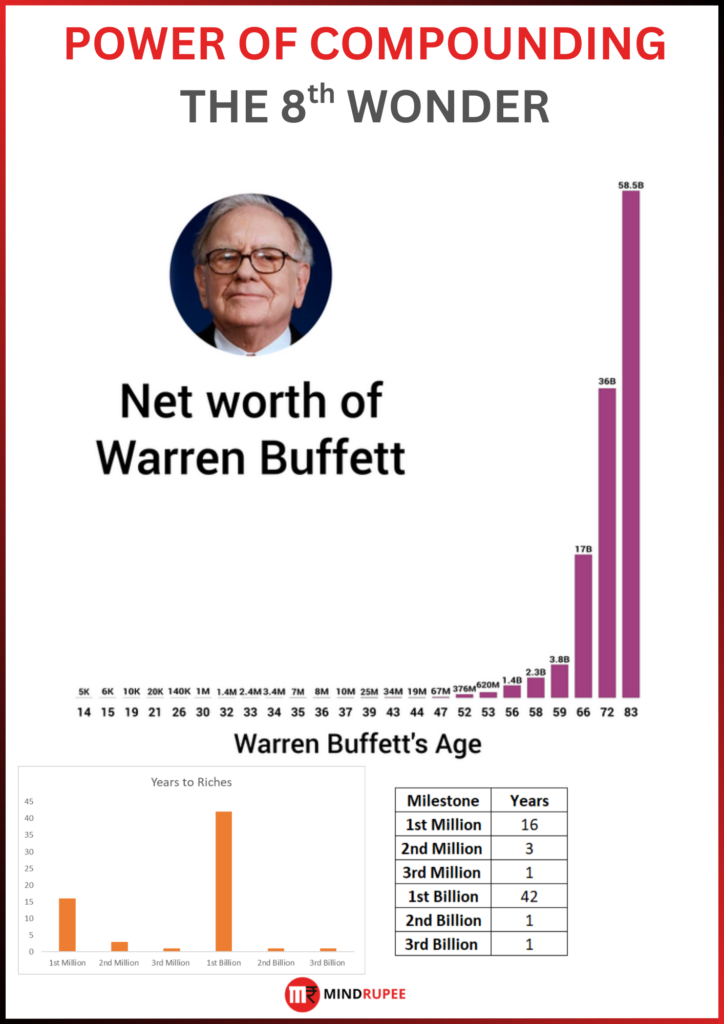

5. Underestimating Power of Compounding

₹10,000 per month for 20 years @12% = ₹99.9 lakh invested → ~₹99.8 lakh earned → ₹2 crore corpus.

But most people stop after 3–4 years, when the invested amount looks small and gains look insignificant. They forget compounding rewards patience, not speed.

To illustrate the power of compounding let me share a story.

Famous “Manhattan land compounding story”

- In 1626, Peter Minuit of the Dutch West India Company supposedly bought Manhattan Island from Native Americans for $24 worth of beads and trinkets.

- At first glance, it seems like the Native Americans got a very poor deal, because Manhattan is now worth hundreds of billions of dollars.

- But if they had invested that $24 at a decent compounded rate, the story changes.

Let’s assume they invested $24 at 8% annual compounding (roughly the long-term return of stock markets):

Its present value comes out to more than $10 trillion!

Even a small amount (just $24) can grow into something massive when left to compound over centuries.

This is why time and patience are the biggest friends of investors. The power of compounding often beats even the biggest one-time gains.

Bucket 2 : Financial / Practical Constraints

1. Mismatch Between Cash Flow & SIP Commitments

Often, SIPs are set up without considering monthly budgets. When sudden expenses arise — festivals, vacations, EMIs, medical bills — SIPs become the first casualty.

It is very important to plan your expenses and make a budget.

Making a proper budget can help stay consistent with your SIPs.

Suppose you earn Rs 100000 per month.

If you are not married you can save as much as 60% of your salary. But if you are married and have kids doing so becomes difficult.

Its better to plan accordingly. Setting unrealistic SIP targets can break consistency and SIPs are paused or skipped to “adjust” finances.

2. Lack of Goal Clarity

If SIPs are started just because “a friend said so” or “advisor recommended,” without a personal financial goal (like retirement, child’s education, or home purchase), motivation fades.

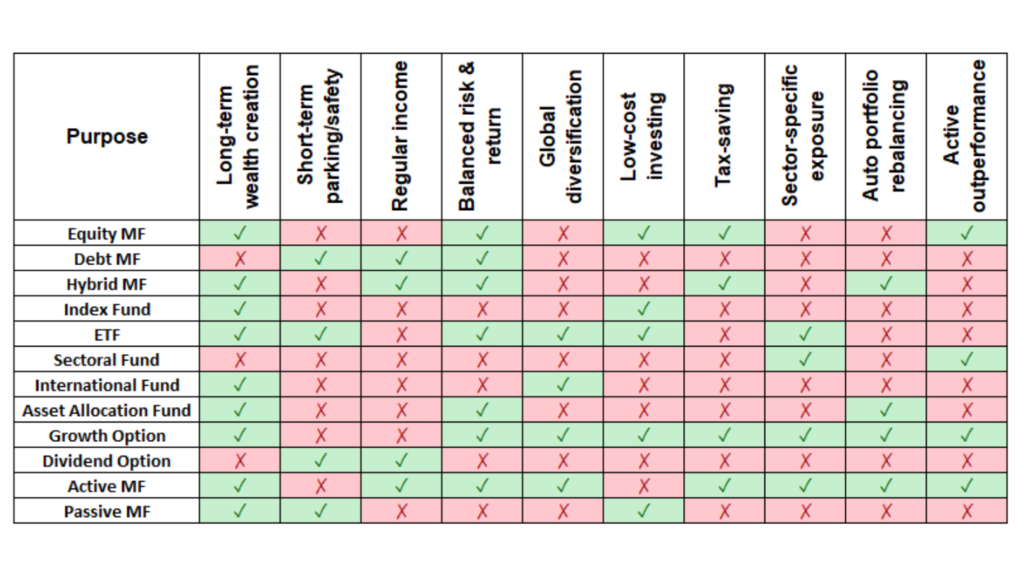

All investment instruments are not made for all goals.

If you have short term goals such as buying a car or vacation due in 3 years or less. Keeping that money in equity is foolishness.

Similarly if you are in your 20s and keeping all your investments in Debt mutual funds also does not make sense.

So it’s important to use proper instruments as per decided goals.

One can use following matrix to decide investment instrument based on specific goal.

Just remember!!

No emotional anchor → easy to stop SIPs.

Bucket 3 : Knowledge / Awareness Gaps

Lack of Awareness about SIP Flexibility

Not knowing SIPs can be paused, increased, or adjusted without stopping.

There can be unexpected, unplanned events that can derail your financial journey.

Unfortunately we don’t have much control at these events.

But don’t stop your SIP and instead do following :

- Try if you can manage by reducing the SIP amount.

- If you have to pause SIP make a rule of not stopping for 2 Consecutive months. That is, don’t pause SIP for 2 consecutive months.

Once in a while we will be faced by extremely tough situations such as Covid. One should try to get back on track at the earliest in such situations.

How to Stay Consistent with SIPs?

Here are practical fixes:

1. Link SIPs to Goals

When your SIPs are tied to tangible life goals, you automatically give them meaning.

- Retirement corpus → You’re not just investing, you’re buying freedom from financial stress at 60.

- Child’s education/college → Every SIP installment is like paying tuition in advance.

- Dream house → Monthly SIPs are brick-by-brick construction of your future home.

Why it works: When SIPs are emotionally connected to milestones, the chance of discontinuing them reduces drastically.

2. Automate Investments

Set up auto-debit from your salary account on the same date each month. Treat SIPs exactly like EMIs.

- SIPs as non-negotiable → Just like rent, EMIs, or school fees, you don’t question or delay them.

- Best practice → Align SIP debit date right after salary credit, before discretionary spends.

Why it works: You bypass the “willpower trap” — automation ensures discipline without constant decision-making.

3. Ignore Market Noise

Markets will always move in cycles — rallies, crashes, corrections.

- Don’t react to every headline like “Markets down 1,000 points”.

- Remember: time in the market beats timing the market.

- A ₹10,000 SIP started in 2008 (market crash year) grew into a much larger corpus than those who paused during the fall.

Why it works: Staying invested through volatility captures compounding power.

4. Keep an Emergency Fund

Most SIP breaks happen not because investors lose interest, but because of cash-flow pressure.

- Keep at least 3–6 months of expenses aside in liquid funds or savings account.

- This buffer ensures that medical bills, vacations, or sudden expenses don’t force you to halt SIPs.

Why it works: You protect SIPs from being sacrificed at the first sign of financial stress.

5. Review, Don’t React

Many investors stop SIPs because they keep checking returns every month.

- Review performance every year instead of every quarter.

- Use rolling returns, not point-to-point returns, for evaluation.

- If a fund consistently underperforms its benchmark for 2–3 years → switch. Otherwise, stay.

Why it works: Patience avoids impulsive exits, while periodic reviews ensure you’re not stuck in laggards.

SIP Consistency Score (self-audit)

Answer yes/no (score 1 for “yes”):

- SIP debits within 48 hours of salary credit

- You keep a 1-month “SIP buffer” in bank

- One platform → one bank mandate

- ≤ 4 funds total (goal-based, not AMCs)

- UPI Autopay/e-NACH status verified in last 6 months

- Auto catch-up rule set (missed month auto-doubles next)

- Pre-commit message for bear markets (“We buy more units when cheap”)

- Step-up every appraisal or every April (5–10%)

- WhatsApp/SMS alert if a debit fails

- Pause rules defined (only for job loss / goal change)

0–3 = fragile, 4–7 = fixable, 8–10 = robust

Final Thought

Consistency is the secret sauce in SIPs. The most successful investors aren’t the ones with the highest IQ, but those who stick with the plan through ups and downs.

Stopping SIPs mid-way is like leaving a cricket match at the 5th over because you didn’t hit enough sixes. Stay on the crease long enough, and the scoreboard will surprise you.